Acuity Brands (NYSE:AYI) announced mixed Fiscal second-quarter results with adjusted earnings of $3.38 per share, up by 11% year-over-year beating consensus estimates of $3.17 per share. The industrial technology company generated net sales of $906 million, a decline of 4% year-over-year but fell short of Street estimates of $907.8 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

When it comes to its business segments, the Acuity Lighting and Lighting Controls (ABL) business saw net sales of $843.5 million, a drop of 5.3% year-over-year while its Intelligent Spaces Group (ISG) generated net sales of $68.1 million, a growth of 17% year-over-year.

Is Acuity Brands a Buy?

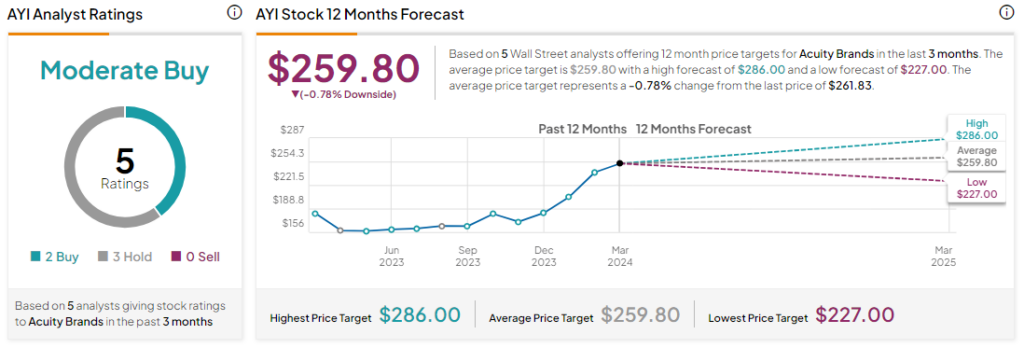

Analysts remain cautiously optimistic about AYI with a Moderate Buy consensus rating based on two Buys and three Holds. Over the past year, AYI stock has surged by more than 40%, and the average AYI price target of $259.80 implies a downside potential of 0.8% at current levels.