Baidu (BIDU) stock jumped 11.3% on Wednesday, as investors are impressed with the Chinese internet giant’s artificial intelligence (AI) push, especially the company’s focus on its in-house AI chip. Moreover, recent bond sales have eased funding concerns, boosting investors’ confidence in Chinese tech names. Meanwhile, Baidu’s growing focus on AI won it a price target hike from a top Jefferies analyst.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Baidu’s AI Focus Drives Stock Higher

Baidu’s U.S.-listed shares have rallied more than 53% in the past month, bringing the year-to-date rally to 63.5%. The company is focused on expanding its AI business, which is expected to mitigate the weakness in its core ad business. Earlier this week, Baidu struck an AI deal with China Merchants Group, a major state-owned enterprise that is focused on transportation, finance, and property development.

According to a report by The Information, Baidu is training new versions of its AI chatbot Ernie using its internally developed Kunlun P800 chip. Additionally, the company has recently secured a deal with China Mobile (HK:0941) for its in-house chip.

E-commerce and cloud computing giant Alibaba (BABA) has also reportedly been using its in-house chips for smaller AI models. Moreover, Alibaba has entered into a deal with China Unicom (HK:0762) for its homegrown AI chip. The Chinese government has been pushing domestic tech companies to reduce their reliance on Nvidia (NVDA) chips, citing security concerns and a focus on domestic production.

Meanwhile, Baidu disclosed a 4.4 billion yuan ($56.2 million) offshore bond offering on Tuesday. Other Chinese companies have also been raising funds to support massive AI investments.

Top Jefferies Analyst Raises BIDU Stock Price Target

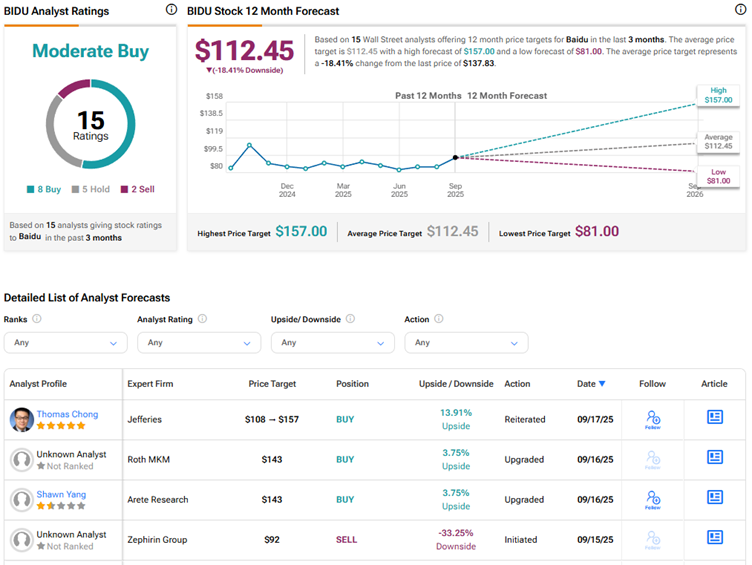

On Wednesday, Jefferies analyst Thomas Chong increased his price target for Baidu stock to $157 from $108 and reiterated a Buy rating. The 5-star analyst stated that the company is gaining attention due to its recent AI developments, including deals with large customers for AI collaboration, as well as news related to the Kunlun in-house chip.

Chong also noted that Baidu is being viewed as a key player based on its market share in AI Cloud revenue and its penetration among large customers. The analyst highlighted the impressive sequential growth in Baidu’s AI agents and digital human offerings, as well as the overseas expansion of its Apollo Go autonomous driving platform.

Is Baidu Stock a Buy, Sell, or Hold?

Currently, Wall Street has a Moderate Buy consensus rating on Baidu stock based on eight Buys, five Holds, and two Sell recommendations. The average BIDU stock price target of $112.45 indicates 18.4% possible downside from current levels.