Bank of America (BAC) is set to release its third quarter 2024 financials on October 15. Wall Street analysts anticipate a decline in both revenue and earnings for Q3, indicating potential weakness in BAC’s near-term performance. They expect the company to report earnings of $0.76 per share, representing an 18% decrease year-over-year. Additionally, revenues are expected to fall by 44% from the year-ago quarter to $25.25 billion, according to data from TipRanks.

It’s worth noting that since July, Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) has been decreasing its stake in Bank of America (BAC), earning nearly $10 billion from the sales. Analysts are divided on the reasoning: some believe Buffett has lost faith in BAC, while others think he anticipates a market downturn. Some suggest he’s merely taking profits from a significant gain in the stock.

With this in mind, it will be intriguing to see how Bank of America performs in its upcoming Q3 earnings report. Investors will closely monitor the situation to assess whether Berkshire’s selloff indicates deeper concerns or is simply a strategy for profit-taking.

Factors to Consider Ahead of Q3

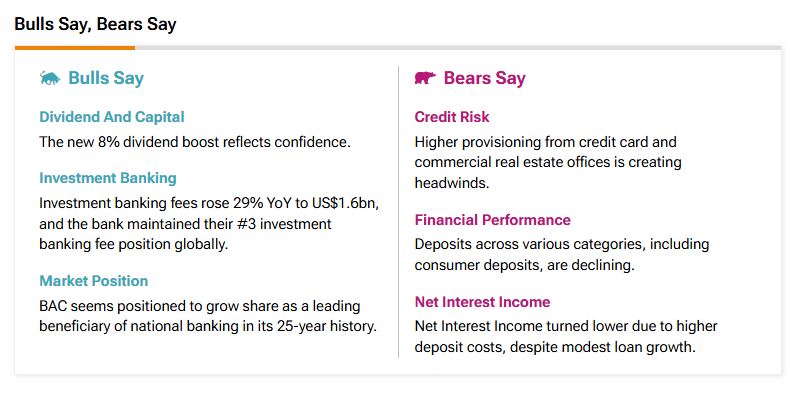

According to TipRanks’ Bulls Say, Bears Say tool shown below, bullish analysts highlight several positive factors for BAC. The recent 8% dividend increase signals strong confidence in the company’s financial health. Analysts also note that BAC is well-positioned to expand its market share, benefiting from its 25-year history as a leader in national banking.

However, challenges remain. Bears raise concerns about increased credit risk from higher provisioning for credit cards and commercial real estate, which are creating headwinds for the bank. Additionally, deposits, including consumer deposits, are declining, further impacting financial performance. Furthermore, Net Interest Income (NII) has fallen due to rising deposit costs, despite modest loan growth.

Options Traders Anticipate a Large Move

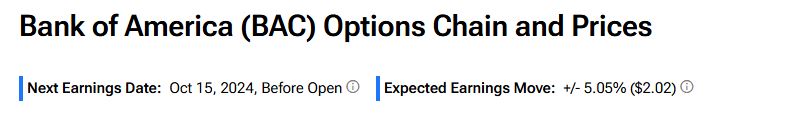

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 5.05% move in either direction.

What Is the Price Target for BAC Stock?

Turning to Wall Street, BAC has a Moderate Buy consensus rating based on 13 Buys and six Holds assigned in the last three months. At $45.89, the average Bank of America price target implies 14.81% upside potential. Shares of the company have gained about 21% year-to-date.