ASML Holding (ASML) continued to extend its losses in pre-market trading on Wednesday after the Dutch chip equipment manufacturer revised its sales forecast for FY25 and indicated weaker demand for chips outside of the AI sector.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company’s disappointing outlook affected global chip stocks on Wednesday, raising concerns about softening demand and oversupply in the chip market. Let’s examine ASML’s forecast in detail and its potential impact on chip stocks.

ASML Issues a Revised Outlook for FY25

The company announced its Q3 results and revised its net sales forecast for FY25. It expects revenues between €30 billion and €35 billion ($32.7 billion to $38.1 billion). This guidance is at the lower end of the company’s previous estimates. To add to ASML’s woes, the company’s net bookings of €2.6 billion ($2.83 billion) in the third quarter were below analysts’ expectations of €5.6 billion.

Furthermore, ASML’s CEO Peter Wennink cautioned that market recovery was slower than expected, with weak demand for chips, excluding AI chips. Moreover, the company is encountering difficulties due to export restrictions on its chip-making equipment imposed by the U.S. and Dutch governments, which have affected its operations in China.

How Does ASML’s Revised Outlook Impact Other Chip Companies?

ASML’s revised outlook has raised fears of slowing chip demand and overcapacity. This is due to analysts suggesting that several chip manufacturers, such as TSMC (TSM) and Intel (INTC), accumulated ASML’s tools during the pandemic and are now functioning more efficiently. Consequently, these companies can produce more chips using their current equipment, which has lessened the demand for new orders.

Furthermore, a Reuters report quoting Dan Hutcheson, vice chair at the analyst firm TechInsights, states that ASML’s customers, including Intel and TSMC, are delaying new orders as chip factory utilization is at 81% this year. Hutcheson notes that manufacturers generally increase tool purchases only when factory utilization climbs into the mid-90% range.

What Is the Best Chip Stock to Buy Now?

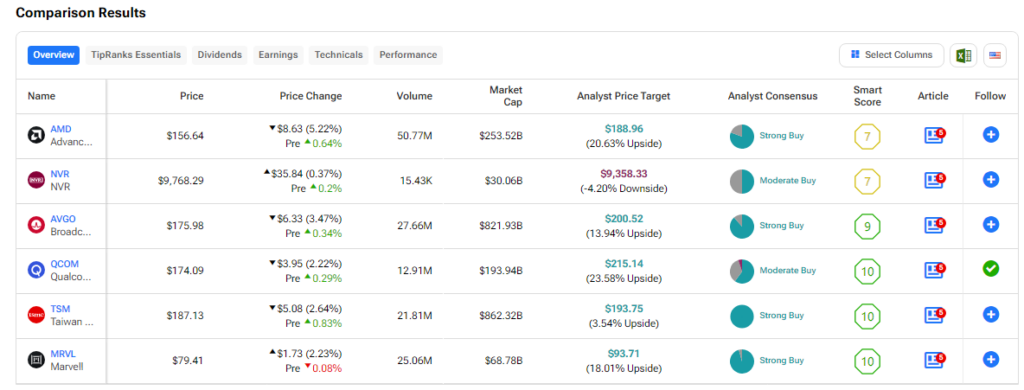

For investors looking to enter the semiconductor sector, we’ve compiled a list of chip stocks that analysts are either bullish on or cautiously optimistic about utilizing the TipRanks stock comparison tool.