Last week, President Donald Trump’s two-day state visit to the United Kingdom resulted in £250 billion ($337 billion) worth of investment agreements, or what has been dubbed a “technology prosperity deal”. U.S. tech giants such as Microsoft (MSFT), Alphabet (GOOGL), and Nvidia (NVDA) altogether pledged multibillion-dollar investments targeted at expanding the UK’s AI and data center infrastructures.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, a key part of the arrangement also includes a series of deals worth over £74 billion ($100 billion) to invest in nuclear technologies in both countries. The arrangement has been dubbed the “golden age of nuclear”.

UK Prime Minister Keir Starmer said the goal is to “drive down household bills in the long run, while delivering thousands of good jobs in the short term.” The commitments build on the UK government’s existing efforts to ramp up its clean energy production, including expanding capacity in nuclear energy production.

The new deals are expected to make it quicker for companies to join forces to build new nuclear power stations in both countries. For instance, the time required for a nuclear project to obtain a license is expected to be reduced from approximately three or four years to about two.

The majority of the deals involve either private U.S. companies (e.g., X-Energy, Holtec, and Radiant) or public British companies (such as Centrica (CPYYY) and Urenco). However, this article highlights the stocks of American public companies involved in the deals.

GE Vernova Plays “First-Mover Role”

GE Vernova (GEV) is a Massachusetts-based company spun off from General Electric (GE). The company focuses on power generation, electrification, and nuclear technologies.

The company’s reactor designs are expected to come into play as the UK and US collaborate to optimize the regulatory process for reactor approvals. The UK is currently evaluating GE Vernova’s technology as part of its small modular reactor (SMR) program. Roger Martella, GE Vernova’s chief corporate officer, has praised the company’s “first-mover role” or early leadership in supporting the global deployment of SMRs.

GE Vernova’s shares currently boast a Strong Buy consensus rating on TipRanks, based on 16 Buys and five Holds assigned by 21 Wall Street analysts over the past three months. The average GEV price target of $677.83 indicates an 8.60% upside potential.

KBR Expands Alliance with TerraPower

KBR (KBR) offers engineering, defense, and energy solutions globally. As part of the arrangement, the American public company will work in conjunction with privately-owned nuclear reactor designer TerraPower to conduct studies and evaluate sites in the UK for the deployment of the Natrium advanced reactor technology.

Natrium is a new type of nuclear reactor that uses liquid sodium instead of water to cool its core, making the reactor safer and more efficient. Each Natrium reactor is projected to create approximately 1,600 construction jobs and 250 permanent positions, aiming to provide dependable nuclear energy combined with gigawatt-scale energy storage.

KBR currently has a Moderate Buy consensus rating on TipRanks, based on three Buy and three Hold ratings assigned by Wall Street analysts over the past three months. The average KBR price target of $60.20 indicates a 23.44% upswing potential from its current level.

BWXT and Rolls-Royce to Power Space Reactor Systems

Meanwhile, the new arrangement between the UK and the U.S. follows an existing partnership between BWX Technologies (BWXT) and Rolls-Royce (RYCEY). Both companies have been working together to advance nuclear technology development, particularly in space reactor systems and advanced modular reactors.

BWXT currently has a Moderate Buy consensus recommendation on TipRanks, based on five Buys, three Holds, and one Sell assigned by nine Wall Street analysts over the past three months. At $179.86, the average BWXT price target points to a 3.07% growth potential from the current level.

What Other Nuclear Stocks to Buy?

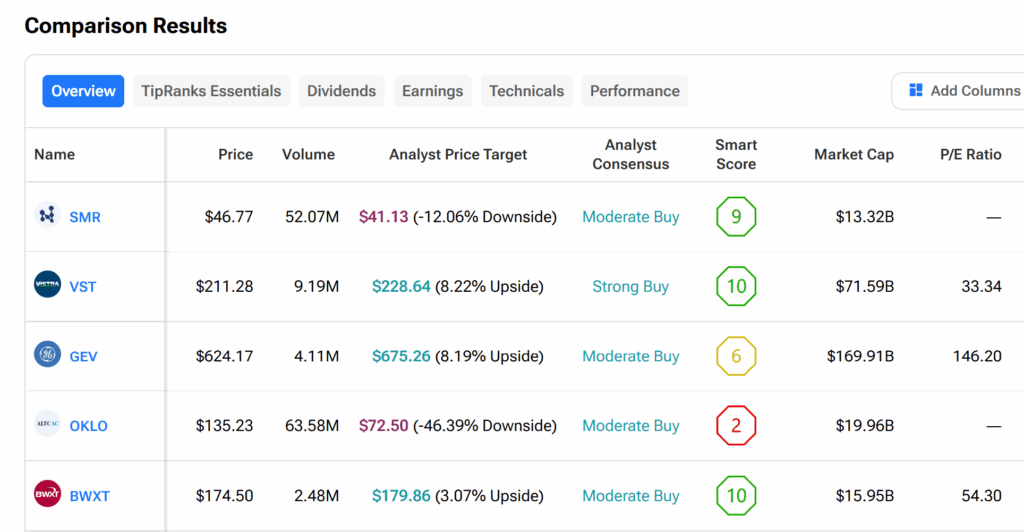

Other U.S. stocks could potentially gain from the renewed interest in nuclear energy between the U.S. and the UK. TipRank’s Stock Comparison tool offers valuable insights into which of these stocks might be worth considering for purchase at this time.

Compare more nuclear stocks here.