Ford’s stock (NYSE:F) experienced a successful few days after the company earned various accolades from market analysts due to its latest strategic decisions. However, the question now becomes: Is Ford’s positive developments priced in, or does it possess further upside potential? I believe Ford’s stock will proliferate for the rest of 2023, which is why I am bullish on the asset.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

A Bullish Call from Jefferies

U.S.-based investment bank Jefferies (NYSE:JEF) spurred on automotive investors last week, deeming Ford a buy. According to Philippe Houchois, an analyst at the firm, “Ford has in recent months refined a strategy to leverage group strengths and fill the gap between the quality of its product franchises and returns that have lagged peers and lacked consistency.”

Houchois’s comments pinpoint the success of Ford’s recent restructuring, which has seen it divide its business model into an electric vehicles (EV) segment and a traditional autos segment. The respective segments are thriving as Ford’s CEO, Jim Farley, has blended senior internal management and top talent with new recruits in the EV space.

Looking ahead, the challenge for Ford will be to maintain adequate industry focus while expanding into new markets. However, the company’s track record of acclimatizing to consumer behavior is second to none, suggesting that Ford is an odds-on favorite to successfully balance its EV integration and existing automotive endeavors.

Ford Partners Up with Tesla

Ford’s supercharger agreement with Tesla (NASDAQ:TSLA) is probably one of the most unexpected market occurrences this year, considering the two companies are set to rival one another in the EV space. Last week, Ford released a statement notifying the public that its electronic vehicles will gain access to approximately 12,000 of Tesla’s North American supercharging stations.

Following the announcement, the salient features of the agreement were published on the company’s website and read: “Ford Motor Company said today it reached an agreement with Tesla Motors that will provide Ford electric vehicle customers access to more than 12,000 Tesla Superchargers across the U.S. and Canada, doubling the number of fast-chargers available to Ford EV customers starting Spring 2024.”

The deal occurred shortly after the White House announced that Tesla would make various of its EV charger available to competitors in exchange for state funding. At face value, it seems like the U.S. government wants to increase the externalities that Tesla’s products bring with them while preventing the firm from forming an industry monopoly.

On the other end of the spectrum, the deal might simply be game theory. Rival partnerships are more common than most think. In fact, they often occur between companies that want to form a coalition and “corner the market.” Is that the goal of Ford and Tesla’s agreement? Only time will tell, but the signs certainly align with such an agenda.

Ford Has Performed Well amid Macroeconomic Turmoil

Although short-term events have provided tailwinds to Ford’s stock, systemic factors such as the economy must be considered. Moreover, valuation always plays a part, which is why a cautious assessment of the stock’s current price is required.

Firstly, despite the lingering macroeconomic turmoil, Ford’s operating profits are robust at 4.68%, nearly 60% higher than the company’s 5-year average. On that note, it has to be remembered that Ford was one of the only automakers to get through the 2008 housing crisis unscathed.

Furthermore, higher-than-usual interest rates have not affected the company, as its year-over-year sales growth of 22.64% signals continued progress across the firm. Even though the company’s bottom-line earnings have receded by 75.05% in the past year, much of Ford’s elevated input costs are due to transitory inflation, such as wage increases and basic material costs, which have already started tapering.

Lastly, at a price-to-earnings ratio of 5.94 and a price-to-book multiple of 1.19, there is a fair argument that Ford’s stock is in undervalued territory.

What is the Target Price for Ford Stock?

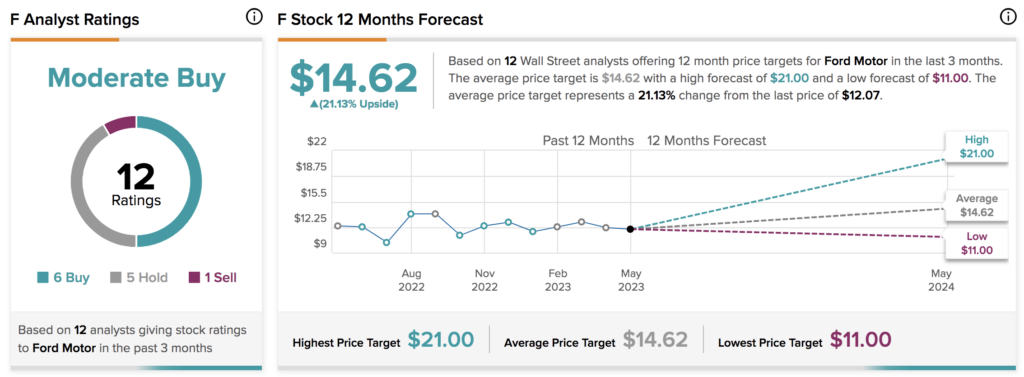

Turning to Wall Street, Ford earns a Moderate Buy consensus rating based on six Buys, five Holds, and one Sell assigned in the past three months. The average Ford stock price target of $14.62 implies 21.13% upside potential.

Concluding Thoughts: Ford’s Stock is Well-Positioned for Growth

Based on short-term events and longer-term fundamentals, Ford’s stock is well-positioned to assume further growth. Moreover, Wall Street analysts rank the stock as a Moderate Buy opportunity with more than 20% upside potential. Although various risks persist, Ford’s stock has many more tailwinds than headwinds.