In a market reeling from President Trump’s sweeping tariffs, Palantir Technologies (PLTR) stands out as a rare beacon of resilience. Last week’s stock market plunge is on track to be extended this week, with Asian markets following their Western counterparts. However, not all stocks are made the same.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Unlike most tech giants battered due to concerns over supply chain disruptions and trade war fears in general, Palantir’s software-driven business model is immune to these headwinds. Better yet, the incoming tariffs could turbocharge its growth. In a world bathed in government-induced protectionist measures, defense spending could rise, and not just in the U.S. PLTR may well benefit as more frightened customers turn to its AI-powered platforms to navigate an increasingly unpredictable world. I’m bullish on the stock and have continued accumulating shares during this profoundly pessimistic broader market.

A Fortress of Immunity

Palantir’s insulation from Trump’s tariff regime is rooted in its business model. Known for its data analytics platforms like Gotham and Foundry, the company doesn’t rely on physical goods crisscrossing borders. Its products are digital, delivered in code rather than container boxes. So while most other tech names, such as chipmakers and manufacturers, wrestle with a 10% baseline tariff on all imports and even steeper levies on “bad actors” like China, Palantir sidesteps the fray.

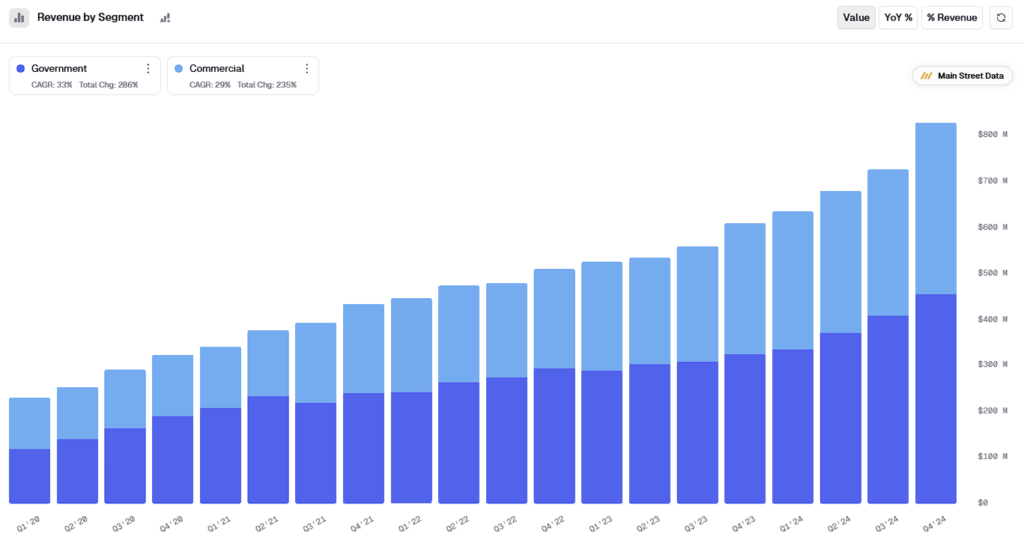

Palantir’s revenues flow from long-term contracts with government and commercial clients without being affected by trade barriers. For both categories of clients, Palantir’s software has become an indispensable part of their business, as we’ve seen dozens of times from mega-executives worldwide praising their products.

Consider BP (BP), a key commercial partner. As oil markets brace for any potential tariff shocks (for example, an impact from a 20% levy on EU-sourced equipment), BP has the right tools it can lean on: Palantir’s Foundry platform. By centralizing operational data across refineries, shipping, and logistics, Foundry can help BP adjust in real-time, rerouting supplies or shifting to U.S. vendors with minimal friction. So, what might be a disruption for some becomes a flexibility play for BP.

This is the theme of Palantir’s story. The company’s business is built on similar long-term, highly vital contracts. That kind of durability makes it largely immune to tariff headlines and positions it as an essential infrastructure for firms managing geopolitical risk.

Tariffs as a Tailwind

As I hinted with the BP example, the ongoing trade war could prove a very powerful tailwind for Palantir, again setting it widely apart from the rest of its sector peers. In fact, Palantir could see tariffs ignite its next growth phase. As global supply chains buckle under new duties, especially with the 34% tariff on Chinese goods and the 20% tariff on EU imports, businesses face a stark reality: adapt or perish.

Palantir’s Foundry and Artificial Intelligence Platform (AIP) offers the invaluable lifeline needed. They effectively allow organizations of all types to unify fragmented data, forecast disruptions, and make swift, actionable decisions. Imagine a retailer rerouting supply chains or a manufacturer pivoting to domestic production. For such businesses, Palantir’s tools turn chaos into opportunity.

The commercial segment will likely see the most benefits here, as it is already surging at a breakneck pace and is perfectly positioned for this moment. Last year, its revenues grew 54%, fueled by demand for AI-driven efficiency, and tariffs should only supercharge that trend. As companies navigate rising costs and potential retaliation from trade partners, demand for Palantir’s core strength, making sense of massive, fragmented data, is only growing. In this kind of environment, clarity is a competitive edge.

Tariffs may also expand Palantir’s role in the public sector. The ongoing push to onshore manufacturing and accelerate domestic infrastructure, from programs like Warp Speed to broader industrial policy, aligns with what Palantir does well: coordinating complex systems at scale. If that momentum holds, its platforms could become critical infrastructure in a more inward-looking economy.

Valuation Caution Amid Resilience

Now, for all the good, the main risk surrounding Palantir’s investment case, namely its valuation, remains the elephant in the room. Trading at 46x and 132x this year’s expected revenues and earnings, respectively, the stock carries such a steep premium that it should make even the most bullish PLTR investors pause and question their rationale.

Still, the stock’s resilience speaks volumes. While most titans have shed tremendous amounts of value in a few days, Palantir’s losses have been milder over the same period. I think this relative strength echoes the market’s confidence in Palantir’s “tariff-proof” story.

Is Palantir a Buy, Sell, or Hold?

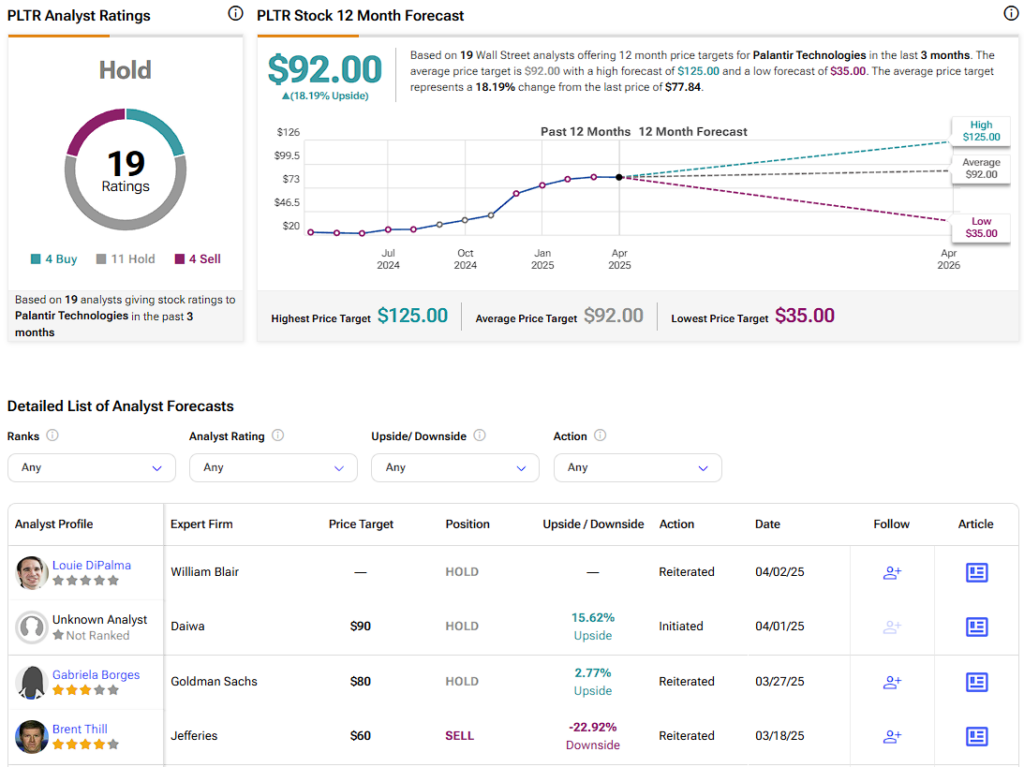

Despite PLTR’s resilience during the tariff-driven sell-off, Wall Street sentiment reveals lingering concerns about the stock’s high valuation. PLTR holds a Hold consensus rating based on 4 Buy ratings, 11 Holds, and 4 Sells issued over the past three months. PLTR’s average price target of $92 per share implies about 18% upside potential over the next twelve months.

PLTR Stock is a Bet on U.S. Supremacy

Palantir’s journey through Trump’s tariff storm is a tale of resilience and opportunity. The stock’s sky-high valuation demands scrutiny, as a steep premium could falter if economic fallout curtails client spending. Yet, its stability during the chaos sets it apart. While tech giants hemorrhage value, Palantir’s milder dips signal market faith in its geopolitically fueled tariff-immune model and growth potential. As businesses and governments lean on its AI prowess to tame uncertainty, Palantir could recast trade war headwinds into a decisive updraft.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue