Bank of America (BAC) has downgraded shares of Oklo (OKLO) due to valuation concerns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts at Bank of America warn that the valuation of the small modular nuclear reactor developer has run “ahead of reality.” As such, the bank has lowered its rating on OKLO stock to a Hold-equivalent neutral from Buy previously.

The downgrade comes after Oklo’s stock had risen 425% this year. However, despite lowering its rating on OKLO stock, Bank of America raised its price target on the shares to $117 from $92. The new price target is 5% above where the stock currently trades.

High Potential

In its note to clients, Bank of America wrote that: “Valuations now embed deployment ramps and discount rates we view as unrealistic at this stage of SMR adoption.” Analysts at the lender added: “While we remain positive on the long-term nuclear theme, current valuations leave little room for error and the near-term risk/reward skews negative.”

Oklo’s stock has skyrocketed this year as investors bet that its small modular nuclear reactors will be used to help power data centers that are at the heart of the artificial intelligence (AI) boom. However, before that happens, the reactors must still receive regulatory approval in the U.S.

Is OKLO Stock a Buy?

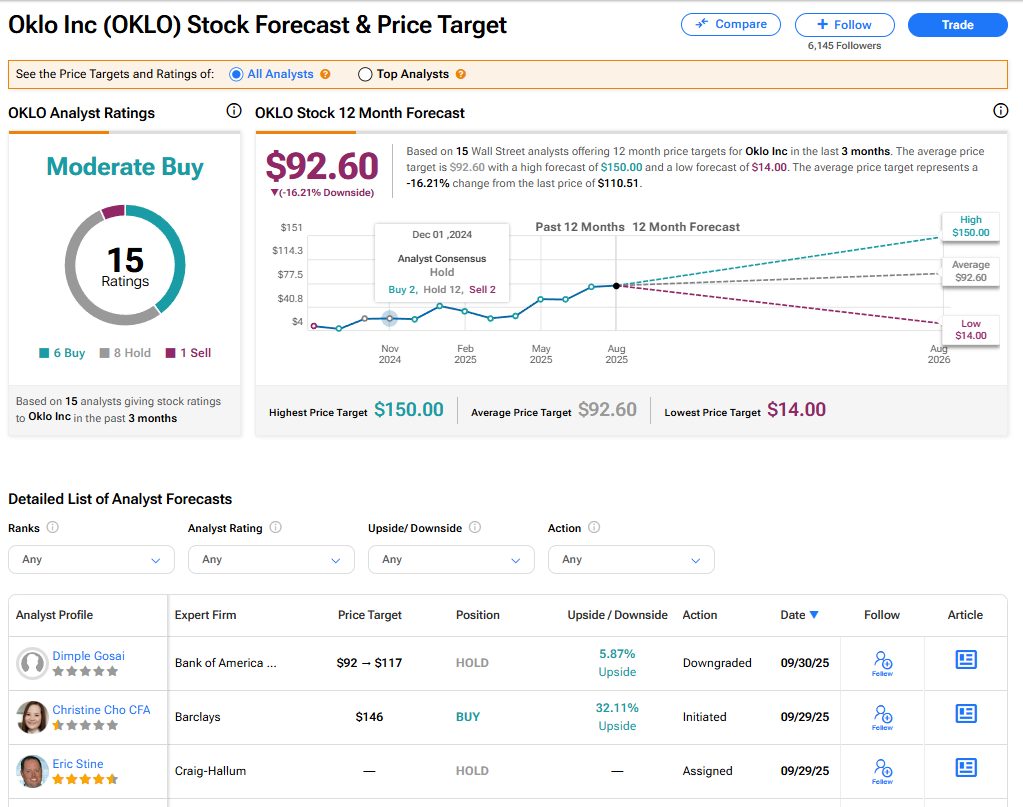

The stock of Oklo has a consensus Moderate Buy rating among 15 Wall Street analysts. That rating is based on six Buy, eight Hold, and one Sell recommendations issued in the last three months. The average OKLO price target of $92.60 implies 16.21% downside from current levels.