AT&T (NYSE:T) shares are under pressure today after the communications major disclosed a major data hack. The company is slated to report its second-quarter numbers later this month.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

A Major Data Breach at AT&T

In April, AT&T became aware that a threat actor claimed to have gained unlawful access and copied the company’s call logs. AT&T immediately began a probe, involving external cybersecurity experts. The company believes that the hackers accessed its workspace on a third-party cloud platform and gained access to AT&T’s records of customer calls and texts that took place between May and October 2022, as well as in January 2023.

AT&T believes the accessed files do not contain the personal information of users or the content of calls or texts. However, the accessed information reveals records of calls and texts of nearly all of AT&T’s wireless customers and customers of mobile virtual network operators using AT&T’s network.

The company has successfully secured the point of entry for this data hack and is preparing to notify affected customers. Additionally, AT&T confirms that the hacked data has not been made public yet. Furthermore, authorities have apprehended at least one person involved in the breach.

T’s Upcoming Q2 Numbers

This disclosure comes only days before AT&T’s second-quarter results on July 24. Analysts expect the company to post an EPS of $0.57 on revenue of $29.99 billion for the quarter. In the comparable year-ago period, AT&T’s EPS of $0.63 had outpaced expectations by $0.03.

What Is the Price Forecast for T Stock?

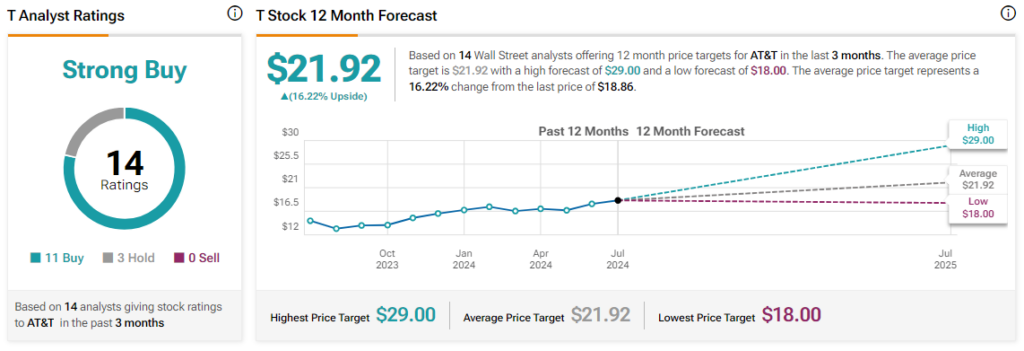

Overall, the Street has a Strong Buy consensus rating on the stock, alongside an average T price target of $21.92. Shares of the company have jumped by nearly 33% over the past year. However, today’s data hack disclosure threatens to wipe out some of those gains over the coming sessions.

Read full Disclosure