Shares of technology distributor and solutions provider Avnet (NASDAQ:AVT) are rising in the pre-market session today after it posted better-than-anticipated fourth-quarter numbers. Revenue rose 2.9% year-over-year to $6.6 billion, outperforming estimates by $330 million. EPS at $2.06 too surpassed expectations by $0.41.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, while Electronic Components (EC) sales rose by 3% to $6.1 billion, Farnell sales inched up by 0.7% to $445.4 million. The company saw healthy growth across the Americas and EMEA regions but witnessed a sharp 11.9% contraction in Asia.

Looking ahead, Avnet expects Q1 2024 sales to hover between $6.15 billion and $6.45 billion. EPS for the quarter is anticipated between $1.45 and $1.55.

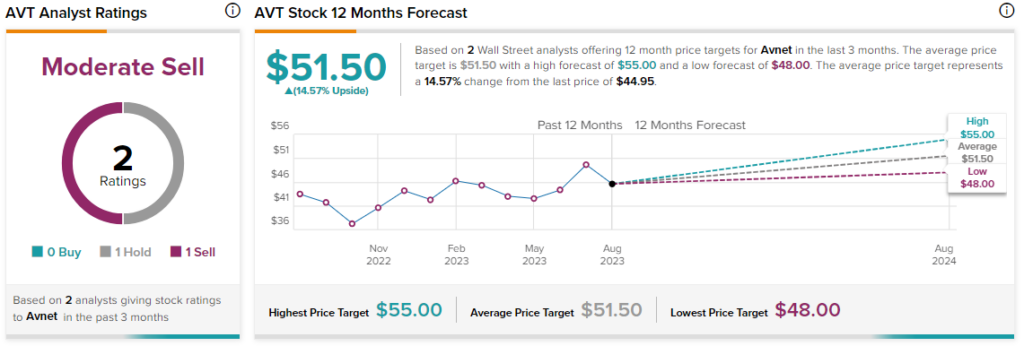

Overall, the Street has a $51.50 consensus price target on Avnet alongside a Moderate Sell consensus rating. This points to a 14.6% potential upside in the stock, on top of an 8% price gain so far this year.

Read full Disclosure