American Express (AXP) reported mixed results for the third quarter. The payments processing company generated earnings of $3.49 per share, up 5.8% year-over-year, and exceeded the consensus estimate of $3.38 per share. However, it slightly lagged analysts’ revenue expectations. Shares were down about 4% in Friday’s pre-market trading.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

AXP’s Q3 Revenues Driven by Higher Card Spending

Furthermore, AXP posted revenues of $16.6 billion, an increase of 8% year-over-year, compared to Street estimates of $16.7 billion. AXP’s revenues in the third quarter were driven by an increase of 6% in total spending by card members. Further, revenues generated through card fees grew 18% year-over-year.

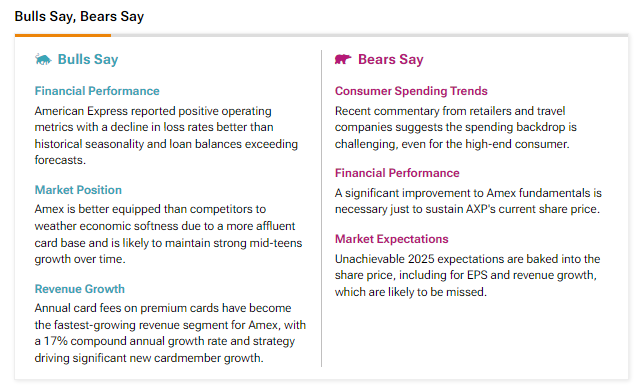

In fact, according to the TipRanks’ Bulls Say, Bears Say Tool, analysts bullish on AXP believe that the company is “better equipped than competitors to weather economic softness due to a more affluent card base and is likely to maintain strong mid-teens growth over time.”

AXP Raises FY24 Guidance

Looking ahead, AXP raised its FY24 guidance to the range of $13.75 to $14.05 per share, up from its prior guidance between $13.30 and $13.80 per share. For reference, analysts were expecting AXP to report full-year earnings of $13.28 per share. Additionally, AXP estimates its revenues to grow by around 9% year-over-year in FY24.

Is AXP a Buy or Sell?

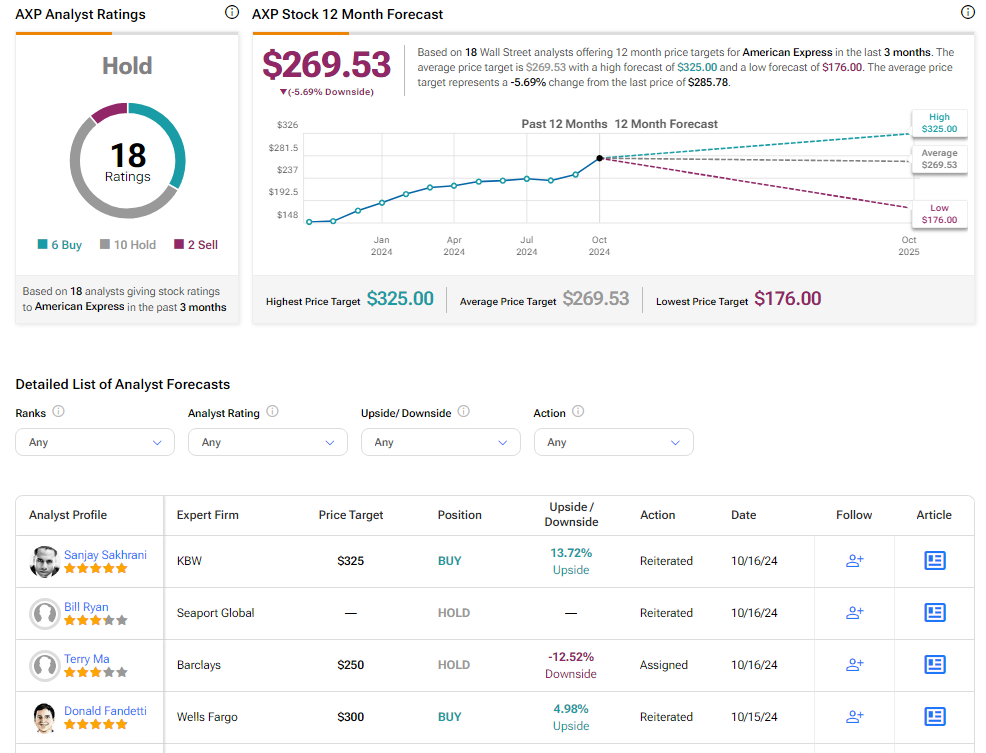

Analysts remain sidelined about AXP stock, with a Hold consensus rating based on six Buys, 10 Holds, and two Sells. Over the past year, AXP has surged by more than 90%, and the average AXP price target of $269.53 implies a downside potential of 5.7% from current levels. These analyst ratings are likely to change following AXP’s results today.