Chip stock ASML (NASDAQ:ASML) had a good thing going for a while. That is until a new but surprisingly familiar competitor stepped up. Now, ASML must compete in a world where it not only reigned supreme but reigned alone. That was enough to send ASML stock plunging nearly 3% in the closing minutes of Friday afternoon’s trading.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For years, ASML stood alone in the field as the only company that made extreme ultraviolet lithography technology. That gave it a particular edge, as it was basically supplying shovels in a gold rush back when the chip shortage was in full bloom. Now, however, it’s a whole different story as Canon (OTHEROTC:CAJPY) is now offering for sale machines to make semiconductors. What’s more, Canon has a whole different process in mind; instead of using extreme ultraviolet lithography like ASML does, Canon’s machines use nanoimprint technology, which can not only handle a five-nanometer process but can go as small as two nanometers. By way of comparison, Apple’s (NASDAQ:AAPL) A17 Pro is a three-nanometer chip.

Amazingly, Canon has been working on this process since 2004, though there have been few takers. Historically, this is because the extreme ultraviolet machines from ASML tended to work better during the process, reports note. That may have changed now and could give Canon a leg up. In fact, some reports suggest that Canon will likely face scrutiny with its machines, especially as the ongoing chip sanctions remain around China.

Is ASML Stock a Buy, Sell, or Hold?

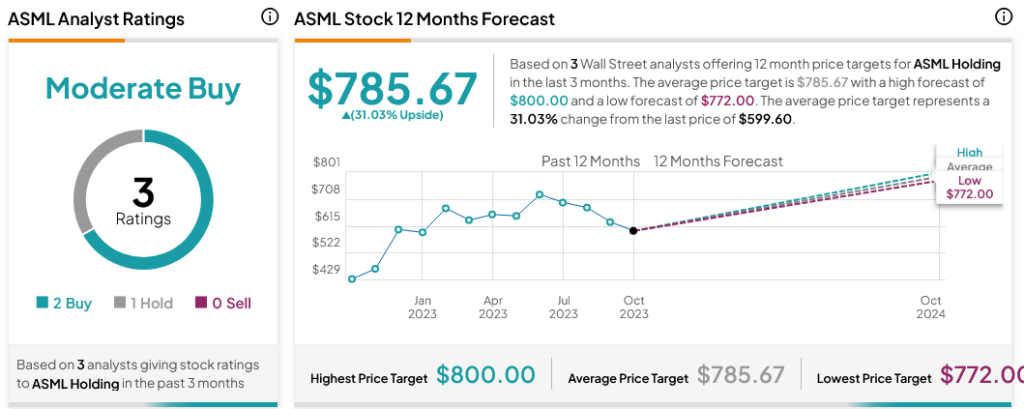

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ASML stock based on two Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average ASML price target of $785.67 per share implies 31.03% upside potential.