Taiwan Semiconductor Manufacturing Company (TSM), or simply TSMC, is widely seen as a consensus no-brainer buy by most analysts. With its dominant position in capturing a significant share of AI industry profits and unmatched chip manufacturing capabilities, TSMC is a hot favorite for many investors. However, there is a sting in this tail, and I’m staying neutral.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

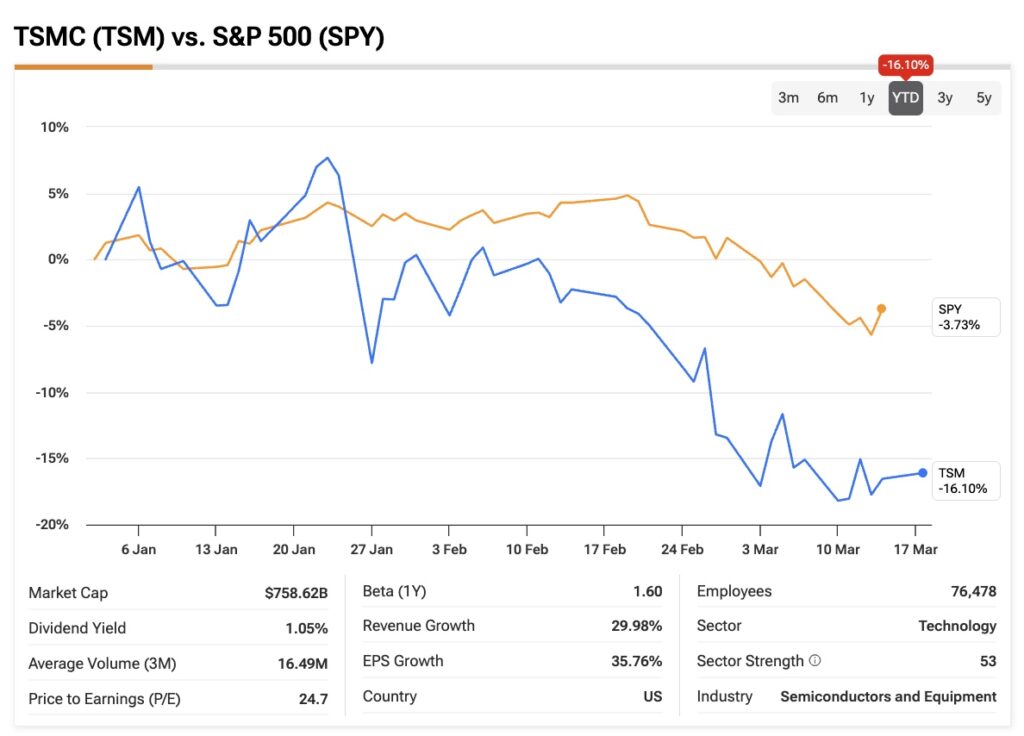

So far this week, the Chinese semiconductor bellwether has dipped from highs above $176 to below $170. Several opportunists are already hailing TSMC as a buy-the-dip candidate.

Beyond its strong business fundamentals, the stock is priced at less than 20x its forward earnings, which looks highly attractive, especially when adjusting for growth. However, since 2025, TSMC shares have underperformed the broader market due to some skepticism about the surge in investments for new overseas fabrication plants, which could negatively impact its robust operating margins.

While it’s hard to ignore the bullish outlook for TSM stock, especially on any share price weakness, it’s important to note that the discounted valuations reflect geopolitical risks that are hard to quantify. Moreover, reverse discounted cash flow analysis based on market consensus and conservative assumptions shows that the current share price leaves little downside protection for the business. I’m taking a cautious, neutral stance on TSM stock, rating it as a Hold. After its nearly triple-digit share price in 2024, most gains may have already been priced in.

Dominating the Chip Game with Margins

TSMC’s fundamentals are strong, especially with solid revenue growth, including a 22% five-year CAGR, recently boosted by rising AI demand. To be clear, TSMC is the manufacturing partner for some of the world’s top tech companies, from Nvidia (NVDA) to Apple (AAPL), and even Intel (INTC)—one of its main competitors—outsources some of its manufacturing to TSMC.

With the massive expansion in the data center and smartphone markets, TSMC has uniquely captured this growth and turned it into value creation. The company stands out because its profit margins are much higher than those of manufacturing companies in other sectors. For instance, TSMC has operating margins similar to those of software companies, around 45%. Even more impressive, the company has been expanding its margins over the past decade, starting at around 38% and now nearing 46%, all while dominating the industry.

More recently, TSMC reported another blockbuster sales report for February, with sales jumping 43% year-over-year. Earlier in January, revenues had grown 36% year-over-year, showing that its business continues to grow rapidly and will likely achieve the projected 37% growth in its top line for Q1 2025.

Choppy Waters for TSMC Bulls

While top-line growth is sailing smoothly, there are some concerns on the bottom line, mainly due to increasing capex and the impact on operating margins as TSMC diversifies its operations geographically. Recently, TSMC reported operating margins of 49% in Q4, but the company forecasted a dip in Q1 due to the launch of its first U.S. fabrication plant. Over the past couple of years, escalating geopolitical tensions have made it a priority for the Taiwanese chipmaker to diversify and expand its manufacturing base outside Taiwan. The company has started producing chips in the U.S. and building facilities in Japan.

In line with this expansion, TSMC will invest $100 billion in new U.S. chip plants, bringing its total announced investment to $165 billion. The company had already agreed to invest $65 billion in the U.S. when it announced plans for a third fabrication plant in Arizona.

The management team has emphasized that these investments are necessary given the geopolitical environment, but they also acknowledged that it’s more expensive to produce outside of Taiwan. As a result, this will likely impact margins, with a predicted 2% to 3% dilution each year over the next five years, according to TSMC’s CFO Wendell Huang.

TSMC’s Buffer Zone Concerns

Given the market skepticism about TSMC’s bottom-line growth this year, investors may wonder if it’s still a good opportunity to buy the stock on a dip. On the one hand, buying TSM stock now seems quite attractive, even though it’s in correction territory. The company is trading at 19x forward earnings, about 15% below its historical average and nearly identical to where it was in April last year, which preceded a massive stock price rally.

However, considering that TSMC is a capital-intensive business operating in a high geopolitical risk region and is likely to experience some volatility in profit margins due to its geographic diversification, a conservative reverse discounted cash flow analysis suggests there’s no compelling margin of safety for the stock right now.

Based on a 5-year CAGR of 9.9% and assuming operating margins stay optimistically at 45% over the same period, along with an aggressive long-term growth rate of 5%, TSMC’s estimated equity value would be around $639 billion. This assumes cash flows are discounted at a 10% rate. As a result, the share price would come out to $123.20.

If we take a more conservative approach and discount cash flows at 12%, TSMC’s equity value drops to $448 billion. It’s important to note that this calculation also assumes no changes in working capital and D&A and capex figures from the last twelve months as a benchmark.

Is TSMC a Buy, Sell, or Hold?

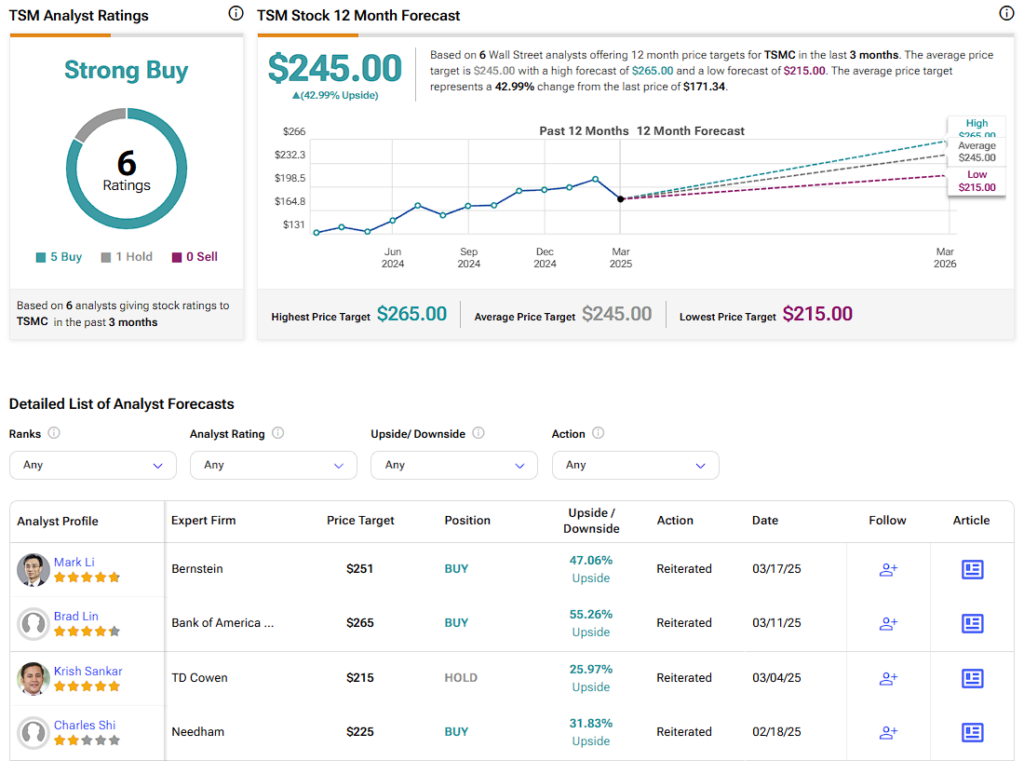

On Wall Street, TSM stock carries a Strong Buy consensus rating based on five Buy, one Hold, and zero Sell ratings over the past three months. TSM’s average price target of $245 per share implies a 43% upside potential over the next twelve months.

TSMC Stock Is Riskier Than It Appears

As a company with so much influence on global big-tech manufacturing and at the forefront of AI advancement, TSM presents a reasonably strong bullish case. However, despite seeming like a no-brainer buy-and-hold during the stock’s current dip, investors should approach TSMC as a high-risk, high-reward stock with plenty of surprises up ahead.

Geopolitical risks are tough to quantify, and if these risks aren’t adequately reflected in discount rates, there may be little margin of safety to justify a bullish stance at current prices. With capex increasing and margins likely taking a hit in the coming quarters, it might be wise to stay cautious, waiting for more stability in TSMC’s rock road. As it stands, market-implied growth rates do not imply much upside at current levels despite the bullish sentiment coming from Wall Street analysts.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue