Australia’s Origin Energy (AU:ORG) (OGFGF) is putting $140 million into Kraken Technologies, the software arm of UK-based energy company Octopus Energy. The investment is part of a larger $1 billion equity raise, aimed at expanding Kraken’s software platform and strengthening its position in the growing clean energy market.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, Origin Energy, one of Australia’s largest energy companies, is involved in electricity and gas retailing, power generation, and renewable energy development. Origin holds a 22.7% stake in Octopus Energy.

Kraken to Spin Off from Octopus Energy

As part of this funding round, Octopus Energy will spin off Kraken Technologies, valuing it at $8.65 billion. Following the spin-off, Octopus will retain a 13.7% stake in Kraken and continue to serve as its foundational customer. Of the $1 billion raised, $150 million will stay with Kraken, while $850 million will remain with Octopus.

Octopus first announced plans for the spin-off in September, and it is expected to happen by mid-2026. Analysts see this as a possible step toward an IPO, with Kraken potentially reaching a $15 billion valuation.

Meanwhile, Origin Energy said the funding round will help separate Kraken from Octopus Energy, providing the capital both businesses need to grow independently. Additionally, Origin Energy has agreed to give up exclusivity to the Kraken platform in Australia in return for an extra 1.5% stake. Origin’s total ownership will stay at 22.7%, offsetting dilution from the funding round.

Is Origin Stock a Buy?

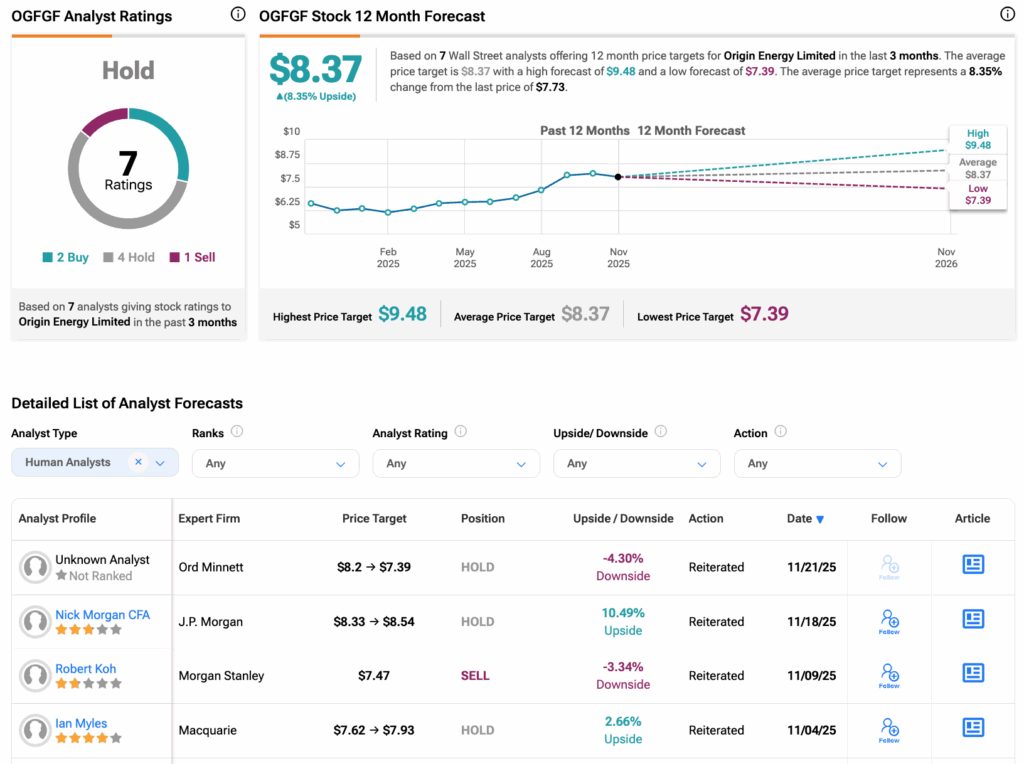

According to TipRanks, OGFGF stock has a Hold consensus rating based on two Buys, four Holds, and one Sell assigned in the last three months. At $8.37, Origin Energy’s average share price target implies an 8.35% upside potential.