AutoZone (NYSE:AZO) shares are trending higher today after the automotive parts and accessories provider delivered better-than-expected second-quarter results. With a year-over-year increase of 4.6%, revenue of $3.86 billion outpaced expectations by ~$10 million. Further, EPS of $28.89 exceeded estimates by $2.27.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

During the quarter, AutoZone’s total same-store sales inched up by 1.5%. While domestic same-store sales improved marginally by 0.3%, its international same-store sales advanced at a faster pace of 10.6%.

Additionally, higher merchandise margins and favorable inventory helped the company expand its gross margin by 160 basis points to 53.9%. The company operated a total of 7,191 stores across the U.S., Mexico, and Brazil as of February 10, 2024. Notably, AZO repurchased shares worth $223.8 million in Q2. It had $2.1 billion remaining under its current share repurchase program.

Is AZO a Good Investment?

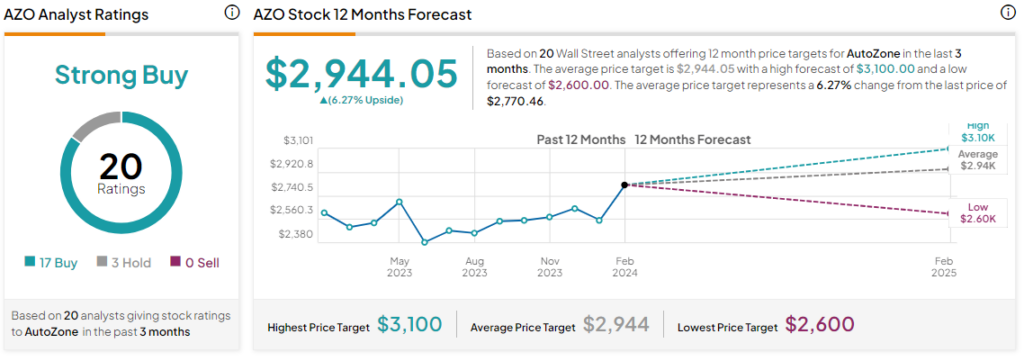

Today’s price gains come on top of a nearly 12% rise in the company’s share price over the past six months. Overall, the Street has a Strong Buy consensus rating on AutoZone alongside an average price target of $2,944.05. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure