Trade policies of the Trump administration and fears of a potential recession amid tariff wars are weighing on the U.S. stock market. While mega-cap stocks are under pressure, Wall Street remains bullish on some of them due to their robust growth potential. Mega-cap stocks, which have a market capitalization of more than $200 billion, are associated with large, well-established companies with strong track records and generally rank among the leading players in their respective industries. Using TipRanks’ Stock Comparison Tool, we placed Broadcom (AVGO), Tesla (TSLA), and McDonald’s (MCD) against each other to find the mega-cap stock that earns Wall Street’s Strong Buy consensus rating.

Broadcom (NASDAQ:AVGO)

Broadcom is one of the prominent suppliers of semiconductors, enterprise software, and security solutions. AVGO stock is down over 17% so far this year due to broader market weakness amid tariff wars, concerns over chip restrictions, and rising competition in the AI (artificial intelligence) space.

Nonetheless, Wall Street is bullish on AVGO stock due to AI tailwinds. Specifically, Broadcom’s custom AI chips, which the company calls application-specific integrated circuits (ASICs), are seeing massive demand due to their ability to train and deploy AI models. Notably, Broadcom’s AI revenue in Q1 FY25 jumped 77% year-over-year to $4.1 billion, with the company projecting it will grow further to $4.4 billion in the fiscal second quarter.

Aside from the strength in its semiconductor solutions business, which includes AI revenue, Broadcom is also optimistic about the potential of its infrastructure software business.

Is AVGO Stock a Buy?

Recently JPMorgan analyst Harlan Sur reiterated a Buy rating on Broadcom stock with a price target of $250. Sur is bullish on AVGO stock due to multiple reasons that reinforce the company’s solid performance and future growth potential. The 5-star analyst noted Broadcom’s stellar Q1 FY25 results, with revenues from AI semiconductors and software beating estimates and offsetting the weakness in non-AI semiconductor sales. He also highlighted AVGO’s upbeat guidance, thanks to robust demand in AI networking and the early adoption of Google’s (GOOGL) TPU v6 3nm ASIC training chip.

Further, Sur believes that Broadcom’s expanding pipeline of AI ASIC design wins, including new engagements with prominent companies like SoftBank/Arm Holdings (ARM) and OpenAI, emphasizes its leadership in the AI infrastructure market. He added that AVGO’s diversified portfolio and successful upselling in its infrastructure software business ensure stable revenue growth even amid macroeconomic challenges.

With 22 Buys and two Holds, Wall Street has a Strong Buy consensus rating on Broadcom stock. The average AVGO stock price target of $252.20 implies 31.6% upside potential.

Tesla (NASDAQ:TSLA)

Tesla stock has plunged more than 38% year to date due to the company’s disappointing electric vehicle (EV) sales amid intense competition, macro pressures, and investors’ concerns about the distraction caused by CEO Elon Musk’s political activities.

Moreover, the company’s financial performance has been disappointing. Tesla’s revenue grew by just 1% in 2024, while adjusted EPS (earnings per share) plunged 22%. The company generated dismal revenue despite offering price cuts and incentives to boost its sales. Tesla’s weak sales and the 194 basis points contraction in the 2024 operating margin indicate that the company is struggling to maintain its dominance in the highly competitive EV market.

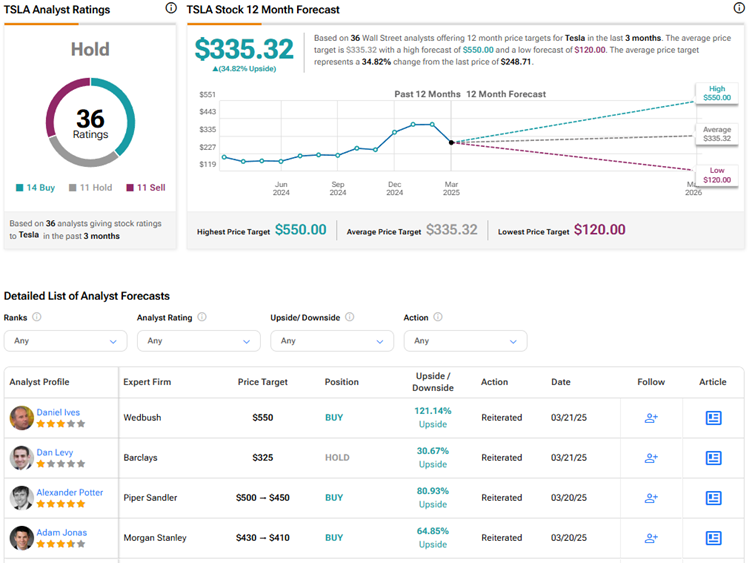

Is TSLA Stock a Buy, Sell, or Hold?

On Thursday, Piper Sandler analyst Alexander Potter lowered his price target for Tesla stock to $450 from $500 but reiterated a Buy rating. While the analyst believes in the company’s ability to reshape the world’s transportation and energy markets, he lowered his 2025 delivery estimate based on the quarter-to-date trends in Tesla’s EVs.

The 5-star analyst contends that one can’t entirely blame politics for Tesla’s weak deliveries. Rather, he contends that factory shutdowns and the Model Y changeover are the main reasons for the lower deliveries. Potter noted that his price target does not account for the potential contribution from humanoid robots or artificial intelligence-as-a-service. At the current price levels, Potter thinks that TSLA stock is “cheap,” given the opportunities in auto, energy, and full self-driving (FSD).

Several analysts don’t share Potter’s optimism. Tesla stock has a Hold consensus rating based on 14 Buys, 11 Holds, and 11 Sell recommendations. At $335.32, the average TSLA stock price target implies 34.8% upside potential.

McDonald’s (NYSE:MCD)

Fast-food chain McDonald’s is known for its resilience during difficult economic periods due to its value offerings. MCD stock is up more than 5% so far this year, outperforming the S&P 500 Index (SPX), which is down 3.4%.

However, last month, McDonald’s reported lower-than-anticipated revenue for Q4 2024 due to a decline in its comparable sales in the U.S., reflecting the impact of E.coli outbreak earlier in the quarter. During the conference call, CEO Chris Kempczinski said that based on many factors, he thinks that the company’s performance will recover to “proper form” over the next several quarters.

Looking ahead, McDonald’s plans to expand its global network of more than 43,000 locations by opening over 2,200 restaurants this year, with about 25% of these openings in the U.S. Overall, the company believes that it is on track to reach 50,000 restaurants by the end of 2027.

Is McDonald’s Stock a Buy or Sell?

Recently, Morgan Stanley analyst John Glass lowered his price target for McDonald’s stock to $335 from $340 and reiterated a Buy rating after adjusting estimates based on recent industry trends and company-specific factors. He now expects 2025 global same-store sales growth of 2.6%, versus 3.0% estimated previously and 2.7% projected by the Street, given Q1 revisions. The reduced top-line expectations lead to an EPS estimate of $12.23, down from the previous projection of $12.42 and slightly lower than the consensus Wall Street estimate of $12.25.

Overall, Wall Street has a Moderate Buy consensus rating on McDonald’s stock based on 15 Buys and 10 Holds. The average MCD stock price target of $327.29 implies about 7.2% upside potential.

Conclusion

Wall Street is highly bullish on Broadcom stock, cautiously optimistic on McDonald’s stock, and sidelined on Tesla stock. AVGO stock scores Wall Street’s Strong Buy consensus rating and could offer an upside of about 32%. Overall, analysts see the pullback in AVGO stock as an opportunity to build a position and gain from the solid AI-led demand for its offerings.