Meta Platforms (NASDAQ:META) stock struggled last year, but it likely won’t recover this year. Its steep decline was largely attributed to poor results from its latest earnings report, raising questions about its near-term future. Compounding the situation is its maverick CEO Mark Zuckerberg’s fixation on the metaverse, which could potentially hamper the company’s ability to effectively address the weaknesses highlighted in its financial statements. Unfortunately, investors face an uphill battle with META stock. Therefore our position on the stock hasn’t changed from a few months ago, and we remain bearish on META stock’s prospects.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

On top of the already tight economic conditions, Meta had to confront many restrictive headwinds that weighed down its results. Moreover, the advertising market was remarkably weak amid numerous economic challenges. Additionally, the current macroeconomic environment, rife with high inflation and ever-increasing interest rates, contributed to an overall sluggish outlook for most companies and allowed very little room for them to grow.

Meta’s metaverse ambitions continue to burn through its cash reserves at an alarming rate. Furthermore, the company’s social media platforms have grown to a point where it’s incredibly difficult to attract new users. Also, most investors dislike Zuckerberg’s pivot to the metaverse and the massive spending that came with it.

The Metaverse Disaster

Despite the massive potential of the metaverse, 2022 was an overwhelmingly disappointing year for the nascent market. Meta just hasn’t been able to chalk out a fresh identity, as discussed by my colleague Joshua Enomoto in his article from a few months ago. The business had a less-than-ideal 2022, which saw it suffer through some rough quarters due to slow ad sales and increased expenditures.

While potential cost-saving measures should be of paramount importance to any business, it’s hard not to be alarmed by the amount of money that Zuckerberg is investing in Reality Labs ($9.4 billion in the first three quarters of 2022), and the spending is likely to continue. Seeing how much funding has already been poured into this project, with seemingly little regard for long-term viability, is concerning.

Meta will continue pumping more money into the metaverse project at the cost of its bottom line. The metaverse project is likely to be the next big growth catalyst for the firm and could add millions, if not billions, in new revenues down the road. However, for now, it’s burning a hole through Meta’s proverbial pockets at an accelerated pace.

Is META Stock a Buy, According to Analysts?

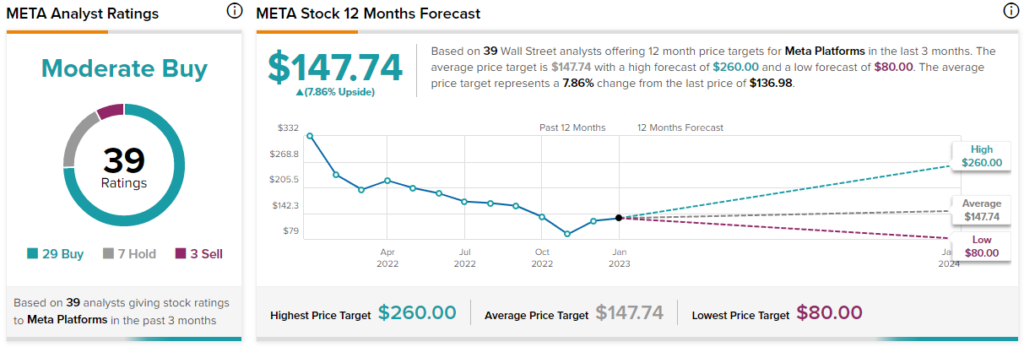

Turning to Wall Street, META stock maintains a Moderate Buy consensus rating. Out of 39 total analyst ratings, 29 Buys, seven Holds, and three Sell ratings were assigned over the past three months. The average META stock price target is $147.74, implying 7.86% upside potential. Analyst price targets range from a low of $80 per share to a high of $260 per share.

The Takeaway

Meta’s spending has largely been out of control, impacting its net income, cash flow, and margins. Moreover, its core business continues to suffer as economic conditions worsen.

Despite many people believing that the idea of the metaverse is dead, there are still those who remain bullish on its future. However, investors expecting a return within certain time frames on their investments may need to revise their expectations and push their horizons out even further before seeing any real progress in the industry.

Also, the economic environment has gone from bad to worse, with monetary tightening processes reducing the stock market’s attractiveness. The risk-to-reward ratio appears too unfavorable for META stock right now. Therefore, it may be best to avoid META at this time.