ASML Holding (ASML) stock is down about 33% from its all-time high in July 2024 and is currently trading around $680 per share. Much of the decline has been attributed to short-term cyclical weaknesses in the company’s end markets, leading to the company missing analysts’ estimates at its previous earnings call in October 2024.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

With ASML’s performance update just days away, investors could see the company posting improved metrics, resulting in a significant re-rating later this week.

Even before the company updates the market, I already think 2025 will be an inflective year for ASML as the company emerges from a cyclical downturn while the consumer market is on the cusp of an electronics replacement cycle.

Even though the stock has fallen since I first shared my thesis in August 2024, my outlook remains unchanged. I remain strongly bullish on ASML because the company is advancing the technology of tomorrow’s world, lacks significant peers, and has several price catalysts on the horizon to reward loyal shareholders.

Competitive Advantage Protects ASML

The primary reason why I’m bullish on ASML is because of its strong competitive advantage in one of the most complicated yet exciting market niches of all: lithography systems. ASML is a European semiconductor equipment manufacturer operating in the niche market of optical lithography, which is a process of manufacturing integrated circuits using light to transfer patterns onto substrates such as silicon wafers. The company’s systems typically cost hundreds of millions of dollars and can manufacture microchips for everything electronic, from smartphones to hyperscale data centers.

As a testament to its innovative ability to produce the best microchips, ASML developed a proprietary technique called “extreme ultraviolet (EUV) lithography,” a technology essential for producing the most advanced chips. So far, no other company has matched it.

According to ASML, 90% of all its lithography machines sold since the company was first formed in the 1980s are still operational. That’s pretty incredible by anyone’s standards, especially for industrial equipment that pushes technological boundaries. ASML’s clients include global giants such as Taiwan Semiconductor Manufacturing Company (TSM), Intel (INTC), and Samsung (SMSN), who use ASML’s technology to make microchips for computers, automobiles, and data centers. ASML’s technology has made the company highly relevant and almost irreplaceable in today’s world, where almost everything we interact with is powered by microchips.

Consequently, ASML’s competitive advantage has secured substantial profits over the past 15 years. The company’s net income has surged from $1.3 billion in 2010 to about $7 billion in 2024. In tandem, ASML has acquired tremendous pricing power because lithography machines are highly complex, which serves as a natural barrier to market entry.

With microchips improving yearly, the machines to manufacture them also have to improve over time. As a result, ASML will be able to charge a premium for its latest innovations, protected by its defacto monopoly status, and enjoy healthy margins as a result. Providing semiconductor manufacturers with the required tools has become one of the most profitable enterprises in the world, as evidenced by ASML’s operating margins of 31% in 2024. Furthermore, according to ASML’s CEO Christophe Fouquet, the company expects to generate average sales growth of 8-14% over the next five years.

Why ASML Stock Can Soar in 2025

There are several reasons why I believe ASML stock can go higher in 2025.

For starters, the upgrade cycle is right around the corner. While consumers paused purchases after the pandemic because of higher interest rates, lower disposable incomes, and higher propensities to save, we could see the next cycle emerging soon. Interest rates are beginning to come down while a greater number of OEMs are bringing next-generation AI products to the market.

Additionally, ASML’s major customer, TSMC, announced that it’s going to spend between $38 billion to $42 billion on capital expenditures in 2025 to support the strong demand from AI, HPC, and 5G technologies. In previous commentary, I explained why ASML failed to meet investors’ expectations in October 2024 because new orders were sluggish. However, TSMC mentioned that 70% of its 2025 capital budget (about $28 billion) has been reserved for purchasing “advanced process technologies” provided by ASML’s machines.

As the upgrade cycle gains traction and foundries ramp up their capital investments, I expect ASML’s sales and revenues to start booming again. The company is expected to report earnings for Q4 2024 later this month, with analysts expecting improved earnings of $7.04 per share on revenue of $9.5 billion. I expect ASML to deliver a positive surprise on both numbers, as it has done so previously.

Moreover, I expect ASML’s management to share positive commentary regarding the outlook for 2025, given the recent news from TSMC. While consumer-oriented end markets might still be chugging along, I expect the AI-related vertical to be strong in the upcoming release. Notably, the company maintained its 2030 outlook in November 2024 and aims for $46-63 billion in sales and gross margins of 56-60%.

What Do Wall Street Analysts Think About ASML Stock?

With ASML stock trading at 29.6x forward earnings, neither Wall Street analysts nor I think this stock is cheap. However, I also do not think that it’s expensive.

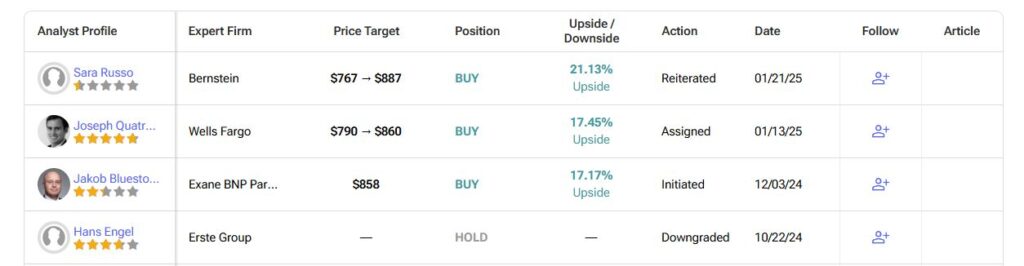

ASML has received a Strong Buy consensus rating based on three Buy, zero Hold, and zero Sell ratings in the past three months. The average analyst ASML stock price target of $868.33 per share implies an 18.5% potential upside from current levels.

ASML Positioned for Re-Rating as Price Catalysts Approach

ASML is a defacto monopolist in the semiconductor manufacturing space, or more specifically, a company that the world’s largest chip manufacturers need to stay in business. With high barriers to entry preventing intense competition and consumer demand for electronic gadgets continuing to rise, I see ASML as well-positioned for tomorrow’s world. The upcoming upgrade cycle and growing orders from key customers should also drive ASML’s performance (and share price) higher in 2025.