Atos SE’s (FR:ATO) shares dropped over 3% as of writing today after the company reduced its financial targets through 2027, citing weakened sales amid a challenging business environment. The company also noted a rise in contract cancellations and delays due to softer demand for its solutions. Nonetheless, Atos confirmed that these challenges would not impact its restructuring plan.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Atos is a French IT company that provides consulting, technology services, cloud and infrastructure services, etc. worldwide.

Atos Trims Guidance

Atos now expects revenue of €9.7 billion for FY24, slightly lower than the earlier forecast of €9.8 billion. Additionally, the company projects that revenue will reach €10.6 billion by 2027, down from the previous estimate of €11.0 billion.

Further, the company expects to achieve an operating margin of €238 million or 2.4% this year, down from the earlier estimate of €282 million or 2.9%. By 2027, it is projected to reach €1 billion, lower than the previous forecast of nearly €1.10 billion.

Atos stock has plunged 88% year-to-date due to mounting financial challenges, including a significant debt burden. The company has also issued several profit warnings and announced numerous changes in top management. Atos reported net debt of €4.2 billion at the end of the first half of 2024, up from €2.3 billion a year ago.

Atos Sticks to Restructuring Timeline

In July 2024, Atos reached an agreement on the financial terms of its restructuring plan with a consortium of banks and bondholders. The company expects the affected parties to vote on the plan on September 27, with a court hearing for final approval scheduled for October 15.

Once the court approves, the plan will be implemented through a series of capital increases and debt issuances from November 2024 to January 2025.

Is Atos a Good Buy Right Now?

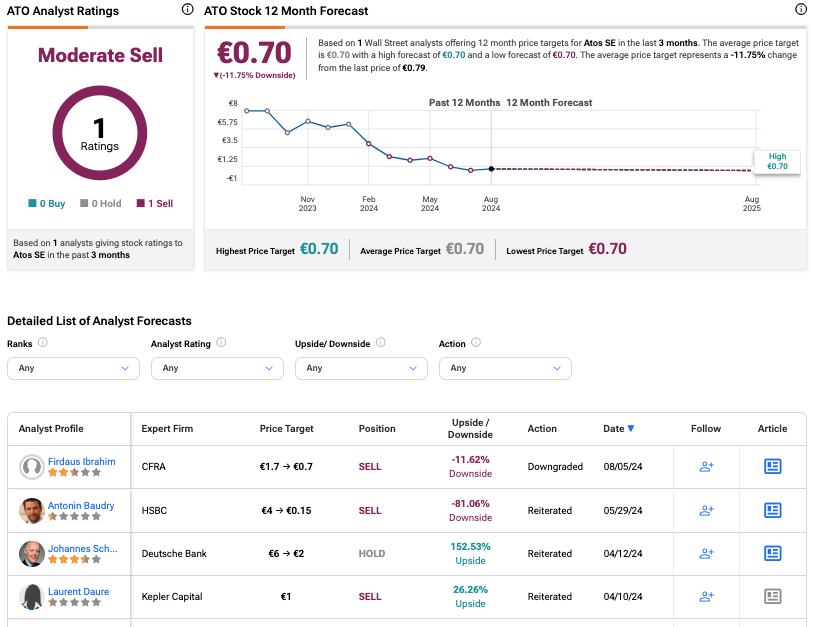

According to TipRanks, ATO stock has received a Moderate Sell rating based on one Sell recommendation from CRFA Research. Earlier this month, CFRA analyst Firdaus Ibrahim downgraded his rating on ATO stock from Hold to Sell, predicting a downside of 11.6%. The Atos share price target is €0.70.