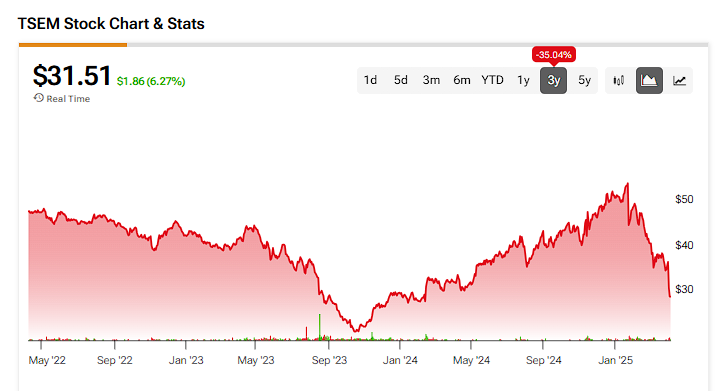

President Donald Trump’s Liberation Day, a sweeping series of new tariffs imposed on multiple countries worldwide, certainly lived up to its name, though perhaps not in the way the administration envisioned. Indeed, the bears were at liberty to slash valuations across multiple sectors, with one of the biggest victims being Tower Semiconductor (TSEM).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

An independent semiconductor foundry based in Israel, Tower specializes in advanced mixed-signal devices. Given its geopolitical profile, it natively falls outside the ire of the Trump administration. Unfortunately, the tech ecosystem is highly dependent on global supply chain networks, particularly those tied to Asia. With the eastern hemisphere firmly in the White House’s crosshairs, Tower caught some stray bullets.

Nevertheless, it’s essential to realize that Tower’s main business of manufacturing infrastructural components—such as sensors and power management systems—will likely accelerate. If so, TSEM stock represents both a bullish trading prospect and a discounted long-term investment.

Robust Fundamentals Should Bolster TSEM Stock

The bullish argument for TSEM stock revolves primarily around its strong fundamentals; specifically, Tower represents an underappreciated component of the broader AI narrative. Sure, headline companies like Nvidia (NVDA) dominate the generative AI discourse thanks to their graphics processors, which enable massive data processing capacities — perfect for training AI models. On the other hand, AI that can’t operate outside its silo or ecosystem (in other words, the real world) isn’t all that useful.

That’s why sensors and microphones, essentially analog-to-digital converters, are vital to the industrial component of machine intelligence. Moving forward, engineers will no longer be satisfied with internally isolated innovations. Instead, they’re seeking to marry tangible functionality with digitalization.

This is also why investors should consider the implosion of TSEM stock a long-term buying opportunity. While the volatility has been ugly, the prospects for the underlying business are incredibly bright. For example, Grand View Research notes that the global Industrial Internet of Things (IIoT) should expand at a compound annual growth rate of 23.2% from 2024 to 2030, culminating in a valuation of over $1.7 trillion.

Right now, TSEM stock’s market capitalization is only $3.29 billion. Based on the acceleration toward the singularity, much growth is still to be baked into Tower Semiconductor.

Counterintuitive Death Cross Buying Opportunity

Perhaps to no one’s surprise, TSEM stock volatility underscored an ugly technical pattern that flashed last week called the “Death Cross.” Essentially, the equity’s 50-day moving average slipped below the 200 DMA, potentially warning of further distress ahead. However, those studying the history of TSEM stock will recognize that the death cross is a contrarian indicator.

In the trailing decade, TSEM stock printed seven death crosses. Notably, one month after the signal flashed, shares swung higher five times, a contrarian success ratio of 71.43%. After three months, TSEM increased six times or a ratio of 85.71%. Moreover, the average return under this positive outcome stands at 14.47%. Put another way, by the options chain expiring July 18, TSEM stock could end up near $34.

Options Strategies to Consider

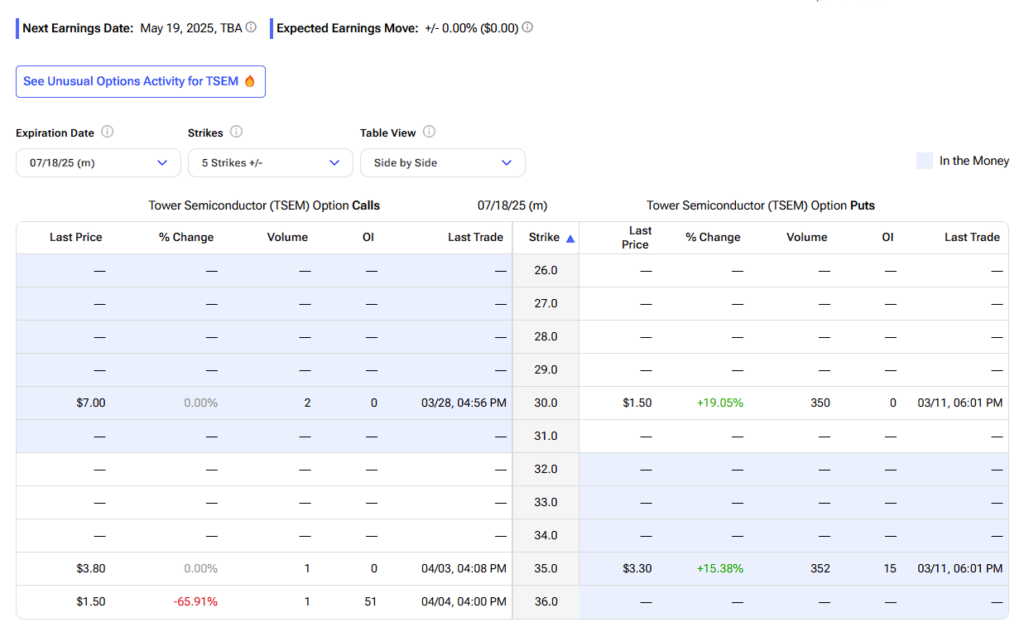

Due to Tower’s fundamental criticality, bullish speculators will likely soon consider TSEM stock a compelling discount. For those who believe that moment could arrive at the next available options expiration date, there’s a strategy called the bull call spread.

Specifically, one might consider buying the 30/32 bull spread for the options chain expiring on April 17. This transaction involves buying the $30 call and simultaneously selling the $32 call. The proceeds from the short call partially offset the debit paid for the long call, resulting in a discounted net debit.

This trade assumes that TSEM stock will rise above the breakeven price of $31.05 and eventually reach $32 at expiration. If so, the maximum reward comes out to the difference between the strike prices (multiplied by 100 shares) minus the net debit paid. As of this writing, the max payout for this trade is over 90%.

Another enticing idea is to play the implications of the aforementioned death cross. It’s possible that TSEM stock could jump near $34 over the next three months, perhaps even more given the severity of last week’s tariffs-induced discount. The boldest wager would then be a 30/35 bull spread for the options chain expiring July 18.

Finally, the most straightforward approach is to sidestep the options arena altogether and buy TSEM stock in the open market. While this methodology foregoes the leverage of options, you don’t have to worry about expiring contracts, an ideal framework for conservative speculators.

Is TSEM a Buy or Sell?

On Wall Street, TSEM stock carries a Strong Buy consensus rating based on three Buy ratings over the past three months. TSEM’s average price target of $60 per share implies approximately 90% upside potential over the next twelve months.

Attractive TSEM Stock Discount

Although Liberation Day whipped the market, Tower Semiconductor plays too important a role in digital innovation to be ignored. Indeed, with the valuation cut, TSEM stock looks incredibly enticing for forward-thinking speculators. Those who want to add spice to their wagers may consider the leverage of options, which can dramatically enhance return potential in exchange for added risk.