Credit card giant American Express (AXP) has reported strong quarterly financial results as its largely affluent cardholders continue to spend money despite signs of an economic slowdown.

The New York City-based company reported first-quarter earnings per share (EPS) of $3.64, which was ahead of the $3.48 expected on Wall Street. Profit was up 6% from a year ago. Revenue in the January through March period totaled $17 billion, which narrowly topped sales of $16.94 billion that was the consensus expectation of analysts.

In its earnings statement, American Express said that cardmember spending, credit performance, and demand “continued to be strong” during Q1. American Express tends to benefit from the fact that its credit card members are more affluent and wealthier and can withstand an economic downturn.

Stable Guidance

The company also issues a lot of corporate credit cards whose balances are paid in full each month by companies rather than individuals. This helps to explain why, despite signs that the U.S. economy is weakening, American Express maintained its full-year 2025 guidance for both revenue and earnings.

In January of this year, the credit card company said it expects 2025 revenue growth of 8% to 10% and earnings of $15 to $15.50 per share. The stock of American Express has declined 15% this year and is trading flat after its latest quarterly financial print.

Is AXP Stock a Buy?

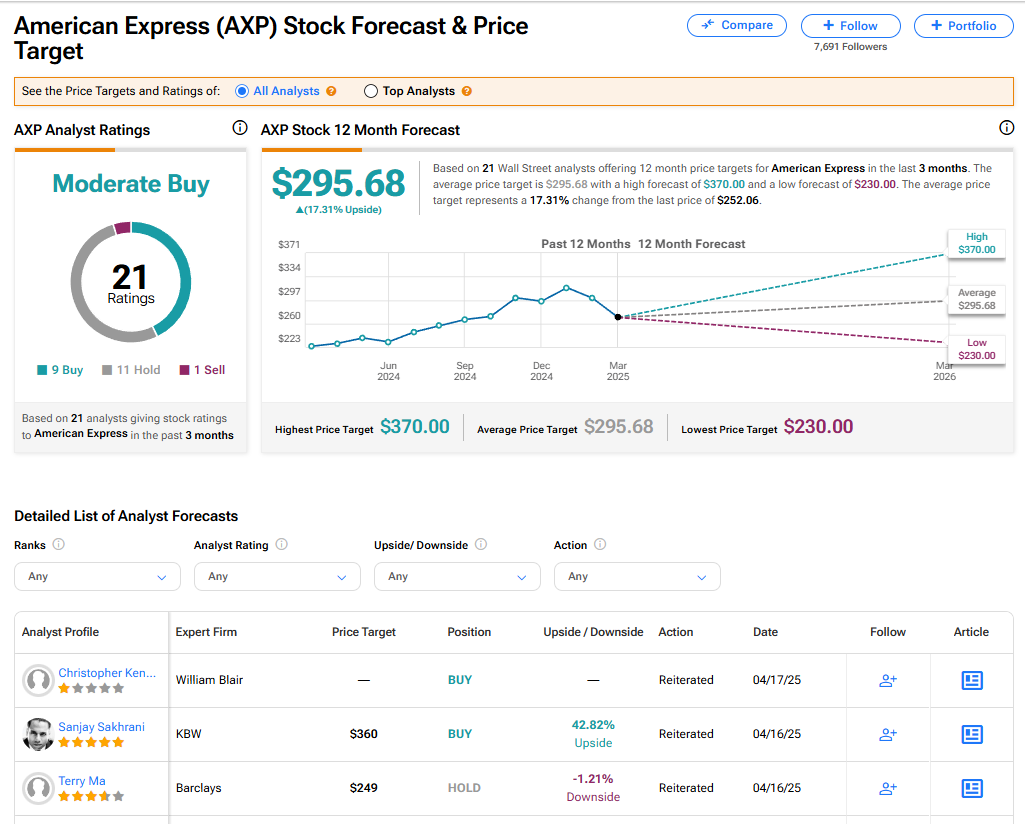

The stock of American Express has a consensus Moderate Buy rating among 21 Wall Street analysts. That rating is based on nine Buy, 11 Hold, and one Sell recommendations issued in the last three months. The average AXP price target of $295.68 implies 17.31% upside from current levels. These ratings are likely to change after the company’s latest financial results.