Shares of the Australia-based CSL Ltd. (AU:CSL) fell by over 4% as of writing despite the company achieving higher profit in FY24. The company reported an NPAT (net profit after tax) attributable to shareholders of $2.75 billion for the year, marking a 25% increase on a constant currency basis. However, investors are hitting the sell button as the FY25 guidance fell short of expectations.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

CSL is a global biotechnology company that specializes in manufacturing and selling biopharmaceuticals and related products. A significant portion of the company’s profits comes from its operations in the U.S.

CSL Delivers Strong Revenue Growth in FY24

In FY24, CSL’s revenue grew by 11% year-over-year to $14.8 billion on a constant currency basis. The company’s growth was led by the CSL Behring segment, which manufactures plasma. The segment reported a 14% increase in its annual revenue to $10.61 billion, driven by solid demand for immunoglobulins (Ig) across all the regions. As a result, immunoglobulin product sales reached $5.7 billion, marking a 20% year-over-year increase.

Coming to shareholder returns, CSL declared a final dividend of $1.45 per share, up from $1.29 last year. This brings the total dividend for FY24 to $2.64, representing a 12% year-over-year increase.

CSL’s FY25 Guidance Fails to Impress

In FY25, CSL expects its NPATA (net profit after tax and amortization) to be between about $3.2 billion and $3.3 billion at constant currency, representing a growth of 10% to 13% over FY24. Even though the forecast surpassed last year’s numbers, it fell below the consensus of $3.39 billion.

Additionally, CSL expects its revenue to grow by 5% to 7% year-over-year in FY25.

Are CSL Shares a Buy or Sell?

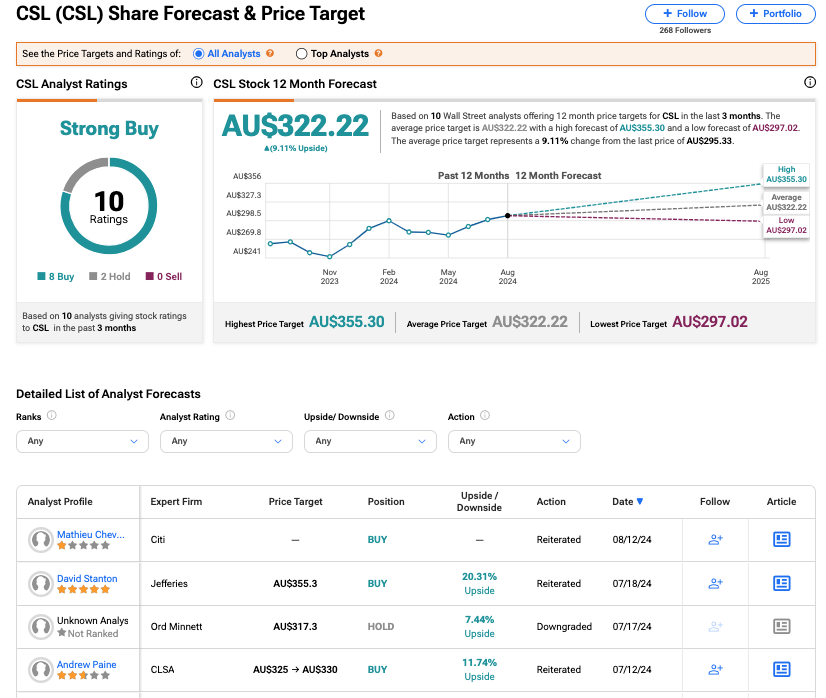

According to TipRanks’ rating consensus, CSL stock has a Strong Buy rating based on eight Buy and two Hold recommendations. The CSL share price target is AU$322.22, which indicates 9.1% upside potential at the current price level.