Smaller U.S. banks have endured significant challenges over the past year, largely due to their substantial loan exposure to the $20 trillion commercial real estate market. The dual difficulties of climbing interest rates and a decrease in office occupancy owing to the shift towards remote working have created a demanding operational environment for commercial banks. Banner (NASDAQ:BANR), a regional bank on with a West Coast-focus, is navigating this tough bank environment with better than expected results.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

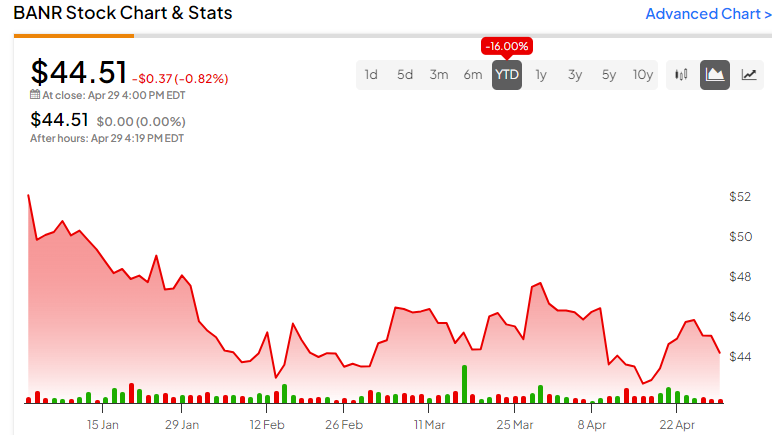

Though the stock is down -16% year-to-date, analysts tend to believe it will rebound in the coming year. Given the current environment, the bank could be a higher-quality option for investors seeking an income-generating small bank stock.

Banner Bank’s Regional Footprint

Banner Corporation is a bank holding company that operates a commercial bank with locations across Washington, Oregon, Idaho, and California. The bank provides a wide array of deposit services and loans and is active in the loan market, particularly in the mortgage business for both single-family and multifamily residential loans.

The company also exhibits a strong focus on servicing the needs of small to medium-sized businesses, generally offering loans aimed at the commercial real estate, construction, agricultural, and consumer sectors.

Third-party sources have recognized Banner Bank’s exemplary performance in the banking industry. Forbes distinguished Banner as one of America’s 100 Best Banks. Newsweek also repeated its recognition of Banner as one of America’s most trustworthy companies, and more recently, named it as one of the best regional banks in the country. S&P Global Market Intelligence placed Banner’s financial performance within the top 50 public banks with assets exceeding $10 billion. Q2 Holdings, a notable digital banking provider, also awarded Banner its Bank of the Year for Excellence.

Banner’s Recent Financial Results

The company recently announced financial results for Q1 2024, reporting revenues of $144.6 million, exceeding the market consensus of $135.8 million. However, revenues decreased from $152.5 million in the preceding quarter, and were down $162.6 million from Q1 2023. Net income for this quarter was $37.6 million, or $1.09 per diluted share, slightly lower than the expected $1.13, and a noted decrease from $42.6 million or $1.24 per diluted share in the preceding quarter.

The net interest income for Q1 2024 was $133 million, a decline from $138.4 million in the preceding quarter. This decrease is attributed to increased funding costs, which were somewhat mitigated by increased yields on earning assets. As of March 31, 2024, the on-balance sheet liquidity stood at $2.77 billion, a slight drop compared to $2.93 billion at the end of December 2023.

The bank issued a dividend of $0.48 per share paid to shareholders in the March 31, 2024 quarter. While this marks an ongoing commitment from the bank to generate income for its investors, the bank has seen a bit of volatility around its dividend over the past decade.

What is the Price Target for BANR Stock?

The stock has been trending downward, shedding roughly -7% in the past 90 days. It continues to demonstrate negative price momentum, trading below the 20-day ($45.23) and 50-day ($45.61) moving averages.

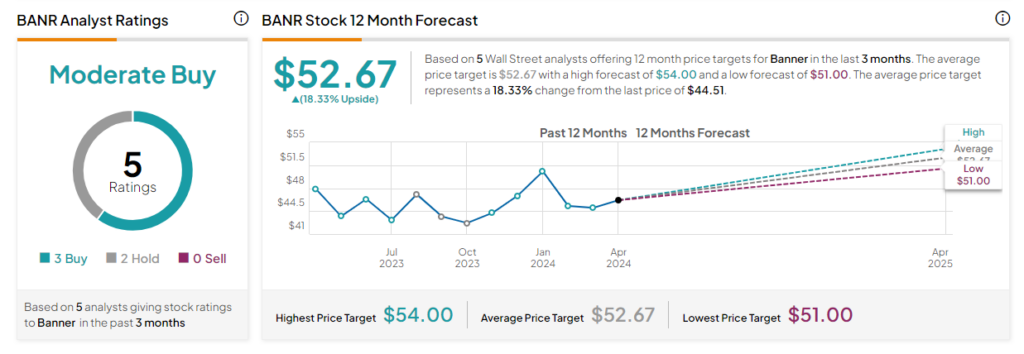

Analysts following the bank have been cautiously optimistic about the stock. For instance, Stephens analyst Andrew Terre recently lowered the price target from $54 to $53 while keeping a Buy rating on the stock. He cites a favorable net interest margin and forecasts upside growth above expectations.

Banner is rated a Moderate Buy based on the recommendations and 12-month price targets that five Wall Street analysts have issued over the past three months. The average price target for BANR stock is $52.67, which represents a 18.33% upside from current levels.

Bottom Line on BANR

The evolving landscape of the U.S. commercial banking sector has put immense strain on regional banks. Despite these challenges, Banner has maintained its reputation as a high-quality banking option. The bank’s financial performance, while slightly lower than anticipated due to rising funding costs and decreased office occupancy rates, still exceeded market expectations. Investors looking for a resilient income-generating small bank stock might want to explore this option in greater detail.