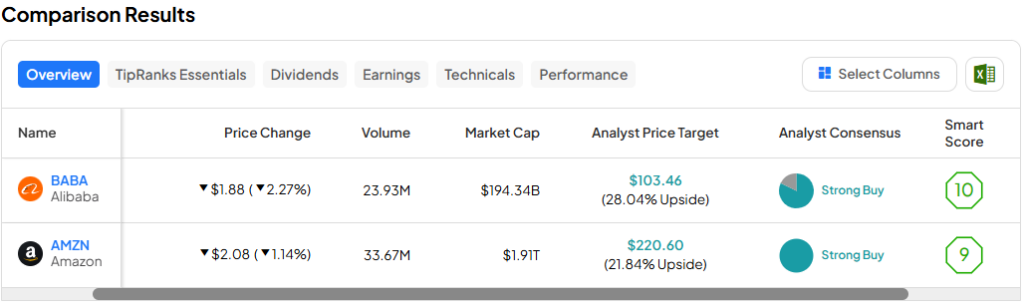

In this piece, I evaluated two e-commerce stocks, Alibaba (NYSE:BABA) and Amazon (NASDAQ:AMZN), using TipRanks’ Comparison Tool below to see which is better. A closer look suggests a neutral view for Alibaba and a bullish view for Amazon.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

China-based Alibaba operates several e-commerce sites, including Alibaba.com, Tmall, and Taobao, and offers cloud computing services and digital media and entertainment. Similarly, U.S.-based Amazon operates its own e-commerce site at Amazon.com and offers cloud-computing services via Amazon Web Services. Amazon also offers media and entertainment through Prime Video and sells various consumer-electronic devices, including various smart-home devices equipped with its Alexa digital assistant.

U.S.-listed shares of Alibaba are up 4.2% year-to-date but only 1% over the last year, while Amazon stock has surged 20% year-to-date and 57% over the last 12 months.

With such a dramatic difference in these companies’ share-price performances, it’s no surprise that they’re trading at very different valuations. However, a deeper dive into their valuation dynamics and other recent trends reveals the clear winner of this pairing.

Alibaba (NYSE:BABA)

At a price-to-earnings (P/E) ratio of 18.9x, Alibaba is trading towards the middle of its typical valuation range between about 10x and 40x since August 2019 (excluding the temporary spike that began in early 2022 and lasted until July 2023). On a forward-P/E basis, Alibaba’s valuation has plummeted to around 10.5x after peaking at around 32 in October 2020. However, a neutral view seems appropriate due to other concerns weighing on BABA shares.

Importantly, BABA stock isn’t actually stock. The U.S.-listed shares are actually American Depository Receipt (ADR) shares representing Alibaba stock, but technically, they aren’t direct shares of Alibaba.

While Alibaba’s revenue growth has slowed in recent years, coming to a near-halt in the year that ended in March 2023, it picked up again slightly in the fiscal year that ended this past March. The Chinese retailer posted ¥941.2 billion (US$130.35 billion) in sales for the full year, up 8% from the previous year.

Investors were initially displeased with the latest quarterly results, which showed a 96% year-over-year plunge in net income to ¥919 million. However, that drop was primarily due to plummeting valuations in Alibaba’s equity holdings due to mark-to-market changes.

Because of Berkshire Hathaway’s (NYSE:BRK.A) (NYSE:BRK.B) massive stock portfolio, Warren Buffett always advises investors to look at the firm’s operating earnings rather than its net income, and the same is true for Alibaba. The Chinese retailer’s operating income declined 3% year-over-year, which is far easier to swallow.

However, on Thursday morning, various news outlets reported that Alibaba was exploring a convertible bond sale, which sent its Hong Kong-listed shares tumbling before the U.S. markets opened. The company reportedly needs to invest in its e-commerce and cloud divisions, which have been shedding market share since Chinese authorities cracked down on them.

Despite that need, Alibaba authorized another $25 billion in share repurchases earlier this year, one of the largest buybacks ever in China. Thus, it’s easy to see how Alibaba shares have come under pressure, especially considering the wider concerns about investing in Chinese stocks amid the delisting threat in the U.S.

Those fears were averted, at least temporarily, when U.S. regulators gained access to company audits, which were previously withheld by Chinese authorities. However, a TD Cowen analyst said in April that the delisting threat hasn’t disappeared entirely, suggesting investors might want to take a wait-and-see approach on Alibaba, especially considering the financial slowdown.

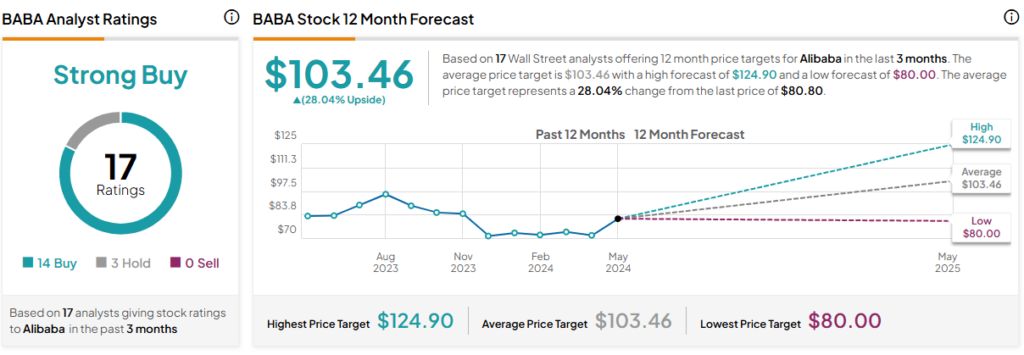

What Is the Price Target for BABA Stock?

Alibaba has a Strong Buy consensus rating based on 14 Buys, three Holds, and zero Sell ratings assigned over the last three months. At $103.46, the average Alibaba stock price target implies upside potential of 28.04%.

Amazon (NASDAQ:AMZN)

At a P/E of 51.2x, Amazon is trading around the bottom of its typical valuation range of between 50x and 100x over the last five years, excluding the sizable swings that started in February 2023 and ended in August 2023. On a forward-P/E basis, it’s a similar story as Alibaba, as Amazon’s forward valuation has plummeted. The difference is that Amazon doesn’t face the same headwinds as Alibaba. Considering these factors, a bullish view seems appropriate for Amazon.

While Alibaba’s recent earnings results showed a business in slight decline, Amazon’s results were as strong as ever. In fact, Amazon Web Services had its best quarter in over a year, and the company’s overall free cash flow hit a new record of $50 billion over the last 12 months.

The company does face a battle in artificial intelligence. However, CEO Andy Jassy said in the company’s first-quarter earnings call that the company is seeing “considerable momentum on the AI front, where we’ve accumulated a multi-billion-dollar revenue run rate already.” It seems that Amazon’s investment in generative AI startup Anthropic could be paying off, given the 17% year-over-year pop in net sales for AWS.

While Amazon wasn’t always a company many would think of when considering blue-chip stocks, it has certainly earned a position among these industry bellwethers with solid, long-running success. As a result, I believe Amazon is a stock worth buying and holding for the long term, especially at a time when investors can pick up shares at a relative discount. The company even joined the Dow Jones Industrial Average this year, which is a huge honor that demonstrates its economic-bellwether status.

What Is the Price Target for AMZN Stock?

Amazon has a Strong Buy consensus rating based on 42 Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $220.60, the average Amazon stock price target implies upside potential of 21.8%.

Conclusion: Neutral on BABA, Bullish on AMZN

While Alibaba has long been considered “China’s Amazon,” its earnings and growth trends aren’t spectacular right now. The talk about Alibaba possibly issuing convertible bonds shortly after authorizing such a massive share repurchase also calls into question the company’s capital allocation. After all, many investors will buy stock because of a large repurchase authorization, but when facing potential dilution at the same time, it may make more sense to wait and see what happens.

On the other hand, Amazon shares look reasonably valued right now. The reignited AWS growth suggests the company is making headway in the AI battle. Plus, Amazon looks like a long-term buy-and-hold position that most investors might not ever want to sell.