Just three months after semiconductors giant Nvidia (NASDAQ:NVDA) announced the arrival of its “Blackwell” GPU architecture tailored for artificial intelligence functions, on Saturday Nvidia announced an even newer kind of AI chip. Delivering the keynote address at the Computex tech conference in Taiwan over the weekend, Nvidia CEO Jensen Huang revealed that Nvidia promised upgrades of the Blackwell architecture (“Blackwell Ultra”) will arrive in 2025, to be followed in 2026 by an even more powerful chip dubbed “Rubin.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

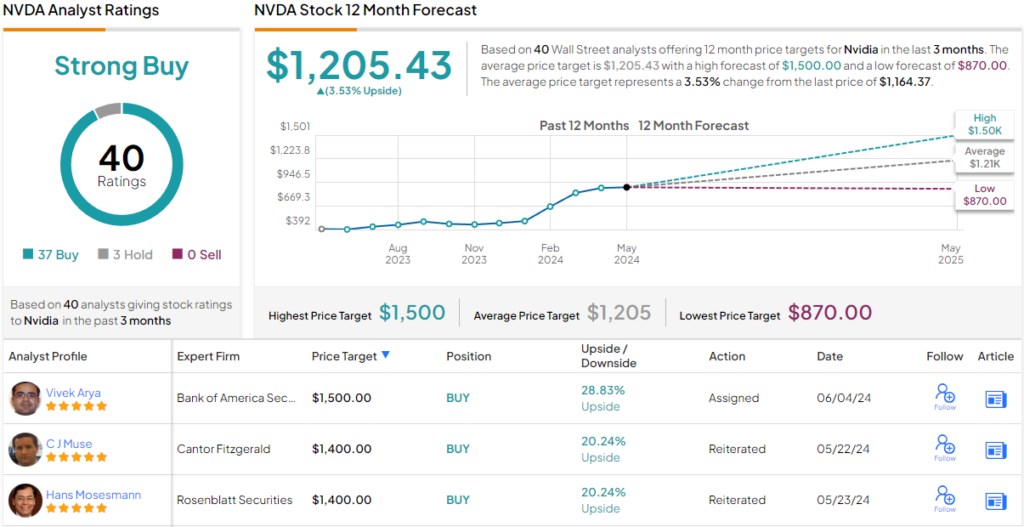

The company’s delivering on its promise to announce new upgrades annually, rather than biannually, inspired Bank of America analyst Vivek Arya to publish a research note reiterating his Street-high price target of $1,500 and Buy rating on Nvidia stock. (To watch Arya’s track record, click here)

Building on its lead in chips for “training” AI systems, Nvidia’s newest Blackwell offering, the GB200 NVL2 platform, will feature two Blackwell GPUs and two Grace CPUs and is intended for use in mainstream large language model “inference” applications (i.e. giving answers to questions posed to the AI). The company is also putting out new offerings with regularity, and laying out a “multi-generational roadmap” giving visibility through at least 2027.

Exactly how big is Nvidia getting in the AI space? Here’s a clue: Huang is now talking up the potential for multiple “cluster data centers” to be built, featuring one million Nvidia GPUs each. Simply put, Nvidia is planning to sell staggering numbers of its high-priced AI chips, generating gross profit margins of 75% per chip – and even more impressively, net profit margins in excess of 50% per chip.

Meanwhile, criticism of Nvidia’s stock price tends to center on the company’s incredibly high price-to-sales ratio, which is in excess of 34x sales at present. What’s not always noticed, however – and what’s in fact so very hard to grasp because it’s so rarely seen in most stocks – is the fact that because the company’s profit margin on sales is so high, Nvidia’s price-to-earnings ratio isn’t so terribly different from its price-to-sales ratio.

This is not a situation where, for example, a P/S of 34 implies that the P/E must be in the triple digits (common among stocks with, say, a 10% profit margin). Rather, because Nvidia converts more than $0.50 of every $1 in sales into bottom line profit, the company’s P/E ratio is actually only 64 at present.

It’s not a cheap price, exactly, but it’s a whole lot cheaper than you’d ordinarily expect from a company with a 34 P/S. What’s more, with Arya predicting that Nvidia will earn $50 per share annually a couple of years from now, even a Street-high $1,500 target price implies Nvidia stock only sells for about 30x earnings, two years out.

Nvidia will need to maintain high profit margins to make that happen, and Bank of America certainly thinks they’re on track to do just that.

The rest of the Street’s take on Nvidia is flashing mixed signals. On the one hand, based on 37 Buys and just 3 Holds, the stock boasts a Strong Buy consensus rating. However, NVDA stock has just clocked a new all-time high, and many believe that, with a $1,205.43 average price target, the shares have run enough for now. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.