It has been a volatile start to 2025 for growth and technology stocks. While many have raced out to juicy gains, we’ve also seen previous investor favorites like Applovin and Palantir nosedive 25%, illustrating the true extent of sentiment volatility pervading the market. Investors are concerned about inflation, the effects of potential tariffs, and elevated valuations ripening for a fall. This backdrop makes it as good a time as any to return to basics and consider investing in some tried-and-true value-oriented dividend stocks. Whether you’re looking to avoid market volatility or add a more defensive holding to your portfolio to complement high-flying but volatile growth stocks, the Schwab U.S. Dividend Equity ETF (SCHD) is worth consideration.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m bullish on SCHD based on its diversified and inexpensively valued portfolio, attractive 3.5% dividend yield, and cost-effective expense ratio. Additionally, sell-side analysts collectively rate it as Moderate Buy and view it as having a double-digit percentage upside over the next 12 months.

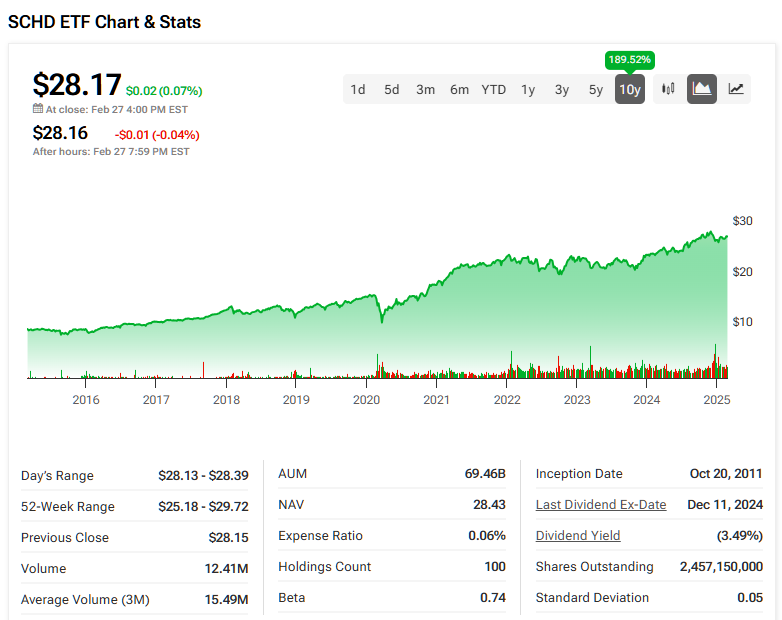

SCHD ETF has appreciated 13% over the past year, 21% over the past three years, and 95% over five years. Over ten years, the fund’s return stands at 189%. When it comes to consistent performance and reliable returns, this is it.

What is the SCHD’s Market Strategy?

SCHD tracks the Dow Jones U.S. Dividend 100 Index and is one of the most popular ETFs out there today, with assets under management (AUM) of nearly $70 billion. According to Charles Schwab, SHCD is “focused on the quality and sustainability of dividends” and “invests in stocks selected for fundamental strength relative to their peers, based on financial ratios.”

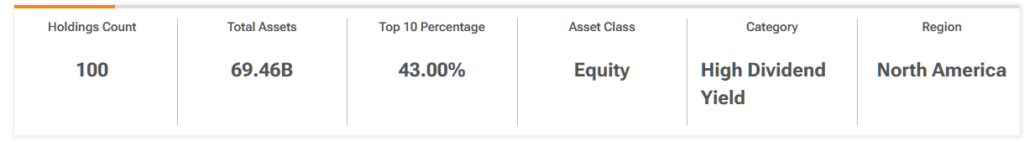

SCHD holds 100 stocks, and its top 10 holdings account for 42.8% of its assets, so this is a reasonably diversified fund. You can check out an overview of SCHD’s top 10 holdings below, using TipRanks’ holdings tool.

SCHD invests primarily in blue-chip U.S. dividend stocks spanning an array of industries and sectors. Its top 10 holdings include consumer staples giants like Coca-Cola (KO) and Pepsi (PEP), big-name healthcare and pharma stocks like Abbvie (ABBV), Amgen (AMGN), Pfizer (PFE), and Bristol-Myers Squib (BMY), and dividend-paying tech stocks like Cisco (CSCO) and Texas Instruments (TXN).

In addition to paying dividends, an advantage to owning these stocks is that they are quite a bit cheaper than the broader market. The S&P 500 trades at nearly 26x trailing 12-month earnings, while SCHD’s portfolio trades for just 17 times earnings (as of the end of the most recent month), meaning that SCHD is about one-third cheaper than the S&P 500. The inexpensive valuation of SCHD’s holdings and its strong dividend yield give SCHD a strong defense against market volatility and pullbacks.

Unlike some giant tech firms, you’re unlikely to see double-digit daily declines for defensive ETFs like SCHD, making it a neat fit for conservative and more risk-averse investors.

Attractive Combination of Dividend Growth and Yield

As the name implies, SCHD is a strong choice for dividend seekers. The fund currently yields an appealing 3.5% per year which is significantly higher than the S&P 500’s 1.3%. Additionally, the fund demonstrates consistent dividend growth after increasing its dividend payout for 13 consecutive years.

Moreover, the fund features a remarkably favorable expense ratio of just 0.06%. An 0.06% expense ratio means that an investor putting $10,000 into SCHD will pay just $6 in fees on the investment annually. The savings from investing in a cost-effective ETF like SCHD tend to add up over time. Assuming that SCHD maintains this expense ratio and returns 5% per year going forward, the same investor putting $10,000 into SCHD will pay just a mere $34 in fees over the next five years.

SCHD’s Performance Proves the Value of Diversification

SCHD has put up a solid performance over time. As of January 31, the fund has generated a strong five-year annualized return of 11.9%. Over the past 10 years, the fund has posted a strong 10-year annualized return of 11.6%.

How does this stack up compared to the S&P 500? Using the Vanguard S&P 500 ETF (VOO) as a benchmark, VOO has turned in an annualized five-year return of 15.11% and an annualized 10-year return of 13.7%. While SCHD has underperformed the broader market, it’s hard to quibble with double-digit annualized performance over five- and 10-year time spans. If we enter a more challenging market environment, SCHD may perform better than the broad-market ETF based on its lower valuation and superior dividend.

Is a SCHD a Buy, Sell, or Hold?

On Wall Street, SCHD earns a Moderate Buy consensus rating based on 55 Buys, 43 Holds, and two Sell ratings assigned in the past three months. The average analyst SCHD price target of $31.38 implies an 11.38% upside potential from current levels.

Notably, the stocks held by SCHD with the highest upside potential include Guess (GES), Leggett & Platt (LEG), and Apa Corp (APA). In contrast, the stocks with the highest downside potential are The Hershey Company (HSY), Bank of Hawaii (BOH), Paychex (PAYX), and Altria (MO).

SCHD is a Safe Bet in a Dangerously Risky Market

Putting it all together, SCHD is a solid choice for long-term investors who want to mitigate market volatility and invest in a diversified group of inexpensive, blue-chip dividend stocks. The added bonus is that SCHD’s stock picks are executed in accordance with strong fundamentals, seeking to maximize returns while minimizing risk. If seeking to profit from the ongoing tech renaissance, it may be a good idea to hedge and diversify as much as reasonably possible. I’m bullish on SCHD based on its inexpensive holdings, attractive dividend yield history of dividend growth, and cost-effective expense ratio while maintaining exposure to the hottest sector in the stock market.