Software specialist MongoDB Inc. (MDB) has been one of 2025’s standout performers, surging more than 52% in 2025 thanks to accelerating adoption of its cloud-based Atlas platform and growing investor enthusiasm over its AI capabilities.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Investors got a preview of that momentum this week when MongoDB issued a positive business update, stating that it expects to exceed the high end of its Q3 revenue and profitability targets. Management had previously guided for revenue between $587 million and $592 million—up about 11.5% year-over-year at the midpoint—with operating margins around 11.5%, factoring in seasonal cost pressures.

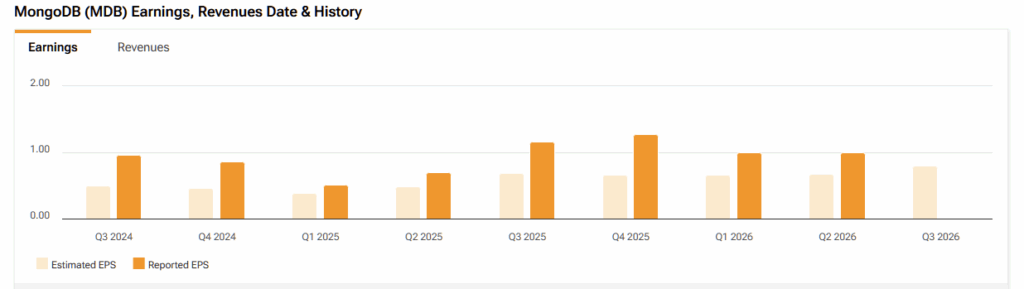

The new update signals broad-based outperformance, led once again by Atlas, the company’s key growth driver. Given this trajectory, I anticipate another earnings beat, reinforcing MongoDB’s consistent track record of topping Street expectations.

While the stock still trades at a premium valuation, I remain Bullish as MongoDB gears up to report its Q3 fiscal 2026 results next month.

Expecting Another Beat in Q3

Current consensus estimates project Q3 revenue of $593.8 million, reflecting 12% year-over-year growth. My forecast is slightly higher—around $610 million—driven by the accelerating adoption of Atlas and stronger consumption trends.

For Atlas, consensus sits at $455 million, up 25% year-over-year, while I project closer to $470 million, aligning with management’s recent comments highlighting robust enterprise workload demand. Looking ahead to the full fiscal year, I expect management to reaffirm or modestly raise guidance around the consensus estimate of $2.36 billion, representing 18% growth from the prior year.

Given the company’s positive pre-announcement and track record of consistency, I anticipate approximately 30% growth in Atlas subscriptions, continuing the momentum seen in prior quarters. With its diversified customer base, expanding AI integrations, and disciplined execution across both sales and product teams, MongoDB appears well-positioned to deliver another strong quarter of revenue growth and margin expansion.

AI Adoption Adds a New Growth Catalyst

One of the most compelling aspects of MongoDB’s story is its growing relevance in the AI development ecosystem. The company continues to attract an increasing number of AI-native enterprises building on MongoDB for unstructured and semi-structured data workloads—areas where its flexible document model provides an edge over traditional relational databases.

AI workloads are driving incremental demand for Atlas, as developers look for scalable and performant databases to power next-generation applications. MongoDB’s Application Modernization Platform (AMP) and AI-powered developer tools further reinforce its positioning as the database of choice for AI-driven innovation.

While management has tempered expectations for AI monetization in the near term, I view these initiatives as foundational investments that will expand the company’s long-term addressable market and solidify its competitive moat.

PostgreSQL Hype is Overblown

A recurring debate among investors has centered on whether PostgreSQL—an open-source relational database—poses a growing threat to MongoDB’s dominance in NoSQL and cloud-native environments. I believe these fears are overstated.

Postgres’ resurgence has been driven largely by new extensions and tools that modernize legacy MySQL and Oracle (ORCL) workloads rather than displace MongoDB’s core use cases. Moreover, GitHub repository data continues to show MongoDB as the more widely referenced and adopted developer solution, despite fluctuations in year-over-year activity.

The recent acquisition of Neon, a Postgres vendor, by Databricks has sparked discussion about competitive overlap, but I do not expect it to meaningfully impact MongoDB’s growth trajectory. MongoDB’s developer ecosystem, feature depth, and robust support for hybrid workloads remain unmatched in the independent database space.

In short, Postgres competition is a headline risk—not a fundamental one.

Long-Term Thesis Strengthened by Durable Growth

While MongoDB’s stock remains a point of debate, I continue to see substantial long-term upside driven by multiple secular tailwinds.

The company operates in a core addressable market of at least $25 billion, with potential to participate in a broader $100 billion-plus global database landscape. MongoDB is uniquely positioned in the fastest-growing segments—namely NoSQL and Database-as-a-Service (DBaaS)—where enterprises are modernizing legacy applications and adopting multi-cloud architectures.

MongoDB has emerged as the clear leader among independent NoSQL providers, benefiting from a strong first-mover advantage and consistent product innovation. Its early shift to a new licensing model has also limited the threat of hyperscaler copycats.

Over time, I expect MongoDB’s revenue growth and margin expansion to remain well above the software industry average. The company’s five-year revenue CAGR of nearly 37% and projected five-year EBITDA growth rate of 36.6% highlight its strong scalability and consistent execution.

MDB Offers Premium Valuation with Proven Execution

At current levels, MongoDB trades at 80.1x P/E and 12.0x EV/Sales, compared to sector medians of 24x and 3.7x, respectively. There’s no question the stock carries a premium multiple, but this reflects its leadership position and superior growth metrics.

Using a blended valuation approach—incorporating 12 models, including EV/EBIT, P/E Multiples, and a five-year DCF Revenue Exit—I estimate MongoDB’s fair value around $290 per share, implying about 18% downside from the current price.

However, I view this potential downside as largely theoretical, given MongoDB’s consistent record of execution, long-term opportunity in AI workloads, and Atlas’ accelerating growth. The company has historically traded at a premium multiple during periods of strong product momentum, and this cycle appears no different.

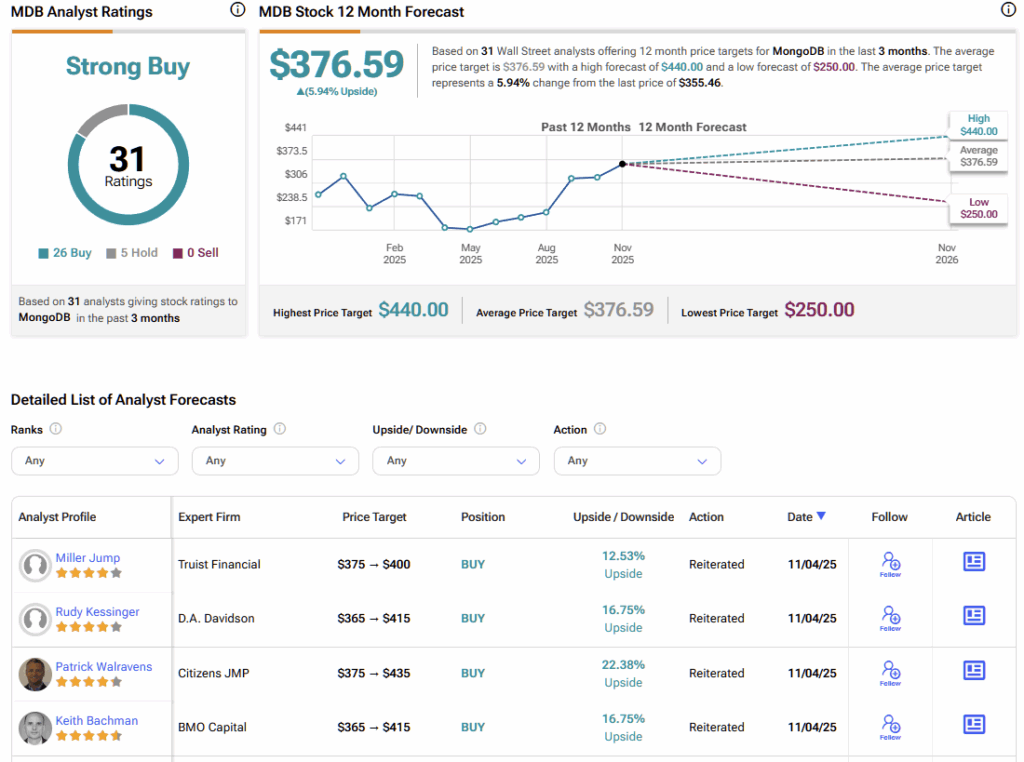

What is the Price Target for MDB in 2025?

According to TipRanks, MongoDB carries a Strong Buy consensus rating, based on 31 analyst reviews. The breakdown includes 26 Buys, 5 Holds, and 0 Sells, obtained over the past three months. MDB’s average stock price target is $376.59, representing ~6% upside over the next 12 months.

MongoDB Poised to Extend Its Winning Streak

MongoDB’s upcoming earnings report is likely to reaffirm its dominance in the modern database landscape. With accelerating Atlas growth, expanding AI integrations, and early signs of another earnings beat, the company appears well-positioned to sustain its momentum into 2026.

Though the stock continues to trade at a premium valuation, that premium is well-earned. MongoDB’s consistent execution, durable growth profile, and central role in next-generation data infrastructure make it one of the most compelling long-term plays for investors seeking exposure to AI and cloud software growth.