BYD Company (BYDDF) may now be the world’s top-selling EV maker, but it remains underappreciated by Western investors. According to Main Street data, BYD has delivered over 4 million vehicles in 2024. While building out a strong battery and charging ecosystem, and a vertically integrated, tech-driven business model, BYD is far more than a regional Tesla rival. Its global expansion and innovation pipeline support a bullish long-term view—I’m assigning a Buy rating.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Evaluating the Chinese EV Giant

Many may not realize BYD’s journey began in 1995 as a rechargeable battery manufacturer. Since then, the company has evolved into a diversified powerhouse spanning electric vehicles, energy storage, mobile components, solar cells, and even monorails.

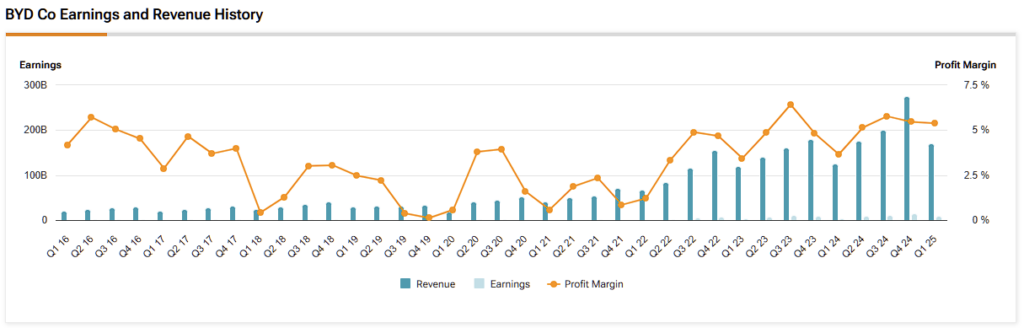

Its vertically integrated structure has enabled smoother global expansion than many legacy automakers, which juggle EVs and traditional vehicles. In 2024, BYD posted impressive results, with revenue surging 29% to ¥777.1 billion and profits climbing 34% year-over-year.

The balance sheet appears exceptional, with solid cash reserves that comfortably outweigh debts of ¥29.13 billion and a declining debt-to-asset ratio in recent quarters, as shown by TipRanks data. Notably, this is unlike many traditional automakers who are struggling to pivot as consumer demands and markets transition towards electric vehicles.

BYD Puts Innovation at the Core of Operations

In the rapidly evolving EV space, technological leadership is a clear differentiator, and BYD’s Blade Battery is a standout. This lithium-iron-phosphate (LFP) battery is praised for its superior safety, longevity, and cost efficiency. Its enhanced resistance to thermal runaway, improved energy density, and lower production costs give BYD a significant edge over traditional battery designs.

From an investor’s perspective, this innovation translates into more competitively priced vehicles without compromising on safety or performance, key factors for converting hesitant consumers.

Beyond the battery, BYD is also making strides in EV infrastructure. Its latest ultra-fast charging platform, capable of adding 400 km of range in just five minutes, directly addresses one of the biggest consumer concerns: range anxiety. Together, these advancements solidify BYD’s leadership across both the vehicle and charging ecosystem.

BYD’s Evolving Global Strategy

Despite already leading global EV sales, BYD shows no signs of slowing down. With operations in over 100 countries and new manufacturing hubs underway, the company is strategically shifting from exporting out of China to producing locally. This pivot—highlighted by a new plant in Hungary to serve Europe and a recently launched facility in Thailand to target Southeast Asia—mitigates not only tariff and regulatory risks but also aligns with shifting global preferences for regional production.

While global expansion is capital-intensive, BYD is in a strong financial position, supported by disciplined management and consistently high R&D investment, often exceeding net profits. Beyond EVs, the company is expanding into high-margin verticals, including advanced driver-assistance systems, AI-integrated hardware, and semiconductors.

Much like Tesla’s (TSLA) ecosystem approach, BYD is quietly building out a diversified platform across clean tech and mobility, positioning itself as a long-term force in next-generation transportation and energy solutions.

BYD Outlook and Valuation

In a market segment often characterized by lofty valuations, BYD stands out as relatively compelling. A conservative discounted cash flow (DCF) model—using a 9.5% WACC, 2.5% terminal growth rate, and stable net margins at 6.5%—yields a fair value approximately 25% above the current share price.

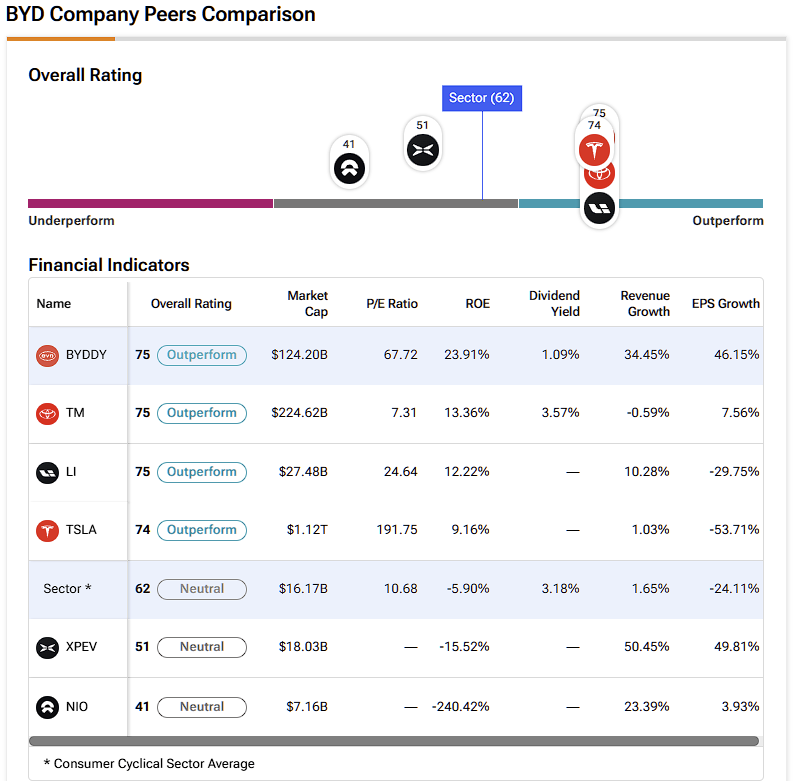

Even under more cautious assumptions, the downside case aligns closely with today’s valuation, offering a margin of safety. While BYD’s current P/E of 67 may appear elevated relative to its nearest peers such as Toyota Motor (TM) with its P/E ratio of just 7.3 and Li Auto (LI) with P/E of 24.6, the Chinese giant remains way better-valued than the likes of TSLA, which carries a P/E ratio of 177. For contrast, the consumer cyclical sector’s average P/E is ~10.6. In my view, substantial revenue and earnings growth are likely to normalize this metric in the near term.

Is BYD a Buy, Sell, or Hold?

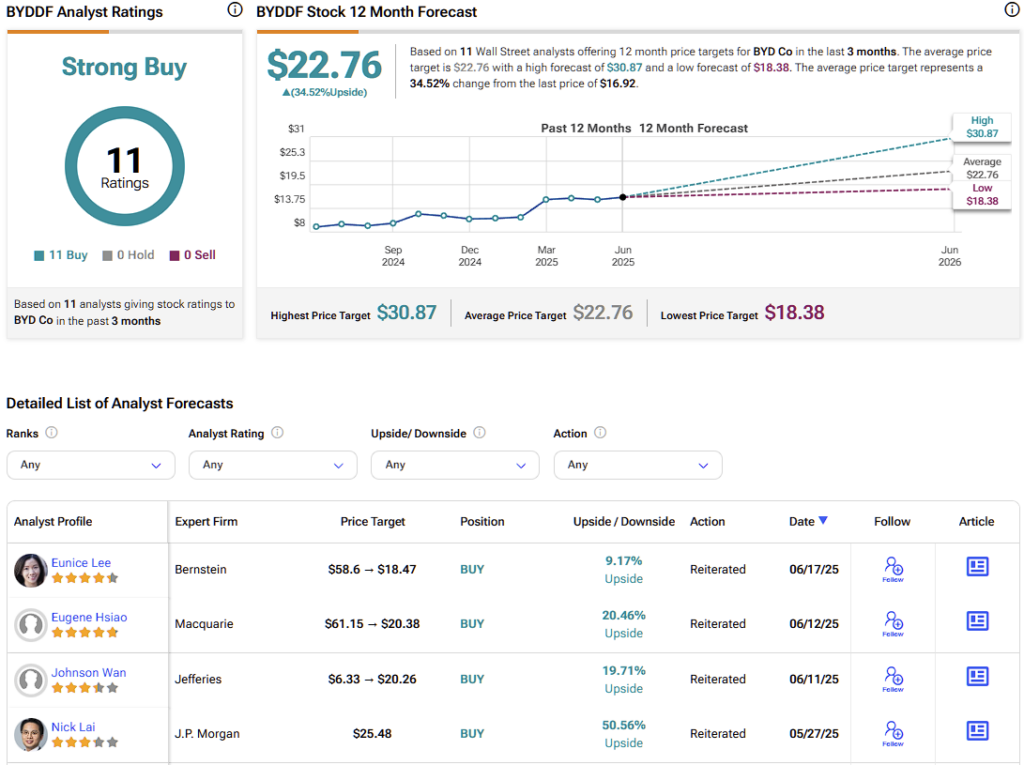

Wall Street shares a bullish outlook on BYD, with unanimous Buy ratings earning it a Strong Buy consensus and an average price target of $22.76, suggesting ~35% upside from current levels. Despite a 66% surge over the past year, analysts remain confident, encouraged by improving profitability, strong momentum, and solid underlying fundamentals.

Risks to the Bullish BYD Thesis

Despite plenty of promise looking ahead, I’d be remiss to ignore the potential risks that could temper any excitement in BYD from the market. Besides the geopolitical and economic risks I have already alluded to, margin pressure from competitors in the EV space, both domestically and globally, could lead to a race to the bottom to preserve market share.

While the company has typically performed well with this strategy, a sudden drop in profits could prove costly, as expensive investments in expansion and innovation are reflected on the balance sheet.

While management has done well to diversify across new markets and regions, the ongoing risk of operational execution at such a scale must not be overlooked, as any delays, intervention from regulators, or unforeseen challenges could seriously erode investor confidence.

That said, the estimated EPS of $0.16 for Q2 2025 looks promising and would represent a fourth consecutive quarter of earnings beats. As the next quarterly report is scheduled for September 1st, the next few months are likely to be highly important for BYD’s ongoing uptrend.

Confident Execution and Innovation Drive a Compelling Buy Case

In summary, I’m encouraged by BYD’s confident execution at scale. A closer look reveals the company is outperforming and out-innovating many of its peers at a pivotal moment, while also proactively managing key risks.

Although geopolitical uncertainties remain, the stock offers a reasonable margin of safety and substantial upside potential, even after its recent rally. For these reasons, I’m maintaining a Buy rating on BYD and will continue to monitor the company closely as it evolves over the coming weeks in preparation for its earnings report in September.