Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made notable portfolio moves on Thursday, January 8, as revealed in daily fund disclosures. The trades underscore ARK’s ongoing emphasis on disruptive innovation in biotech, autonomous driving, blockchain, and fintech, alongside reductions in underperforming sectors with slower growth.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Wood Buys the Dip in Key Shares

ARK’s largest purchase was 31,573 shares of chip maker Broadcom (AVGO) through the ARK Next Generation Internet ETF (ARKW), valued at $10.4 million. AVGO stock fell 3.2% yesterday, amid a broader market slump.

Additionally, Wood leveraged the 1.9% dip in Joby Aviation (JOBY) stock, buying 162,270 shares through the ARK Space Exploration & Innovation ETF (ARKX) for $2.5 million. Wood appears to be betting on Joby’s strategic expansion, as it announced the purchase of a large 700,000-square-foot manufacturing facility in Dayton, Ohio, to increase production of its electric air taxis, also known as eVTOL aircraft.

Similarly, Wood added 73,097 shares of another eVTOL player, Archer Aviation (ACHR), after it announced a strategic partnership with Nvidia (NVDA), aimed at bringing AI systems into future aircraft. ACHR stock was up 3.4% on the news.

Wood also capitalized on the 10.4% dip in Personalis (PSNL) stock, adding 22,395 shares to the ARK Genomic Revolution ETF (ARKG), consistent with her recent buying spree.

Wood Dumps $10M in Palantir Technologies

On the sell side, Wood dumped $10.4 million worth of AI darling Palantir Technologies (PLTR), offloading 58,741 shares. This came as President Donald Trump proposed a $1.5 trillion U.S. defense budget by 2027, a substantial increase from current levels. Palantir relies heavily on government contracts for its artificial intelligence (AI) offerings. Yet, PLTR shares dropped 2.7% Thursday, pressured in part by Jim Cramer’s warning to shorts.

ARK also trimmed smaller stakes in Aerovironment (AVAV), Rocket Lab (RKLB), and Kratos Defense (KTOS).

Wood’s Strategic Portfolio Shuffle

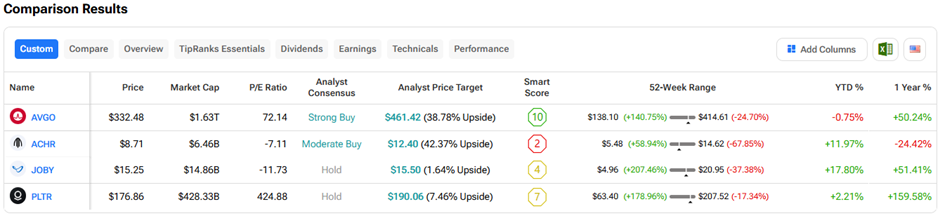

Let’s see how some of these stocks perform using the TipRanks Stock Comparison Tool:

Currently, analysts have a “Strong Buy” consensus rating on Broadcom shares, offering a 38.8% upside potential over the next twelve months.