ETFs are a cost-effective solution for diversifying a portfolio as they offer low expense ratios and broker commissions in comparison to individual stocks. Further, the lower investment requirements make them particularly attractive to budget-conscious investors. By leveraging the TipRanks ETF Screener to scan for ETFs with significant upside potential in the next 12 months, we have shortlisted two such funds: XES and XBI.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a deeper look at these two ETFs.

SPDR S&P Oil & Gas Equipment & Services ETF (XES)

The SPDR S&P Oil & Gas Equipment & Services ETF seeks to track the investment results of the S&P Oil & Gas Equipment & Services Select Industry Index. XES has $319.42 million in assets under management (AUM), with the top 10 holdings contributing 42.72% of the portfolio. Further, the expense ratio of 0.35% is encouraging.

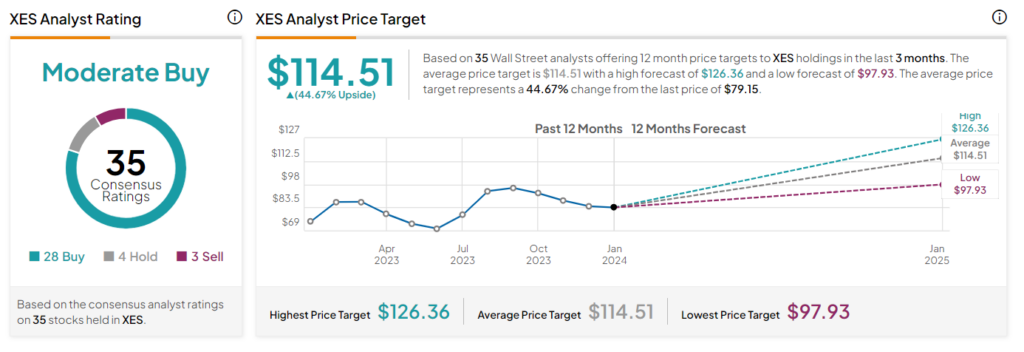

On TipRanks, XES has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 35 stocks held, 28 have Buys, four have a Hold, and three stocks have a Sell rating. The average XES ETF price forecast of $114.51 implies a 44.7% upside potential from the current levels. The XES ETF has declined 6% in the past six months.

SPDR S&P Biotech ETF (XBI)

The SPDR S&P Biotech ETF replicates the performance of the S&P Biotechnology Select Industry index. XBI has $7 billion in AUM, with its top 10 holdings contributing 17% of the portfolio. Its expense ratio stands at 0.35%.

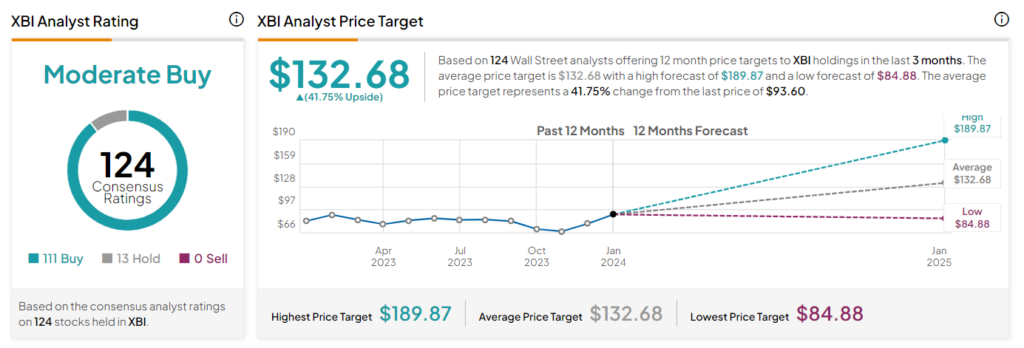

On TipRanks, XBI has a Moderate Buy consensus rating. Of the 124 stocks held, 111 have Buys, and 13 have a Hold rating. The average XBI ETF price target of $132.68 implies a 41.8% upside potential from the current levels. The ETF has gained 11.1% in the past six months.

Ending Note

Investors looking for ETF recommendations could consider XES and XBI due to the solid upside potential expected by the analysts.