Shares in Chinese internet giant Baidu (BIDU) motored higher today as it gets set to launch its robotaxi services on the roads of Europe.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Switzerland Set For Go

BIDU stock was over 2% higher after the Wall Street Journal reported that it has been in talks with Switzerland’s PostAuto to launch its Apollo Go robotaxi service in the country. It is also reportedly planning to set up a local entity in Switzerland and start testing the technology by the end of 2025. It also plans to launch Apollo Go in Turkey.

This follows fellow Chinese group WeRide (WRD), which raised $440.5 million in a U.S. IPO last year. It launched a pilot program for autonomous vehicles in Switzerland in January and in March started trial operations for a driverless shuttle bus service in France.

The robotaxi sector is becoming increasingly competitive both in China and the U.S. where Elon Musk’s Tesla (TSLA) is planning to launch its robotaxi technology in Texas next month.

Big Prize on Offer

Chinese firms are deliberately targeting Europe for expansion because of fears that they will face extra regulatory scrutiny if they decide to launch services in the U.S. Particularly, some might argue, given Musk’s close relationship with the White House.

But American firms also have their sights set on Europe with Uber Technologies (UBER) planning to deploy robotaxis in Europe early next year. They will partner with Chinese self-driving startup Momenta in that move.

However, Europe may also have plenty of its own regulatory barriers in place. “It will take some time for safety trials to convince regulators,” said Kai Wang, a Morningstar analyst in the WSJ report.

Other analysts said the prize would be worth any pain and would be a success given the relatively high cost for taxi drivers in Europe.

Nomura analyst Joel Ying said that successfully launching a robotaxi service in the EU would be “good business,” as the market has a relatively high cost for taxi drivers and demand for comfort or in layman’s terms stressfree driving.

Is BIDU a Good Stock to Buy Now?

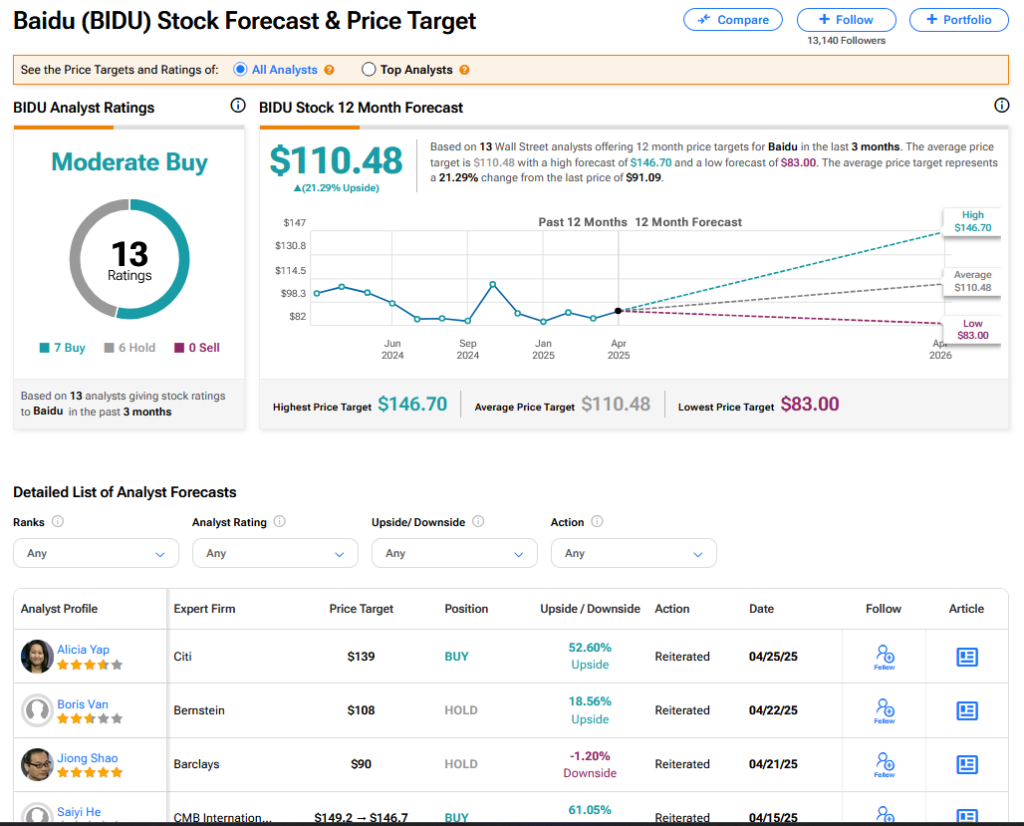

On TipRanks, BIDU has a Moderate Buy consensus based on 7 Buy and 6 Hold ratings. Its highest price target is $146.70. BIDU stock’s consensus price target is $110.48 implying an 21.29% upside.