Bank of America (BAC) shared a new list of stocks that it sees as well set for the rest of the year. The group covers companies in tech, finance, health, and industry. Each name has strong gains so far, yet the bank still sees more room for progress. The view is based on trends in sales, new clients, and long-term plans.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

AI Strength

Nvidia (NVDA) remains the top pick. The bank kept its Buy call after the chip firm posted strong demand for its AI parts. The latest quarter reported revenue of $57 billion, a clear increase from last year. In addition, Bank of America said the stock still trades at a fair level when set next to its earnings path. The bank expects earnings per share to rise more than 40% in the next year, and it sees a stable need for AI hardware.

Next on the list is Palantir (PLTR). The bank lifted its price target to $255 from $215 after the software firm gave new data on client growth. Total clients rose 45% from last year, and U.S. commercial clients grew 65% in the same period. The bank said the firm has strong skills in secure AI tools and sees a long line of new work in both public and private groups.

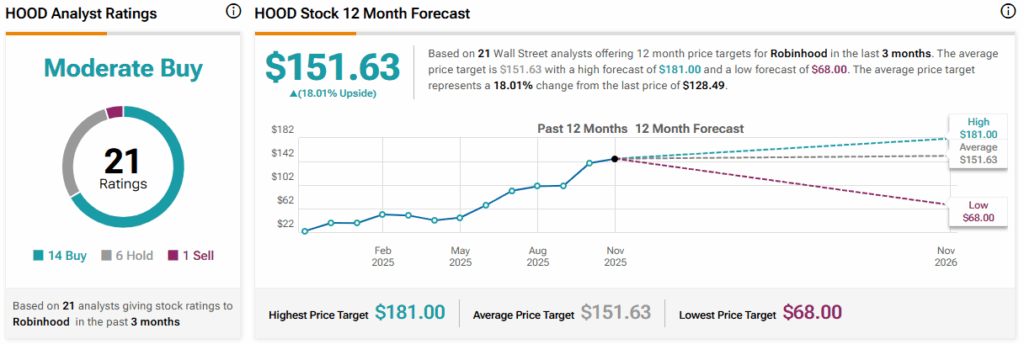

Bank of America also maintained its positive rating on Robinhood (HOOD). The firm beat sales and profit forecasts in the most recent quarter. Revenue hit $1.27 billion, which was up 100% from last year. Crypto trades rose 339% and equity trades rose 132% in the same period. As a result, the bank raised its price target to $166. It also noted that Robinhood now serves a wider range of clients and adds new tools at a quick pace.

Other Picks

Crane (CR) also appears on the list. The bank said the firm gives stable gains in a time of mixed trends across the wider market. While Crane works in many fields, the bank pointed to its strength in its aerospace and flow tech units. It also said the firm has room to lift profit rates in older lines while it seeks new deals to add scale.

Lastly, BofA issued a Buy rating on Supernus Pharmaceuticals (SUPN). The bank set a price target of $65 and said the firm has three drugs that guide its near-term growth path. These drugs treat attention deficit cases and motor issues in late-stage Parkinson’s disease. The bank noted that the market has not yet set a fair view of this growth path.

We used TipRanks’ Comparison Tool to align all five stocks side by side. This tool helps investors gain an in-depth look at each stock and the AI, Aerospace, and Pharmaceutical industries as a whole.