While BYD Co. (BYDDF) may not attract the same media attention as Tesla (TSLA), that relative lack of hype can appeal to value-oriented investors. From a fundamentals perspective, BYD appears attractive, demonstrating consistent growth in revenue, profitability, and market share. Its vertically integrated business model, which includes in-house production of key components such as batteries and semiconductors, enhances operational efficiency and cost control.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, one notable limitation is BYD’s relatively underdeveloped autonomy strategy. Compared to Tesla’s aggressive investments in Full Self-Driving (FSD) technology and its broader AI initiatives like the Optimus robot, BYD has yet to articulate a clear roadmap in this area. For that reason, while I view BYD as a strong contender in the EV space, my outlook remains only moderately bullish over the medium to long term. Ultimately, there is room for both of these car giants in investor portfolios, but for slightly different reasons. Although BYD may lag behind TSLA in autonomous technology, it makes up for it in other areas.

BYD’s Financial Power and Valuation Advantage

Beginning with the fundamentals, BYD’s most recent quarterly report, released in April, showcased impressive performance. For the full fiscal year, the company achieved nearly 30% revenue growth, outpacing Tesla’s growth multiple. BYD also reported a 34% increase in net income, reaching approximately $5.6 billion.

While this was below Tesla’s $7.1 billion, it’s important to note that Tesla’s figure was aided by aggressive price cuts—a strategy that BYD has largely avoided. In Q1 FY2025 alone, BYD’s revenue rose 36% year-over-year, and net profit more than doubled, surpassing Tesla’s quarterly profit figures.

From a valuation perspective, BYD currently trades at around 20x forward earnings. For a company delivering consistent earnings growth above 30%, this appears significantly undervalued. In contrast, Tesla is trading at over 150x, indicating how investor sentiment and market perception can drive valuation multiples. For now, BYD offers a compelling mix of strong fundamentals and attractive pricing, making it a standout for value-oriented investors.

Why Vertical Integration Is BYD’s Secret Weapon

One of the key reasons BYD is so successful is its incredible level of vertical integration. Contrary to nearly all other car manufacturers, BYD makes many of its batteries, semiconductors, and electric powertrains in-house. This enables the business to have cost and quality control over its products, protecting it from supply chain lockups and shortages. Its Blade Battery technology is a good example—it offers lower cost, higher efficiency, and safer performance.

This deep vertical integration allows BYD to manufacture cars profitably at a price below many of its peers, particularly in low-end markets, which is vital for expansion in emerging markets. BYD is even producing many of its own chips, shielding it substantially from global chip shortages that can beat down competitors. That kind of control and operational effectiveness is a core reason why I’m especially bullish on BYD’s ability to maintain growth and healthy margins.

Autonomy Gap Is BYD’s Weak Spot

For all its positives, BYD is not perfect. Its worst long-term weakness is the absence of a bold autonomous driving vision. Currently, BYD provides its so-called “God’s Eye” driver-assistance system. As practical and popular as the technology is, it is far from fully autonomous, though the company is well on its way to this goal.

Tesla, meanwhile, is aggressively aiming for a complete autonomous taxi economy through its FSD software. It’s also pioneering robotics with its Optimus humanoid robot. These projects could represent substantial future revenue streams with significantly higher margins.

BYD has made strides in similar directions, but it’s lagging Tesla significantly in technological advantage and future strategy. I believe this is a real long-term risk for BYD shareholders. Without a more compelling plan, BYD is potentially giving up the bulk of the high-margin software profits Tesla is seeking.

BYD’s Stock Price Is Still Too High Right Now

Although BYD is a textbook case of a value investment on paper, it still requires timing to achieve an optimal return, which is always a function of investor sentiment. BYD’s share price is well above its 50-week moving average, indicating that, at least for now, the market has become overly optimistic. Although I’m very positive about BYD’s future over the intermediate term, I don’t think this is the time to start a new position.

Another key indicator I watch is the 14-week Relative Strength Index (RSI). The RSI is currently at 66, making the stock relatively expensive. It’s not definitively overvalued yet, but it’s climbing into the territory where near-term appreciation can wane. I’m content to wait for a pullback before even considering buying shares.

Lastly, BYD is a Chinese firm, and as a result, investing in it comes with inherent geopolitical risks. This factor alone could be a turn-off for Western investors who value geopolitical stability highly.

Is BYD a Buy, Sell, or Hold?

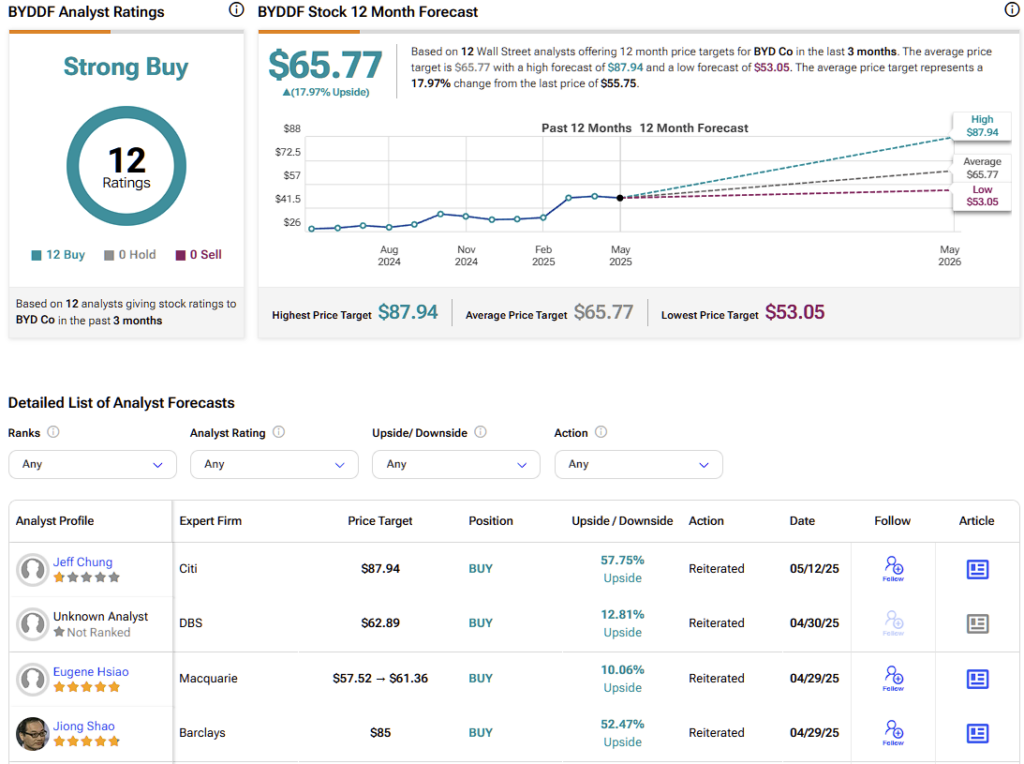

On Wall Street, BYD carries a unanimous Strong Buy rating based on coverage from twelve analysts. The average BYD stock price target is $65.77, indicating an ~18% upside potential over the next 12 months. This is a reasonably good return, but there are better investments on the market right now due to near-term sentiment for BYD being a tad too high.

BYD Strengths Outweigh Its Autonomy Gap

I remain bullish on BYD because it stands out in the EV sector as a rare combination of profitability, high growth, and reasonable valuation. Its vertically integrated business model and manufacturing efficiency provide significant competitive advantages that few rivals can match. While BYD’s relatively undeveloped autonomy roadmap presents a longer-term concern, the company’s strong fundamentals and compelling valuation make it an appealing investment despite ongoing sentiment and geopolitical risks.

As investors, balancing short- and long-term risk and reward is essential. In my view, BYD offers one of the most attractive risk-reward profiles in the EV space over the medium term, assuming stability in Chinese markets continues.