Shares of online higher education services provider Aspen Group (ASPU) dropped 7.7% on July 14 after the company issued weaker top-line guidance for Fiscal Year 2022.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a look at Aspen’s financial performance and what’s changed in its key risk factors that investors should know.

Aspen reported a 35% year-over-year jump in revenue at $19.1 million, beating consensus of $18.5 million. However, its net loss per share of $0.09 was wider than the estimated $0.08.

The robust revenue growth was on the back of significant contributions from Aspen’s MSN-FNP and BSN Pre-Licensure programs. With a focus on reducing losses and cash burn, the company aims to achieve profitability in Q4 2022.

For Fiscal Year 2022, Aspen estimates revenue to be in the range of $85 million to $88 million, a 27% year-over-year growth at the midpoint. It sees net loss per share to be between $0.18 and $0.12 for this period. (See Aspen Group stock chart on TipRanks)

Chairman and CEO of Aspen Michael Mathews said, “Growth spending will be focused on our highest efficiency businesses to accelerate the growth in these units, with decreased spending in our lowest efficiency unit.”

The move is expected to increase bookings by 6% year-over-year and cut advertisement spend to 17% of revenue from the present 19%.

Following the results, Roth Capital analyst Darren Aftahi reiterated a Buy rating on the stock with a price target of $11 (86.8% upside potential).

Aftahi said, “The pivot to Aspen 2.0 was the likely shift we long saw coming at some point given its higher LTV segments operate on much higher growth and profitability rates.”

Based on 5 unanimous Buys, consensus on the street is a Strong Buy. The average Aspen group price target of $11 implies 114% upside potential from current level.

Now, let’s take a look at the company’s key risk factors.

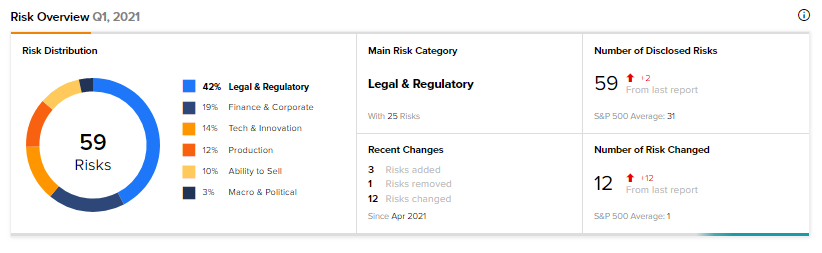

According to the new Tipranks Risk Factors tool, Aspen Group’s main risk category is Legal & Regulatory, which accounts for 42% of the total 59 risks identified. The next two major risk factor contributors are Finance & Corporate and Tech & innovation at 19% and 14%, respectively. Since April, the company has added three new risks under Finance & Corporate and Legal & Regulatory.

Some of the major risks under the Finance & Corporate category include strong competition in the postsecondary education market, the impact of COVID-19 and any future public health emergencies, and Aspen’s ability to carry out its growth strategy of opening new nursing campuses.

Under the Legal & Regulatory category, the company has added two new risks. The company acknowledges that any release of personally identifiable or other confidential information could bring civil penalties or a loss of eligibility in participating in Title IV programs for Aspen.

Commenting on this, Aftahi said, “If Aspen were to fail to comply with the extensive and complex regulatory requirements for Title IV funds, future enrolments and financial results would likely slow.”

The company further acknowledges that “jurisdictions, both nationally and internationally, are continuing to enact additional laws and regulations relating to privacy, data protection, information security, marketing and advertising, and consumer protection, and compliance with one set of laws and regulations rarely suffice for compliance with another.”

Compared to Finance & Corporate risk factor’s sector average of 37%, Aspen is at 19%.

Related News:

GoDaddy Joins Hands with Google; Street Says Buy

Netflix Extends Deal with Universal Pictures

Apple to Launch Buy Now, Pay Later Service; Shares Hit Record High – Report