Amplitude (AMPL), a provider of digital analytics platforms, has reported an impressive fourth quarter for the calendar year 2024, surpassing market revenue and earnings expectations. The company has seen its shares continue an upward trajectory, climbing roughly 28% year-to-date, as it anticipates a promising 2025.

Expanding Client Base Driving Revenue Growth

As traditional ad spending strategies become less effective, Amplitude focuses on helping companies leverage analytics platforms to employ product-led growth strategies, improving user engagement, retention, and monetization from within their products. The firm boasts roughly 3,800 customers, including 27% of the Fortune 100 companies.

Its services span across digital analytics platforms, with solutions like Amplitude Analytics. This feature offers real-time product data and reconstructed user activity. The company also offers Amplitude Experiment, Amplitude CDP, and Amplitude Session Replay, tools used by product, marketing, and data teams alike to understand user behavior and improve product outcomes.

The company reported sales up 9.4% year-over-year, totaling $78.13 million. This figure exceeded market expectations, while the non-GAAP earnings per share (EPS) of $0.04 also beat analysts’ consensus projections.

For the year, annual recurring revenue was reported at $312 million, marking an 11% increase year-over-year. The company has also shown growth in the number of customers with more than $100,000 in ARR, which increased by 16% year-over-year.

The company issued an optimistic forecast for the next quarter’s revenue at $79.5 million, 2.3% above analyst estimates, and $324.8 – $330.8 million for the full year.

Analysts Take Notice

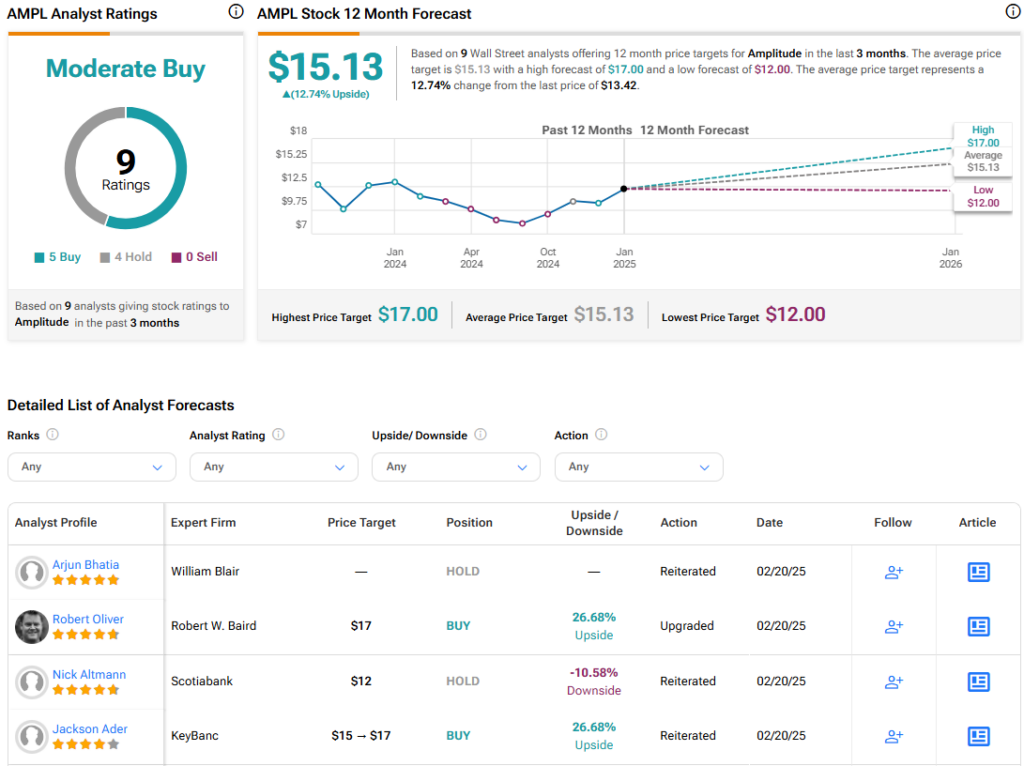

Based on the recent news, analysts following the company have raised their price targets. For example, Morgan Stanley increased its price target to $13 (from $11) and maintained an Equal Weight rating, noting the company’s Q4 results boosted confidence that macroeconomic challenges are now behind them. However, this was partially offset by higher expenses in support of go-to-market changes. It was also noted that the company’s shares competently reflect its growth relative to its profitability.

On the other hand, KeyBanc has upped its price target to $17 (from $15) while maintaining an Overweight rating, noting Amplitude’s revenue growth remains consistent and is looking forward to seeing substantial margin improvements with this revenue acceleration.