AT&T (T) announced a multi-year agreement with Corning (GLW) worth $1 billion to purchase fiber, cable, and connectivity solutions, aiming to expand its high-speed internet offerings. With this deal, the telecom giant intends to expand its fiber network and bring high-speed connectivity to more U.S. citizens while also reducing its deployment costs.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Why Has AT&T Entered into a Deal with Corning?

This partnership comes as AT&T and competitors like Verizon (VZ) shift their focus toward high-speed internet services, especially as the U.S. wireless market slows down. The high-speed internet market has traditionally been dominated by broadband giants such as Comcast (CMCSA). However, demand has grown, particularly for AT&T’s bundled plans, which offer customers discounts when they combine fiber data with wireless phone services.

AT&T’s Fiber Business Is Facing Challenges

Despite these developments, AT&T’s fiber business has faced recent challenges. The business added 226,000 new customers in the third quarter, falling short of consensus estimates of 257,860 customer additions. This shortfall was largely due to a work stoppage in the southeastern region, which began in August and disrupted fiber installations.

In the third quarter, AT&T reported 28.3 million fiber passings, indicating potential customer locations reached by its fiber network. The company expects to exceed 30 million passings by the end of 2025, marking a key milestone in its expansion strategy.

Is AT&T a Buy, Hold, or Sell?

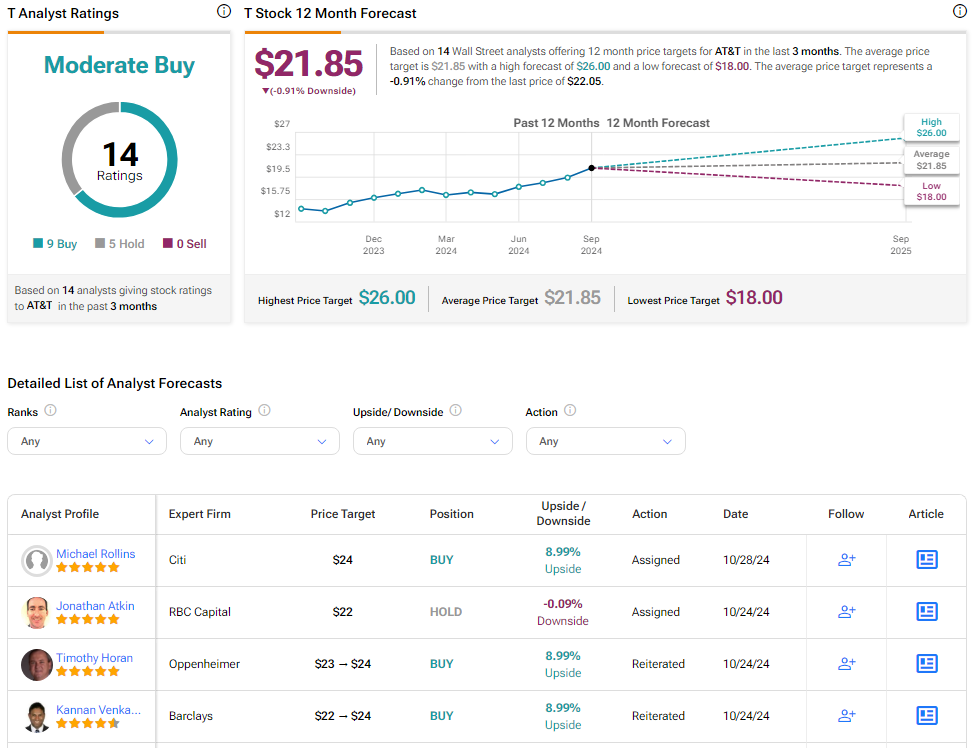

Analysts remain cautiously optimistic about T stock, with a Moderate Buy consensus rating based on nine Buys and five Holds. Over the past year, AT&T has increased by more than 45%, and the average AT&T price target of $21.85 implies a downside potential of 0.9% from current levels.