Shares in Dutch semiconductor group ASML Holding (ASML) climbed higher today as hopes of a new European program to boost the region’s chip industry gathered pace.

Geopolitical Urgency

According to a Reuters report members of the European Parliament today urged the European Commission to launch a new investment program, known as the Second EU Chips Act, for the continent’s semiconductor industry targeting AI chips and other technological gaps.

“Recent geopolitical developments have shown that Europe cannot take continued access to advanced technologies for granted,” a letter authored by representatives of three major factions in parliament and signed by 54 lawmakers said. “We must take active steps to make the EU attractive as an R&D, production and investment location.”

Chips Need Funds

It followed a call last week from chip makers and semiconductor supply chain firms, including ASML, for a follow up to the original EU Chips 2023 Act. The aim of that first act was to bolster Europe’s “competitiveness and resilience in semiconductor technologies and applications and help achieve both the digital and green transition.” This was to be done partly via investment in capacity and skills.

However, it struggled after failing to attract advanced chipmakers. One of those Intel (INTC) shelved plans for a large factory in Germany. EU member states and the European Commission were also criticized for the slow pace at which they approved projects.

The Commission has yet to set out plans for the semiconductor industry, though it has reportedly said it intends to launch five funding packages this year spurring European investment, notably in AI.

Is ASML a Good Stock to Buy Now?

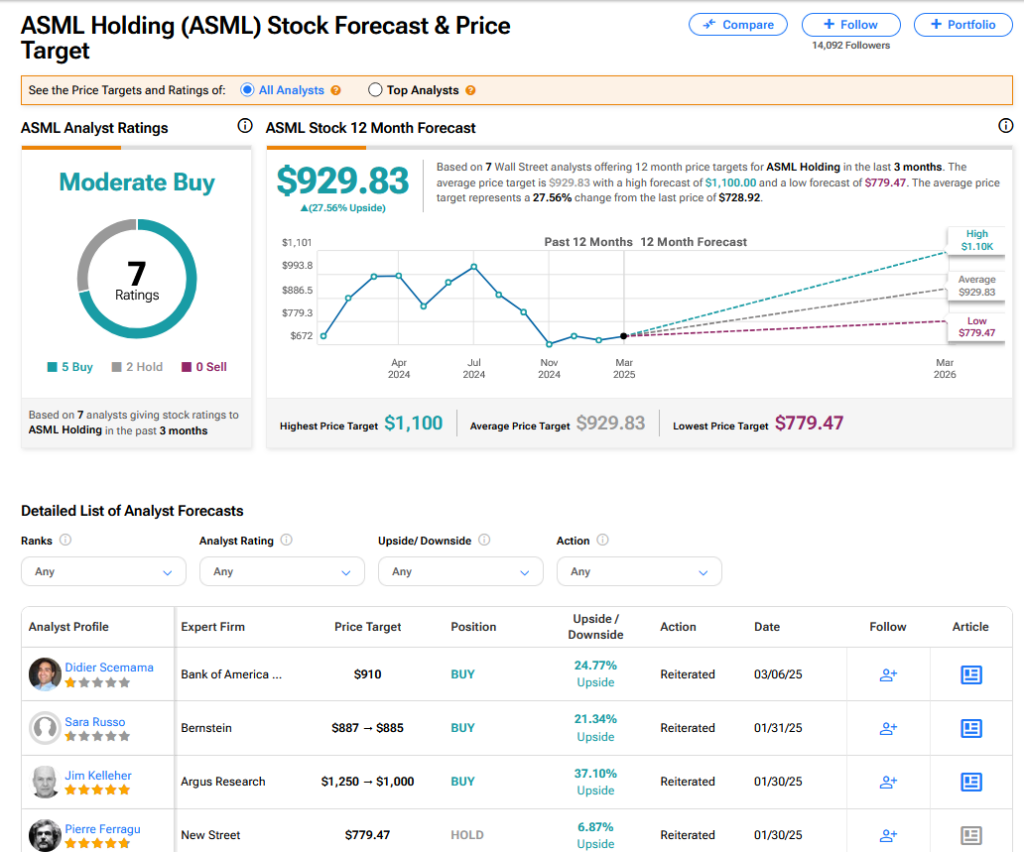

On TipRanks, ASML has a Moderate Buy consensus based on 5 Buy and 2 Hold ratings. Its highest price target is $1,100. ASML stock’s consensus price target is $929.83 implying an 27.56% upside.