There’s been a lot of talk recently about this year’s bull market, both on its own merits and in comparison to last year. But somewhat less attention has been paid to it as part of a larger trend overall – a secular bull market that began in 2013 and has seen the S&P 500 reach recent record highs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Long-term trends are good for the market generally, but what the average retail investor really wants is a solid return in the here-and-now. There are several routes to accomplish this, and one of the surest is investing in high-yield dividend stocks. Dividend payments ensure a regular income stream, regardless of market conditions, while high yields offer the potential for solid returns on investment.

Several stock sectors are recognized for their high dividends, but we’ll focus here on some business development companies. These firms provide credit access to a wide range of small- and mid-sized businesses, and return their investment profits to their own investors.

Bank of America analyst Derek Hewett is upbeat on the BDC sector, writing: “Our more optimistic view is due to stronger core EPS and relatively stable credit given the improving investment outlook… Base rates are expected to stay elevated in the near-term, which support a more durable top line. And despite higher rates, we expect solid credit to persist as underlying borrower performance remains resilient.”

Hewett goes on to upgrade his stance on two of these stocks, BDCs that feature at least 9% dividend yields.

In fact, it’s not only Bank of America who favors these names. Using the TipRanks database, we found that both are also rated as ‘Strong Buys’ by the analyst consensus. Let’s take a closer look.

Golub Capital BDC (GBDC)

The first stock that we’ll look at is Golub Capital. This is a mid-cap BDC firm that, like its peers, invests in small- and mid-sized enterprises, providing a necessary combination of capital, credit, and other financial services to its client base. The firm’s target clients reside within the small business sector, which has contributed to the long-term growth of the US economy, relying on BDCs to provide necessary credit and capital services.

Golub focuses on a crucial aspect of its business: delivering attractive total returns for its investors. The company achieves this by cultivating a high-quality client base, with many repeat clients. Golub, as an experienced credit asset manager, understands the importance of portfolio quality.

The company’s investment portfolio is substantial. As of December 31, 2023, it consisted of investments in 357 companies with a fair value of $5.443 billion. The largest part of the portfolio, 86% of it, comprises first lien one-stop loans. The remainder includes 8% in first lien traditional senior loans, 5% in equity, and 1% in junior loans. Golub’s investments span a wide range of business sectors, with a preference for investing in software firms, which represent 27% of the portfolio. The next two largest segments are healthcare providers, accounting for 8% of the total, and specialty retail, at 6%.

This high-quality portfolio generated a total investment income of $164.77 million in the last reported quarter, fiscal 1Q24. This figure exceeded the forecast by $3.79 million, although it remained flat year-over-year. It supported a net investment income of 50 cents per share by non-GAAP measures, surpassing estimates by 2 cents per share.

Golub’s net investment income per share was sufficient to fully cover both regular and special dividends, which were scheduled for payouts on March 28 and March 15, respectively. Calculating based on the regular dividend only, at 39 cents per common share, the annualized payment of $1.56 yields a forward yield of 9.5%.

In analyst Hewett’s view, this is a stock that deserves more attention from investors. He writes of it, “We believe GBDC’s value proposition is not fully discounted in current share prices due to (1) a top-tier lending reputation Golub has developed in the middle market, (2) attractive financing from securitizations and SBIC financing, and (3) unique scale to underwrite larger deals since Golub manages private funds.”

Quantifying his stance, the Bank of America analyst has upgraded GBDC shares from Neutral to Buy. His $17 price target, combined with the dividend, gives the stock a total return potential of 13.5% for the year ahead. (To watch Hewett’s track record, click here)

Overall, this stock has 4 recent analyst reviews on file, with a 3 to 1 split favoring Buy over Hold for a Moderate Buy consensus rating. (See GBDC stock forecast)

Blackstone Secured Lending Fund (BXSL)

The next Bank of America BDC pick is Blackstone Secured Lending Fund, a BDC that operates under the aegis of the larger asset manager, Blackstone. The BXSL, in its own operations, works in financial services as a source of capital and credit for private companies in the US. BXSL has diversified its investments across a wide range of industries. Similar to Golub Capital, it favors the software and healthcare fields. The former makes up 17% of the company’s investment portfolio, while the latter comprises 11%.

Of the investments that Blackstone makes, 98.5% are first lien senior secured loans, and 94.75% are in the US. The company also has investments in Canada and Europe. Overall, this BDC has active investments in 196 client companies, and the investments are worth $9.9 billion at fair value.

The company’s portfolio generates strong income, and in its last fiscal quarter, 4Q23, it reported total investment income of $304 million. This income was up a robust 21% year-over-year, and came in $11.28 million better than had been anticipated. At the bottom line, BXSL’s net investment income of 96 cents per share was 2 cents over the forecast.

Turning to the dividend, we find that BXSL declared a payment of 77 cents per common share, scheduled to be paid out on April 26. This dividend is fully covered by the company’s net investment income, and its annualized rate, at $3.08 per common share, gives return-minded investors a forward yield of 10%.

Taken together, all of this caught Hewett’s eye, and in his note for Bank of America the analyst explains why he believes that this BDC is a sound choice: “We believe BXSL is well positioned to gain share due to (1) a proprietary origination platform, (2) late-cycle oriented portfolio, (3) favorable fee structure creates greater shareholder alignment. Additionally, BXSL has demonstrated best-in-class credit since inception.”

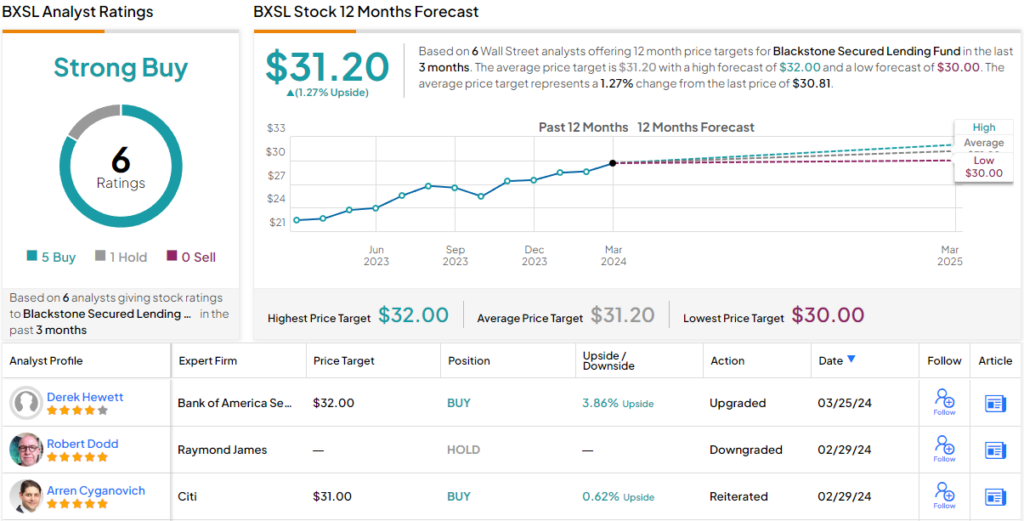

The analyst goes on to upgrade BXSL from Neutral to Buy, while setting a $32 price target that points toward a modest gain of ~4% on the one-year horizon. That potential share appreciation, added to dividend, equals a possible one-year return of 14%.

Zooming out to the broader picture, we find that the 6 recent analyst reviews of this stock break down 5 to 1 in favor of Buy over Hold for a Strong Buy consensus rating. (See BXSL stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.