At first glance, enterprise software giant Salesforce (CRM) seems like a dubious investment. While there’s no denying its relevance, broader economic challenges have cast a dark shadow over the wider tech innovation space. Nevertheless, with Salesforce suffering a sizable drop over the past few months, the smart money appears to be moving in via astute options strategies. Therefore, I am bullish on CRM stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CRM Stock Offers Relevance Despite Economic Turmoil

Last year, investors couldn’t get enough of the latest innovations, such as artificial intelligence and quantum computers. This year, the general appetite for advanced tech remains robust. At the same time, more investors recognize the harsh realities of the moment. In particular, the Trump administration tariffs and subsequent trade wars with key economic partners have deflated valuations for growth-oriented businesses.

What’s particularly troublesome for CRM and its ilk is skyrocketing gold demand. While it may be a precious metal, that’s all gold is — a metal or commodity. By itself, the asset generates no earnings nor pays dividends. Investors speculate that its market value will be higher tomorrow than it is today. Such an attitude at scale is not conducive to the tech ecosystem, which rises on the belief of the forward impartation of productivity.

Investors tend to opt for gold when they anticipate something terrible will happen. Despite this overhang, CRM stock is intractably relevant. First and foremost, the underlying company dominates the customer relations segment through its pioneering cloud-based platform. Thanks to Salesforce, enterprises can more easily track customer interactions, manage sales pipelines, personalize marketing, and streamline customer service.

Further, Salesforce delivers convenience. With its expanded suite of enterprise tools, the company offers marketing, customer support, commerce, data analysis, and workflow communication solutions. Even better, the scalable offerings allow Salesforce to soak up market share from small startups to Fortune 500 giants.

Not surprisingly, Wall Street analysts anticipate steady growth over the next two years. For the current fiscal year, they’re targeting sales of $401 billion, up almost 8% from the prior year’s tally of $38 billion. And in the following year, experts see the top line reaching $45 billion, up 9.3% from projected FY2026 revenue.

Still, CRM stock hasn’t been exempted from broader economic challenges. On a year-to-date basis, the equity slipped more than 15%. Notably, though, a silver lining is that CRM’s top-line multiple has declined to 7.21x trailing 12-month (TTM) sales. A little more than one year ago, this metric stood at 8.15x.

The Smart Money Anticipates a Floor in Salesforce Stock

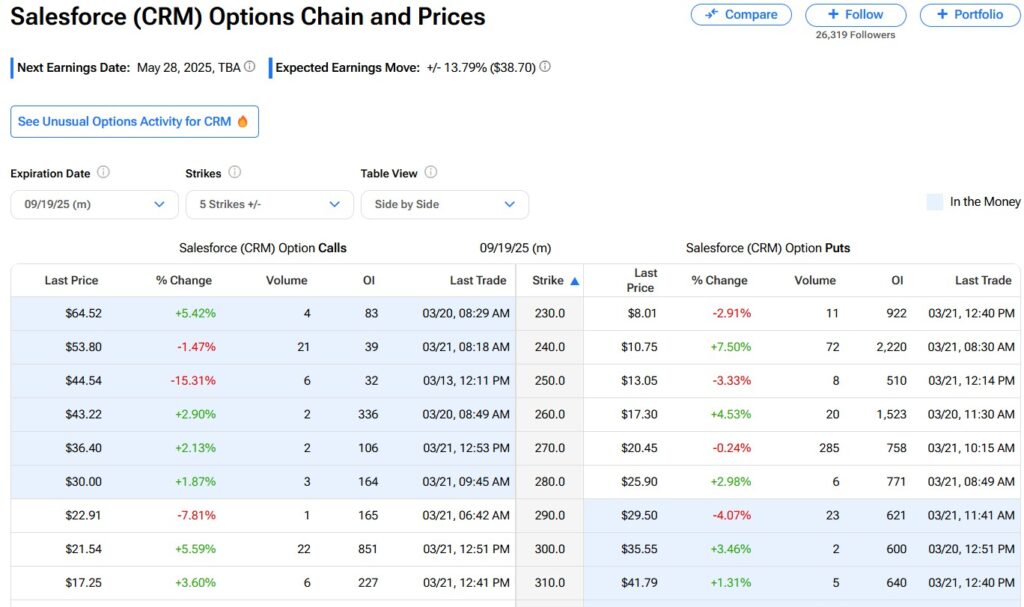

Another element to consider regarding CRM stock is its underlying unusual options activity. Generally speaking, the derivatives market represents the arena for sophisticated investors — the professional or institutional class. Therefore, aberrant trades in this space may tip off future trends in the open market. In other words, even if you don’t trade options, monitoring what the big banks are doing is always useful.

What I particularly found interesting was the high volume of sold or written put options that began earlier this year and has continued into the current month. Puts provide holders the right but not the obligation to sell the underlying security at the listed strike price. This is significant because on the other end of the transaction, put sellers are underwriting the risk that the security will not materially decline.

If the stock in question falls below the breakeven threshold, put buyers will likely exercise their options at some point. This action would force the put writers to buy the stock, a process known as “assignment.”

Because of this backdrop, we can infer two things about CRM stock. First, institutional investors believe that CRM’s volatility is potentially overdone, which is why they’re willing to risk assignment in exchange for receiving income (or the premium paid to buy the put options). Second, the put strike price minus the premium received essentially represents the price at which put sellers are comfortable buying CRM.

Currently, the smart money is buying call options, many with strike prices above the current market price. That’s a bullish signal because buying out-the-money (OTM) calls indicates a belief that the security will move higher. With smart money betting that CRM stock won’t drop materially lower and simultaneously betting that it will swing higher, the prospect for upside looks enticing.

One aggressive idea to consider is the 290/300 bull call spread for the options chain expiring May 16 this year. This transaction involves buying the $290 call and simultaneously selling the $300 call. The proceeds from the short call partially offset the debit paid for the long call. Should CRM stock hit the $300 short strike price at expiration, the maximum payout clocks in at nearly 147%.

Is Salesforce a Buy, Sell, or Hold?

On Wall Street, CRM stock carries a Moderate Buy consensus rating based on 30 Buy, eight Hold, and two Sell ratings over the past three months. CRM’s average price target of $375.58 per share implies approximately 32% upside potential over the next twelve months.

Options Strategies Offer Most Capitalization Potential

While broader economic pressures have deflated the tech sector, Salesforce could potentially rise above the muck thanks to its extraordinary relevance. The company basically owns the enterprise-level customer relations market, a segment that will likely only continue to grow in importance.

Perhaps the most significant bullish catalyst for CRM stock comes from the smart money. Options data indicates that major traders anticipate both a floor in the security and a future upward trajectory. Retail traders can front-run this dynamic with an aggressive options strategy.