Chinese technology giant Baidu, Inc. (NASDAQ:BIDU) has posted better-than-expected second-quarter 2022 results, which were driven by the strong performance of the company’s cloud and other AI-powered businesses.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Q2 Results in Detail

Baidu reported earnings per ADS of $2.36, beating analysts’ consensus by $0.82. The bottom-line figure rose 2% from the year-ago period. Total revenues of $4.43 billion (RMB 29.6 billion) slipped 5% from the year-ago period but surpassed analysts’ expectations by $230 million.

Revenue from iQIYI came in at RMB 6.7 billion ($994 million), falling 13% year-over-year. The average daily number of iQIYI’s total subscribing members stood at 98 million in the reported quarter, comparing unfavorably with 99 million in the same quarter last year.

Baidu Core reported revenue of RMB 23.2 billion ($3.46 billion), down 4% year-over-year. There was a 10% year-over-year fall in online marketing revenues in the reported quarter to RMB 17.1 billion ($2.55 billion).

Meanwhile, non-online marketing revenue surged 22% over the prior year to RMB 6.1 billion ($906 million) on the back of robust growth in cloud and other AI-powered businesses.

Adjusted EBITDA came in at $1.05 billion (RMB 7.1 billion), down 3% from the year-ago period.

Selling, general, and administrative expenses were RMB 4.8 billion ($714 million), falling 16% from the last year’s quarter. The downside can be attributed to constrained channel spending and promotional marketing.

Additionally, research and development expenses remained flat at RMB 6.3 billion ($939 million).

In June, Baidu App’s monthly active users (MAUs) were recorded at 628 million, rising 8% from the year-ago quarter, while daily logged-in users touched 84%.

Further, Baidu’s autonomous ride-hailing service, Apollo Go, delivered robust growth as it provided 287,000 rides in the second quarter of 2022. Interestingly, Apollo Go touched the milestone of one million accumulated rides on July 20, 2022.

Financial Position

Baidu recorded cash, cash equivalents, restricted cash, and short-term investments of RMB 189.4 billion ($28.28 billion) as of June 30, 2022. The company’s free cash flow came in at RMB 5.5 billion ($823 million).

Wall Street Is Optimistic about Baidu Stock

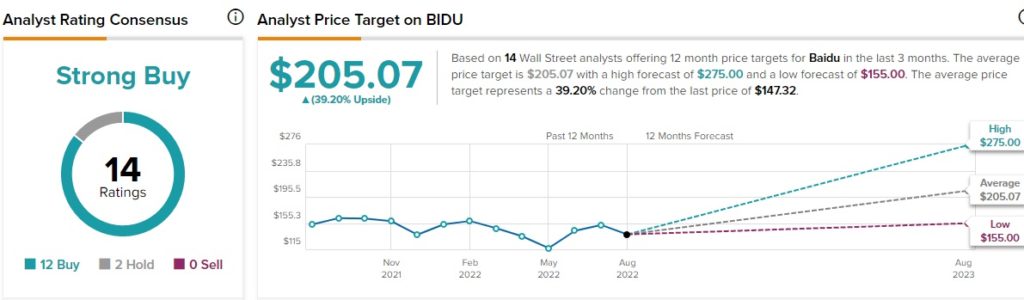

Baidu seems like a good stock to grab now. As per TipRanks, the Street is highly confident about this Chinese multinational technology company, which enjoys a Strong Buy consensus rating based on 12 Buys and two Holds. BIDU stock’s average price target of $205.07 signals that it may surge nearly 39.2% from current levels.

TipRanks data shows that financial bloggers are 90% Bullish on Baidu stock, compared to the sector average of 65%.

Final Thoughts

Baidu has managed to deliver impressive earnings results despite COVID-19 lockdowns in China during the reported quarter. Following the news, shares of the Beijing-based company rose 1.6%, at the time of writing, in the pre-market trading session on Tuesday.

The company’s management seems to be upbeat about the continued strength of Baidu’s cloud and other AI-powered businesses. Also, the company’s efforts to improve operational efficiency are translating into enhanced operating margin levels.

Read full Disclosure