Big-box retailer Walmart (WMT) should have benefited from a robustly positive upswing. Last week, the company posted its results for the fourth quarter of fiscal 2025, revealing strong revenue growth and impressive operating income. However, a disappointing outlook amid brewing economic concerns weighed heavily on investor sentiment, sending WMT stock down. Nevertheless, historical trends favor taking advantage of the discount and I’m up for the challenge as a WMT bull.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Looking at the Q4 results alone, imagining any hesitation toward the retailer would be difficult. For example, revenue jumped 4.1% from the year-ago quarter to $180.6 billion. Notably, the company’s e-commerce segment gained 16%, demonstrating significant momentum in digital sales. Further, domestic comparable sales rose by 4.6%, boosted by general merchandise demand.

Unfortunately, management admitted that it believes the company’s profit growth will decelerate in the current fiscal year. Specifically, the retailer anticipates full-year adjusted earnings will land between $2.50 and $2.60 per share, undershooting Wall Street’s consensus view of $2.76 per share. Add in President Donald Trump’s tariffs against key economic partners—particularly China—and investors rushed for the exits.

Still, the economic headwinds represent narratives Walmart has fended off and overcome with flying colors on previous occasions. A similarly optimistic outcome could materialize again, so I am bullish on WMT stock.

For WMT Stock, It’s a Different Name But the Same Game

When understanding the broader context of Walmart’s financial disclosure, it’s easier to sympathize with—even if one doesn’t agree—the cautious approach. The big-box retailer doesn’t primarily serve the most affluent members of society. Instead, it targets everyday consumers and families, folks who are looking for the best deals and discounts.

Stated differently, the company’s base is most vulnerable to economic and monetary challenges. With shifting political winds sparking fears of higher costs and the possible devaluing of the dollar via inflation, it hasn’t been a great time to be among Main Street’s rank and file. Thus, further pressures could cause significant societal damage, potentially impacting Walmart’s consumers the most.

It’s not an ideal position. Nevertheless, it’s important to consider the full picture. For one thing, Walmart enjoys pricing power of its own. Sure, on average, its consumers may not be the wealthiest. However, if these folks are shopping at Walmart for the discounts, there aren’t many other stores (if at all) that offer the big-box retailer’s massive scale advantage.

Moreover, there is the baseline effect. People who shop at Walmart because they have to aren’t adversely affected by more economic challenges. They’re already at the most discounted store on the market, and there’s nowhere lower. When you’re at the bottom, there is no lower, and the only way is up.

Second, Walmart, being a massive retail giant, can potentially flex its muscles with its suppliers. Sure, with tariffs, inflation, and other high-level dynamics, the consumer usually pays the price. However, Walmart could influence its suppliers to help pick up the tab. Since the company owns the floor regarding enticing discounts, it commands considerable leverage.

Finally, the tariff issue might not be the death sentence on WMT stock that some pessimists think it is. In 2019, Walmart said it would raise prices due to the trade war with China under Trump 1.0. Even with that stark warning, WMT was no worse for wear.

Of course, every circumstance is different, but WMT stock is relevant because the underlying business represents a critical lifeline for millions of families. That’s a catalyst investors should be able to bank on over the long run.

Walmart Investors Consistently Buy Its Dips

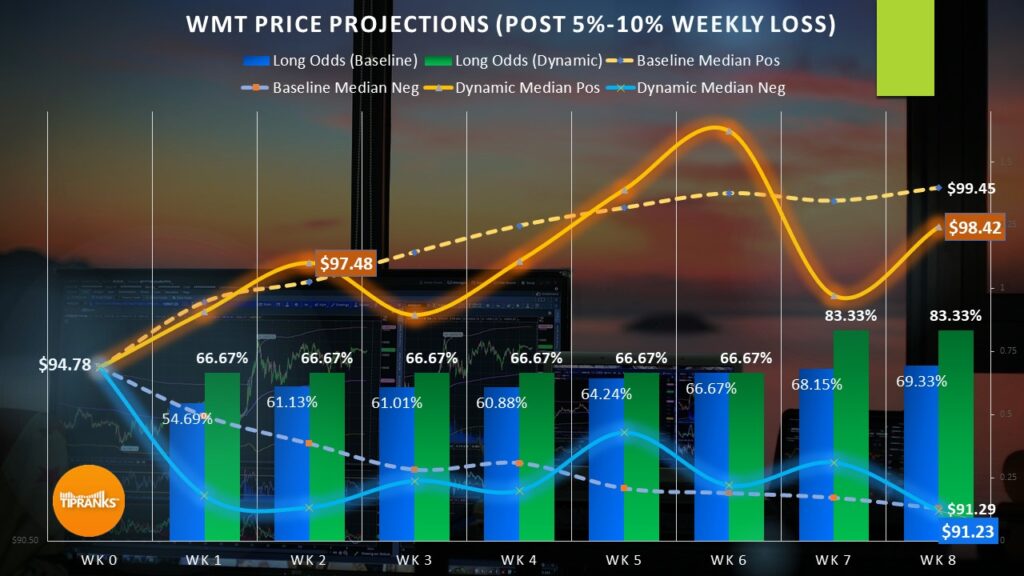

The security’s upward bias is another factor that warrants bullish consideration of WMT stock. Looking at data since January 2019, a position entered at the beginning of the week has roughly a 55% chance of rising by the end. Over four weeks, the long odds improve to around 61%, and over eight weeks, to over 69%.

That’s an excellent baseline: over two months, you can expect your long position in WMT stock to be profitable roughly seven times out of 10. But the catch is that the median return over these eight weeks — assuming a favorable scenario — isn’t that exciting at just under 5%.

What should be noted, though, is that extreme bouts of volatility in WMT stock are rare. Last week, WMT lost almost 10% of its equity value. Since January 2019, Walmart has only suffered a one-week equity loss between 5% and 10% six times. While this is a tiny dataset, investors buy the dips more often than not, which makes perfect sense—they’re already buying WMT anyway.

For an aggressive options strategy, traders may consider the 95/97 bull call spread for the options chain expiring March 7. This transaction involves buying the $95 call and simultaneously selling the $97 call, using the credit received from the short call to partially offset the debit paid for the long call.

Under similar volatile circumstances, statistical trends suggest that WMT stock could pop around 2.84% over the next two weeks. If so, that would be more than enough to trigger the aforementioned short call strike price of $97, thus qualifying for the maximum payout (minus any remaining time value of the options spread if exercising early).

Is Walmart Stock a Good Buy Right Now?

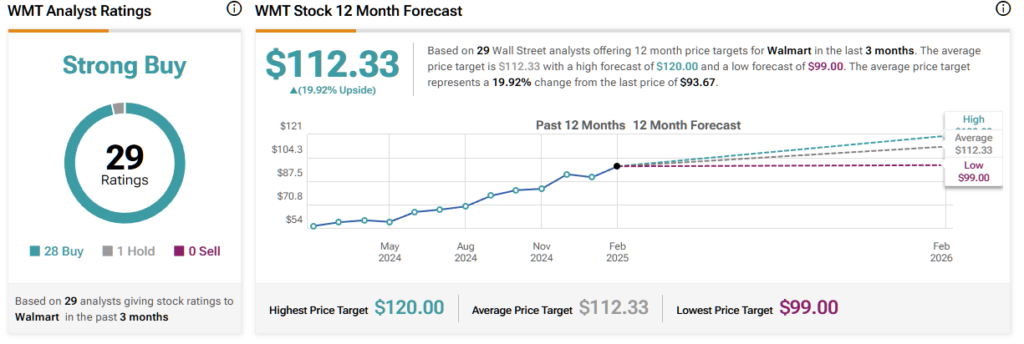

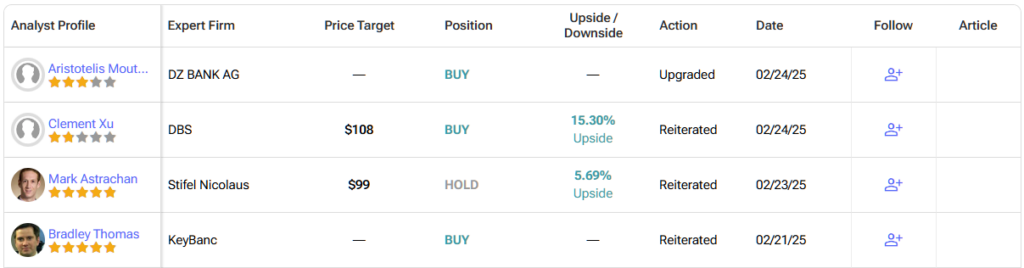

Turning to Wall Street, WMT stock has attained a Strong Buy consensus rating based on 28 Buys, one Hold, and zero Sell ratings over the past three months. The average WMT price target is $112.33 per share, forecasting an almost 20% upside potential.

WMT Stock Dip Lands in Familiar Territory

Walmart recently posted strong quarterly results, yet the market fixated on management’s cautious outlook, sending shares lower. Concerns about economic headwinds, shifting trade policies, and inflationary pressures weighed on sentiment despite the retailer’s proven resilience to similar challenges.

However, history suggests that Walmart’s stock tends to rebound from such dips, with statistical trends favoring a recovery. The retailer’s pricing power, supplier leverage, and critical role in the consumer economy provide a solid foundation. Given these factors, a near-term bounce appears likely, making the current weakness a buy-the-dip profit opportunity rather than an early warning sign of Walmart’s demise as the largest retail giant in the U.S.