The Walt Disney Company (NYSE:DIS) is firing on all cylinders to accelerate organic growth by boosting its business segments. The company has recently bagged a deal with the International Cricket Council (ICC), which should increase the subscribers of its international streaming brand, Disney Star. The media and entertainment company is also focusing on increasing the profitability of theme parks by raising prices and charging for services that were free earlier. These initiatives are expected to help drive Disney’s top-line growth and provide support to its beaten-down stock, which is in the red so far this year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Coming to the ICC deal, Disney Star has won broadcasting rights for Indian TV and digital rights of global cricket events through the end of 2027. Although the financials of the transaction have not been released, Disney has won the deal by quoting a significant upside to the previous cycle’s rights fee in a single round and sealed-bid procedure.

Further, Disney is also aiming to increase revenues from its Parks, Experiences, and Products division. Despite keeping the number of visitors below the pre-pandemic level, Disney is seeing rising profits from its theme parks, as it is focusing on better yield management.

Eliminating or charging for some free services, launching a smartphone-app feature called Genie+, and raising the reservation cost for main attractions, food and other services are helping the company to rake in solid profits.

Is Disney Stock a Buy, Sell or Hold?

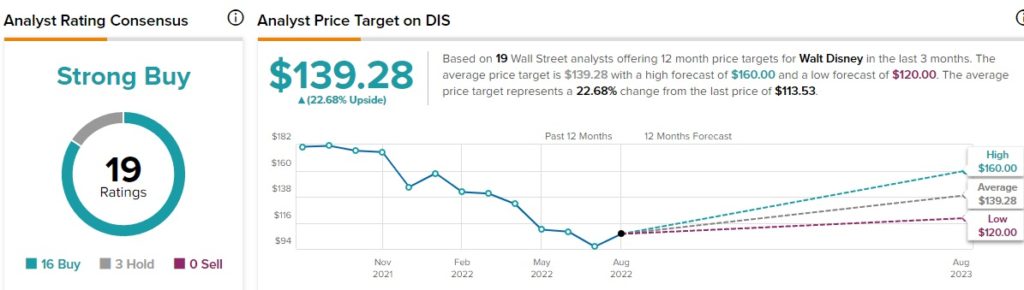

Disney seems like a good stock to grab now. As per TipRanks, the Street is highly confident about DIS stock, which enjoys a Strong Buy consensus rating based on 16 Buys and three Holds.

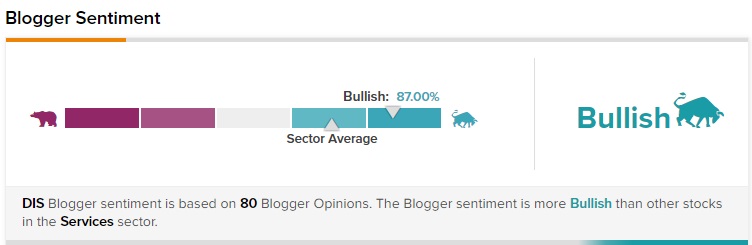

TipRanks data shows that financial bloggers are 87% Bullish on Disney stock, compared to the sector average of 71%. Further, retail investors seem to be bullish about Disney stock. They have increased their holdings in DIS stock by 2.6% in the last 30 days.

Is Disney Stock Expected to Rise?

Although shares of the company have declined 27.2% so far this year, Disney’s average price forecast of $139.28 signals that DIS stock may surge nearly 22.7% from current levels. This is because Disney’s latest initiatives are brightening up its prospects.

Further, the new streaming rights could help Disney grow its subscriber base globally. Also, the change in strategy to focus on increasing the visit cost at its amusement parks seems to be working in the favor of the media and entertainment giant.

Read full Disclosure