There’s perhaps no better place to be as consumers start getting more confident about spending money again on discretionary (nice-to-have) goods. Undoubtedly, credit card firms did a pretty sound job of navigating through inflation. Even as consumer budgets took a hit, firms like American Express (NYSE:AXP) and Visa (NYSE:V) were there to benefit as grocery bills rose through the roof. In a way, credit card companies are some of the best ways to make it through the inflationary environment. And at this juncture, both credit card plays are Buys, according to analysts.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In due time, inflation is poised to drop further, wages stand to creep higher, and lower rates will allow indebted consumers to spend money (primarily with their credit cards) on goods that would have otherwise gone on interest payments.

Of course, the timing of a consumer bounce-back is always tricky. Regardless, you really don’t need to time anything when it comes to American Express or Visa. They will be there once a consumer spending resurgence hits. And while it may not be as explosive as the one experienced in 2021, when we emerged from pandemic lockdowns, I think the post-inflation environment could see personal budgets rise. And with that, credit card firms may be in a prime position to experience another wave of growth.

Therefore, let’s check in with TipRanks’ Comparison Tool to gauge two very different credit card firms: Visa, the undisrupted market leader, and American Express, the firm behind higher-end cards that are really starting to gain appeal among younger people. And, for the record, I am bullish on shares of both companies going into the second half of the year.

American Express (NYSE:AXP)

American Express has surprisingly outpaced its top rival, Visa, on a year-to-date basis, surging more than 23% versus Visa’s 5.7% return. Despite being the older company, American Express is a smaller firm that could grow by leaps and bounds as it plays catch up. Just how can a firm that’s synonymous with high-status credit cards continue its relative outperformance? The answer is growth to be had from young consumers, specifically from its fee-based cards.

Young people, like those in the Millennials and Gen Z generation who will be entering their prime working years, are poised to become better off financially over time, and they’ve taken a liking to American Express cards.

American Express cards make a statement. They’re flashy, and they have “sweet” perks (think VIP experiences at concerts) tailored to their age group. Indeed, management’s aggressive push to win their business is worthy of investor applause. It’s these younger cardholders who may hold the keys to explosive spending over the next decade and beyond.

In the first quarter, the company saw around 60% of new card acquisitions coming from Millennials and Gen Z. While the growth in young cardholders is, to some degree, already reflected in AXP stock today, I believe the best has yet to come as Millennials become the biggest generation of spenders.

At writing, the stock goes for 19 times trailing price-to-earnings (P/E). This comes after the stock recently pulled back following a Hold rating slapped on AXP stock by Citi, as the bank is concerned about valuation. If you’ll be in the name long enough to benefit from recent growth in young consumers, I have no issue with paying the current multiple.

Additionally, these younger, tech-savvy consumers are likelier to be easier to reach via digital services. American Express’ digital app makes it easy to access offers, points management, customer service chat, and other services (think paying in installments via Plan It, Pay It). Additionally, American Express will have more data on its users to serve them delightful perks. Arguably, the company has never been this close to cardholders.

With such a digital advantage relative to Visa and a growth spurt in younger consumers, there should be no mystery as to why the firm has set a goal to grow its top line by 10%+ and EPS in the mid-teens annually in the long term.

What Is the Price Target of AXP Stock?

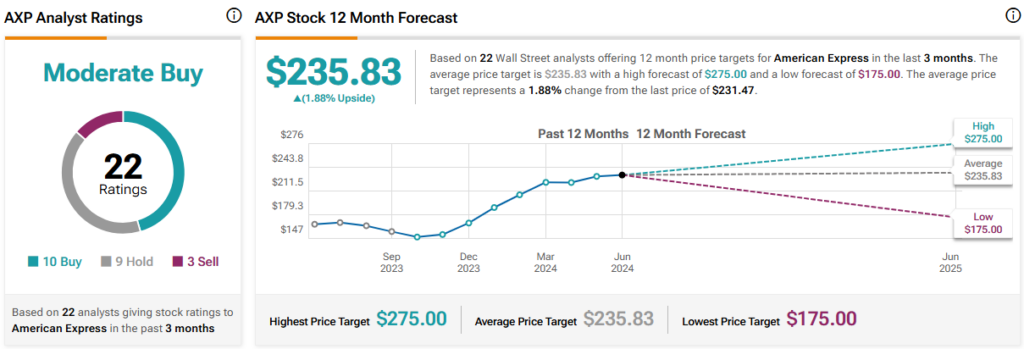

AXP stock is a Strong Buy, according to analysts, with 10 Buys, nine Holds, and three Sells assigned in the past three months. The average AXP stock price target of $235.83 implies 1.9% upside potential.

Visa (NYSE:V)

Visa reported a decent showing, with 10% revenue growth in its latest (second) quarter. Similar to American Express, about 70% of Visa’s new card sign-ups have been for fee-based cards recently. The company is also poised to tap into tech to hit the spot with younger cardholders while expanding its presence internationally. Visa’s Prosa deal (a payments processing company in Mexico) gives it a pretty nice runway in the emerging, high-growth Mexican market.

While Visa has been dragging a bit compared to American Express, I still think the name is worthy of investors’ radars, especially as the firm uses its size to its advantage. Despite being a market leader, the firm still has a literal world of growth opportunities in emerging markets. And with better acceptance internationally, Visa has an edge over American Express when it comes to convincing international customers to sign up for a new card.

Additionally, we’ve learned of some firms, like eBay (NASDAQ:EBAY), who’ve stopped accepting American Express due to higher swipe fees. Every time this happens, Visa stands to win some business from customers who would have otherwise swiped their Amex Platinum cards. Though the loss of one merchant isn’t a cause for concern for American Express users, I view the lower swipe fees as a potential edge for Visa, especially in international markets.

At writing, V stock trades at 30.9 times trailing price-to-earnings, making it far pricier than American Express but cheap relative to where the stock has spent most of the past year. All considered, Visa is a solid option for investors looking to play a global spending comeback.

What Is the Price Target of V Stock?

V stock is a Strong Buy, according to analysts, with 20 Buys and four Holds assigned in the past three months. The average V stock price target of $316.40 implies 14.5% upside potential.

The Bottom Line

Consumers should have an American Express and Visa card in their wallets to maximize their respective benefits. As for investors, I view AXP stock as not only the cheaper stock but also the one with more upside as it continues to attract younger consumers. By focusing on Millennials and Gen Z, American Express is doing a better job of future-proofing its business.