Shares of the ASX-listed Goodman Group (AU:GMG) declined following a report that China Investment Corporation (CIC) sold its stock in the Australian company for $1.2 billion (AU$1.9 billion). According to The Australian, CIC sold 2.6% of its stake, equivalent to 50.4 million shares, in Goodman Group. After the media report, GMG shares dropped by nearly 5% in early trading. However, the stock recovered some ground and closed down by around 3% on Wednesday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Goodman is an industrial real estate group, developing and managing high-quality properties. Meanwhile, CIC is a state-owned investment fund that allocates capital to public and private assets to broaden its foreign exchange reserves.

China’s CIC Makes Big Move with $1.9B Goodman Deal

CIC is among the top shareholders in Goodman Group and owned around a 7.84% stake as of July 31, 2024, as per LSEG (London Stock Exchange Group) data. This sale marks the first reduction in CIC’s position in Goodman shares since 2012.

The report further stated that the recent transaction was managed by investment bank Citi, which retained at least AU$35 million worth of the stock following the repriced sell-down. However, Citi, Goodman Group, and CIC did not release any official statement.

Goodman Group Sees Strong Data Center Growth in Q1 FY25

Last month, Goodman released its Q1 FY25 trading update, emphasizing strong demand for data centre infrastructure, which has created significant growth opportunities. The company mentioned over $12.8 billion worth of development projects underway across 74 sites as of September 30, 2024. Meanwhile, data centers made up around 42% of these projects. The company’s total property portfolio stood at $78.8 billion.

Moving ahead, Goodman Group confirmed its forecast of operating EPS (earnings per share) growth of 9% and a full-year distribution of 30 cents per share in FY25.

Is Goodman Group a Good Stock to Buy?

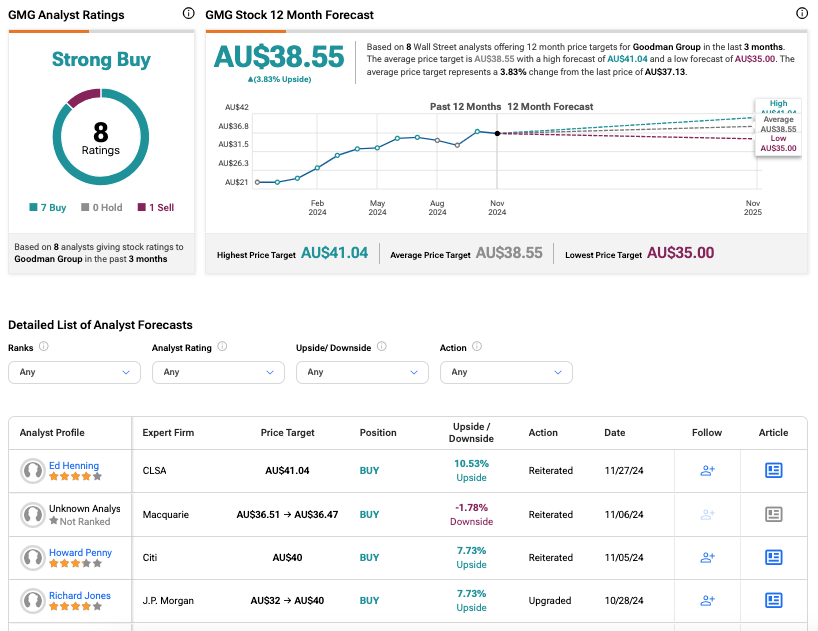

According to TipRanks’ consensus forecast, GMG stock has received a Strong Buy rating based on seven Buys and one Sell recommendation. The Goodman share price forecast is AU$38.55, which is around 4% above the current trading level.

Year-to-date, the stock has gained 47.4%.