Shares of social media company Pinterest (PINS) continued to tumble on Wednesday afternoon after its third-quarter results, released after market closure on Tuesday, missed Wall Street’s estimates. PINS collapsed over 22% as of 2:37 p.m. EDT.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reacting, analysts have lowered their price targets on PINS stock, with one calling the earnings conference call “unsettling” and another believing the AI boom could pose an “existential risk” to the company.

Pinterest Posts Q3 Miss despite User Growth

In its third-quarter earnings report, Pinterest’s revenue increased 17% from a year ago to $1.05 billion, meeting analysts’ expectations. But the company generated adjusted earnings of 38 cents per share — up 19% year-over-year, but below Wall Street’s forecast of 42 cents per share.

Julia Donnelly, Pinterest’s chief financial officer, noted that the company’s ad revenue was impacted by “pockets of moderating ad spend” in the U.S. and Canada, as larger U.S. retailers faced margin pressure due to the Trump administration’s tariffs on the retailing industry. This is despite its global monthly active users jumping 12% YoY to 600 million during the quarter.

While Pinterest expects the trend to continue into its fourth quarter, the company still expects its revenue to rise between 14% and 16% from a year ago, reaching between $1.313 billion and $1.338 billion by the end of its fourth quarter.

Analysts Bemoan ‘Uninspiring’ Results

However, analysts are not impressed with the future outlook. Monness Crespi analyst Brian White described the Q3 performance as “uninspiring,” noting that Pinterest hosted an “unsettling” conference call and provided “muted” fourth-quarter guidance.

Evercore ISI analyst Mark Mahaney, who noted that Pinterest’s growth rate was slowing, described the social media company’s Q4 projection as “less optimistic.” Yet, Mahaney argued that “there are still some promising elements in the mix.”

On his part, RBC Capital analyst Brad Erickson noted that the first-time impact of tariffs on the company’s digital ads revenue might prove analysts who are bearish right about the company’s lack of diversity in its customer base and increased sensitivity to macroeconomic factors.

Will Pinterest Survive the AI Era?

Meanwhile, Rosenblatt Securities analyst Barton Crockett believes that the results are “okay” and is much more concerned about how the “explosion of chatbot capabilities” will impact Pinterest in the future.

Such a trend could encroach into Pinterest’s space, Crockett argued, further noting that the development could birth an “existential risk” that shreds the value of PINS stock.

Adding to this, Monness Crespi’s White noted that, in addition to Pinterest facing more challenging conditions in certain advertising segments, concerns about the social media company’s ability to compete in generative AI have forced his team to the sidelines when it comes to PINS stock.

The concerns come even as Pinterest last week unwrapped Pinterest Assistant, a visual-first artificial intelligence assistant designed to help users shop online, including by giving recommendations.

Is PINS a Good Stock to Buy?

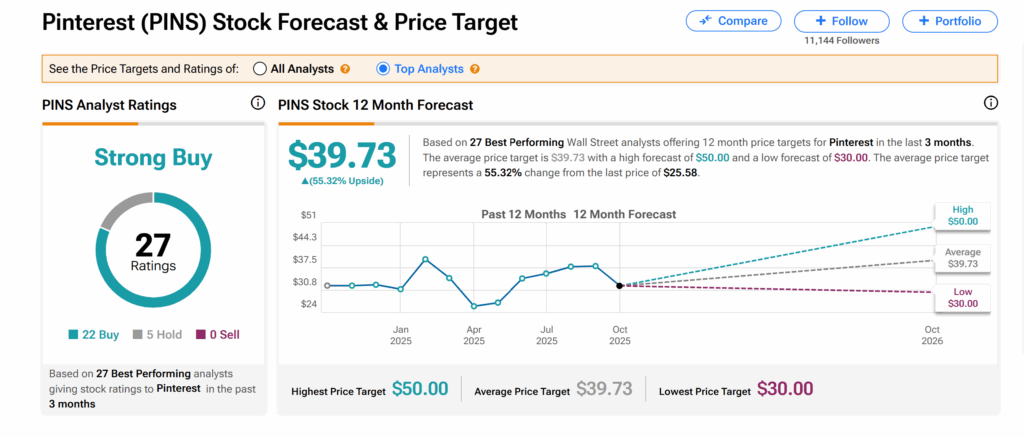

Despite the lower price targets pinned by analysts on Pinterest after its Q3 earnings results, Wall Street’s consensus on PINS stock remains a Strong Buy, according to TipRanks. This is based on 22 Buys and five Holds issued by analysts over the past three months.

Moreover, at $39.73, the average PINS price target suggests more than a 55% upswing from the current trading level.