British-Swiss pharma giant AstraZeneca (AZN) has committed to a $50 billion investment in the U.S. by 2030. The news follows similar announcements by other pharmaceutical companies, including a $50 billion investment by Swiss drugmaker Roche (RHHBY), as the Trump administration has threatened to impose steep tariffs to discourage imports of active ingredients and finished drugs and boost domestic manufacturing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Trump has warned that he would impose tariffs of up to 200% on pharma imports. The President intends to give pharma companies a period of up to a year and a half to relocate their manufacturing. Several analysts contend that such hefty tariffs would adversely impact drug prices and weigh on the profit margins of pharma companies.

AstraZeneca Pledges Huge Investment in the U.S.

AstraZeneca’s $50 billion investment in the U.S. over the next five years would be made across its research & development (R&D) and manufacturing footprint in the country. The company’s planned spending includes the expansion of its R&D facility in Gaithersburg, Maryland, a state-of-the-art R&D center in Kendall Square, Cambridge, Massachusetts, and the next-generation manufacturing facilities for cell therapy in Rockville, Maryland, and Tarzana, California.

The company will upgrade its U.S. clinical trial supply network and support ongoing investment in novel medicines. AstraZeneca believes that its investment in the U.S. will help it achieve its goal to generate $80 billion in revenue by 2030 and launch 20 new medicines by the end of the decade.

Notably, AstraZeneca highlighted that the U.S. is the largest market for the company, where it has 19 R&D, manufacturing, and commercial facilities. The U.S. accounts for 42% of AZN’s overall revenue, which the company aims to increase to 50% by 2030.

AZN’s Upcoming Q2 Earnings

The announcement of the $50 billion investment in the U.S. comes ahead of AstraZeneca’s second-quarter results, scheduled for release on July 29. Wall Street expects the company to report earnings per share of $1.09, reflecting a 10% year-over-year growth.

Revenue is estimated to rise 9% to $14.1 billion, backed by strength in the company’s oncology and respiratory treatment portfolios.

What Is the Price Target for AZN Stock?

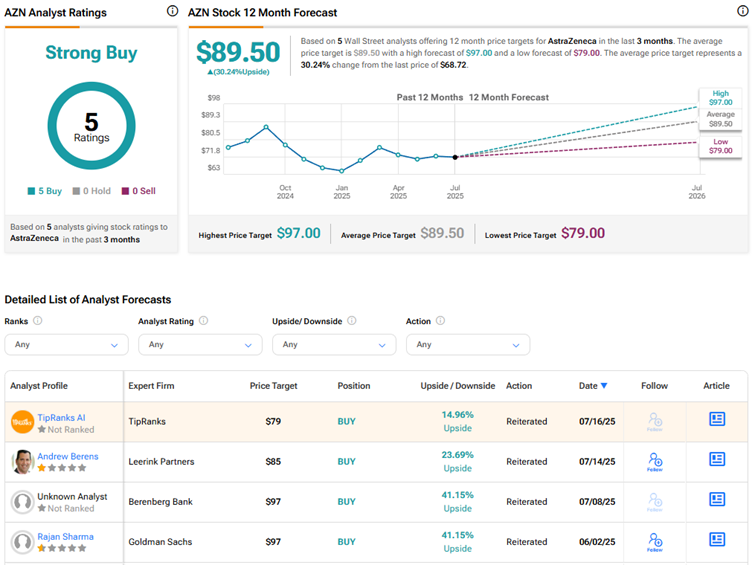

Ahead of Q2 results, Wall Street has a Strong Buy consensus rating on AstraZeneca stock based on five unanimous Buys. The average AZN stock price target of $89.50 indicates 30.2% upside potential. AZN stock has risen about 5% year-to-date.