ASML Holding (NASDAQ:ASML) (DE:ASMF) shares plunged by nearly 4% in the early trading session today. This drop followed the Dutch advanced semiconductor equipment maker reporting lower profits and disappointing orders for the first quarter.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

ASML’s Weak Numbers

During the quarter, revenue declined by ~21% year-over-year to €5.3 billion. ASML sold 66 new lithography systems in Q1, compared to 113 units in the fourth quarter. Additionally, net bookings dropped to €3.6 billion from €9.2 billion in Q4. The company’s gross profit declined to €2.7 billion from €3.7 billion in Q4. In sync, its EPS contracted to €3.11 from €5.21 in Q4.

Gearing Up for Growth

ASML continues to invest in capacity ramp-up and technology. Peter Wennink, the president and CEO of the company, noted that ASML sees 2024 as a transition year as the semiconductor equipment supplier gears up for the industry’s recovery from a downturn. For the upcoming quarter, ASML foresees net sales in the range of €5.7 billion to €6.2 billion. Furthermore, the company plans to declare a total dividend of €6.10 per share for the full year 2023.

What Is the Price Prediction for ASML?

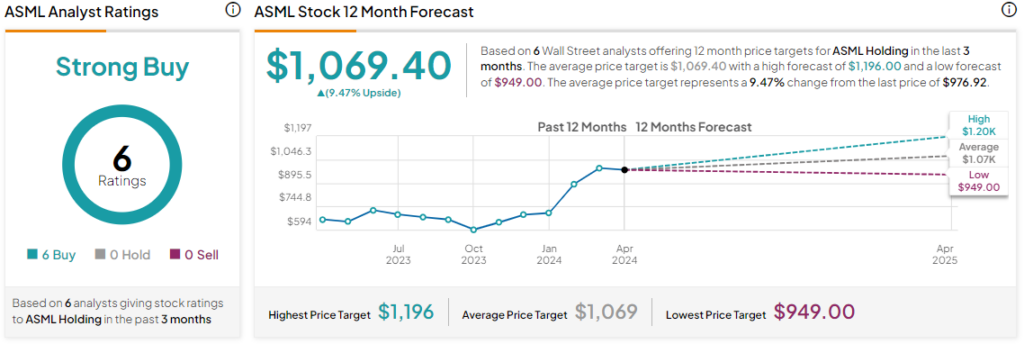

Today’s price decline comes after a nearly 54% jump in ASML’s share price over the past year. Overall, the Street has a Strong Buy consensus rating on the stock, alongside an average ASML price target of $1069.40. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure