UnitedHealth (UNH) has long been viewed as a defensive play in the healthcare space. As the market leader in private healthcare in the U.S., the company has built its reputation on financial consistency, low default risk, and a reliable dividend. That stability has allowed it to trade with a consistently low beta of around 0.5 over the past five years, making it a go-to name for long-term and risk-averse investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

So when a stock like that drops nearly 50% in less than a month, it’s a strong signal that something fundamental has broken down—and it’s probably not a small deal. In this case, UnitedHealth has been hit by multiple headwinds at the core pillars of the company’s business model: cost predictability, government relations, corporate reputation, and management stability.

Given the scale of these disruptions, this doesn’t seem like the right time to be aggressive and look at tempting valuations. For now, my stance is to hold on to UNH stock.

When a Defensive Giant Trips Over Its Own Feet

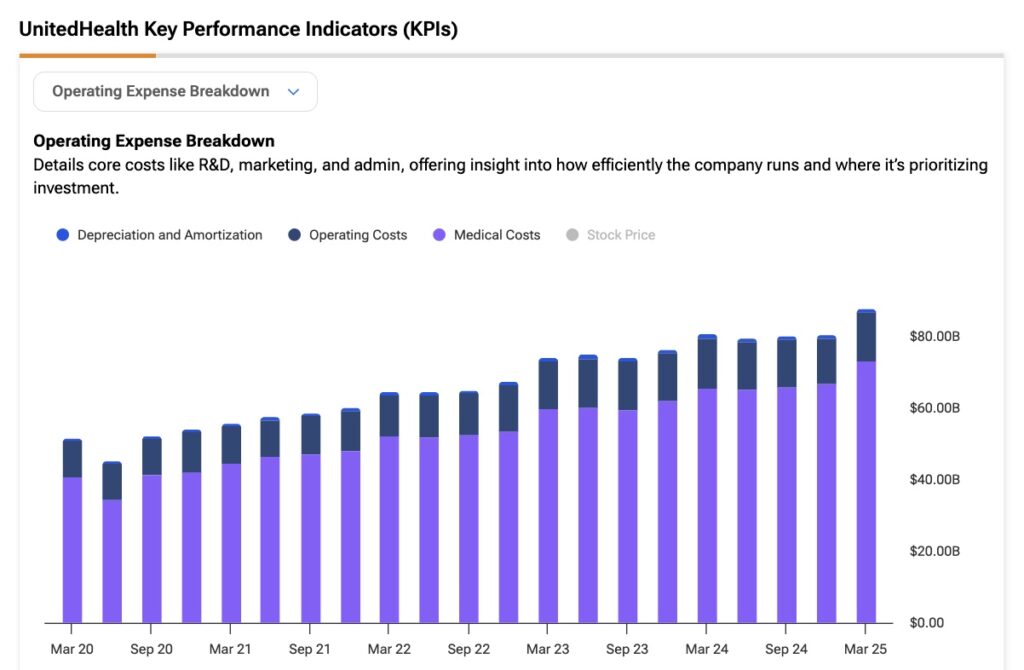

It all began on April 17, when UnitedHealth released its Q1 earnings report and stunned the market by slashing its 2025 earnings forecast from $29.50–30.00 per share down to $26.00–26.50. The main reason was a sharp and unexpected spike in medical costs, particularly in its Medicare Advantage business. The company ended up serving more patients (and more high-acuity cases) than expected, which severely squeezed profit margins. Healthcare service usage reportedly doubled compared to internal projections, triggering a significant margin hit.

What’s harder to pin down is how the company miscalculated so badly. One likely reason is the use of outdated forecasting models, which relied too heavily on past trends that no longer reflect current realities. Another possible issue is the risk profile of newly enrolled patients. Since Medicare Advantage targets older adults, bringing in a higher-than-expected number of sicker, high-cost patients would naturally push expenses much higher.

And there’s little flexibility to recover those costs. Medicare Advantage pricing is highly regulated and locked in, meaning that if the company underestimated how expensive its member base would be, it’s stuck with the consequences, at least in the near term.

When Things Couldn’t Get Any Worse…

As if a completely off-the-mark earnings forecast wasn’t enough, the bullish thesis on UnitedHealth took three more hits that made things go from bad to worse.

First, the U.S. government announced a major ramp-up in regulatory oversight, with plans to dramatically increase audits of Medicare Advantage plans. The Centers for Medicare & Medicaid Services (CMS) is expanding its audit staff from just 40 to nearly 2,000 people. That move raised alarms about potential financial penalties and payment adjustments, which could directly impact UnitedHealth’s bottom line going forward.

Next came the unexpected departure of CEO Andrew Witty, which threw some uncertainty over the company’s leadership. To calm the waters, Stephen Hemsley, the newly appointed CEO, bought $25 million worth of company stock, joining a wave of insider buying. The CFO also boosted his stake by 9%, investing another $5 million, and three board directors chipped in with purchases totaling over $1.6 million in the past few weeks.

Those insider moves gave the stock a temporary lift, with shares jumping 17% over the next three trading days. But that rally didn’t last. On May 20, the stock slid again after reports emerged accusing UnitedHealth of paying secret bonuses to nursing homes to discourage them from sending patients to hospitals, allegedly to cut costs. Even though the Department of Justice investigated and found insufficient evidence to proceed, the damage to the company’s reputation was done.

Since the earnings report dropped on April 17, UnitedHealth’s stock has tumbled nearly 50%, showing just how fast sentiment can unravel—even for a company once considered one of the safest plays in the market.

Serious Trouble or Just Market Chatter?

Despite the wave of bearish sentiment that has shaken the once-stable thesis around UnitedHealth as a defensive stock, there are still several points that run counter to the negativity, starting with the company’s current valuation. UnitedHealth appears to be deeply undervalued, trading at a forward price-to-earnings of 13, well below both its historical average and the broader sector median.

Other valuation metrics, like EV-to-EBITDA and price-to-cash flow, are also down 40% to 50% compared to historical averages. On paper, that makes it appear to be a potential long-term buying opportunity, especially for a market leader with a history of steady performance. The 2.8% dividend yield adds to the case, offering a bit of income stability in the middle of all the uncertainty.

Still, valuation metrics are only part of the story, especially when the bigger question is whether the core business model is facing a structural reset. If Medicare Advantage margins remain compressed or new regulations significantly disrupt Optum’s (UnitedHealth’s health services division) operations, then even at a discount, the stock may not present a favorable risk-reward setup.

The bottom line, in my opinion, is that this probably isn’t the typical “buy the dip” moment. The combination of pricing mistakes, leadership changes, political scrutiny, and regulatory risks suggests more profound, more fundamental challenges ahead. Given all that, the current price may not just reflect short-term volatility but could be part of a longer-lasting re-rating.

What is the Target Price for UnitedHealth Group?

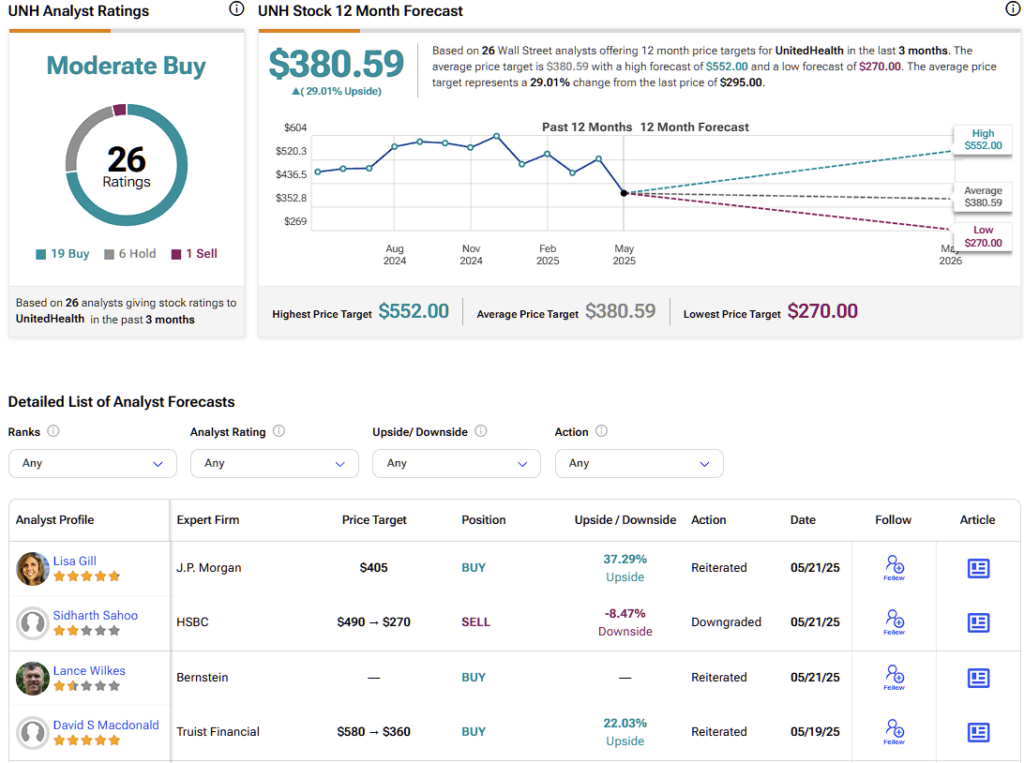

It may still be too early to tell whether all the recent chaos surrounding UnitedHealth is just a rough patch that can be fixed, or the beginning of something deeper, like permanently lower margins or major regulatory shifts. But despite everything that’s happened, Wall Street clearly hasn’t thrown in the towel yet.

Since the Q1 earnings report, six analysts have downgraded UNH from Buy to Hold, and most have lowered their price targets. Even so, overall sentiment remains surprisingly positive. Of the 26 analysts covering the stock, 19 are bullish, six are neutral, and one is bearish. Rather surprisingly, UNH’s average stock price target is $380.59, which implies a potential upside of almost 30% over the next twelve months.

Too Many Red Flags to Buy UnitedHealth Now

There’s so much going on with UnitedHealth right now that it’s hard to stick to the classic defensive bull thesis. For the time being, it’s probably wise to stay on the sidelines. At the very least, UNH is facing some apparent structural headwinds and a potentially deeper issue with how the company estimated medical costs, especially within Medicare Advantage.

The leadership change could also be a structural concern. While the return of former CEO Stephen Hemsley and the wave of insider buying may be efforts to stabilize sentiment, they also signal that the company is in crisis management mode.

In short, these issues aren’t just short-term distractions—they hit at the core pillars of UnitedHealth’s business model. And right now, it doesn’t seem like the right time to play hero and go long on UNH stock, even if the valuation looks inexpensive on the surface.