With the tariff situation spiraling over the past few days, it’s been almost impossible to establish a clear stance in the stock markets. The extreme volatility has made every trade feel unpredictable, with positive and negative news about global equities swinging wildly in both directions. But amid all this chaos, Apple’s (AAPL) stock has erased its gains from the past twelve months. That’s pretty unusual for a stock of Apple’s size and stability.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

No other company seems to be more in the crosshairs of this tariff storm than Cupertino’s finest. Only about 5% of Apple’s major suppliers are based in the U.S., which leaves it heavily reliant on overseas production and imports. With tariffs pushing up production costs almost overnight, some of Apple’s core products could see prices double. This is a massive, unprecedented challenge that no analyst could have predicted at this scale.

Given the chaotic situation in the U.S. tech sector, Apple is facing serious structural headwinds. For me, this doesn’t feel like an overreaction, even though the stock is down nearly 30% this year. With the current state of tariffs, I’m rating Apple as a Sell. The long-term outlook is uncertain depending on how the tariffs are resolved, and there’s a real chance the stock could drop even more.

Tariff Storm Puts AAPL at Greatest Risk

While trade tariffs can bring more revenue into government coffers over time, they also destroy economic value by reducing trade volumes, especially in the short to medium term. Raising costs for foreign suppliers to do business with the U.S. might “encourage” them to set up factories in the U.S. But this pressure on suppliers doesn’t automatically lead to that outcome—it depends on a range of factors.

Now, let’s consider Apple in this context. The company has 36% of its supplier facilities in Southeast Asia and India, 33% in Mainland China, 10% in Taiwan, 9% in Japan, 5% in Europe and the U.S., and just 1% in Latin America. In other words, 95% of Apple’s product manufacturing occurs overseas. Currently, a third of Apple’s suppliers are subject to a massive 104% tariff on goods from Mainland China, not to mention the additional tariffs imposed on production in every other country where Apple has manufacturing facilities.

Speaking of China, let’s rewind to between 2018 and 2019 when the U.S.-China trade war was in full swing under the Trump administration. At that time, Apple was trying to find ways to reduce its reliance on China, where nearly half of its biggest suppliers were based. Fast-forward more than five years, and 33% of Apple’s suppliers are still in Mainland China.

In short, this shows how complex and time-consuming it is—even for a company as large and influential as Apple—to reshape its supply chain. The big question is whether Apple can soften the tariff impact without hiking prices on its flagship products like the iPhone, Mac and AirPods. For now, the near-term future for Apple’s sales is bleak.

Even Apple’s Strongest Bulls Are Concerned

In my opinion, Apple cannot dodge the tariff bullet without taking a major hit to its business. Apple’s supply chain is one of the most complex in the world, and the company’s ability to distribute its suppliers globally is the only reason it can offer an iPhone 16 for $799.

Now, imagine Apple trying to shift its most prominent suppliers to the U.S. First, there are some huge problems. The biggest one is that unemployment in the U.S. is very low at 4.2%, which means the country would need a complete overhaul of its labor market to accommodate this shift. The second issue is that, unlike countries like Mexico and India, where manufacturing workers earn around $6,500 and $4,000 a year, the average wage in the U.S. is around $40,000.

Even Dan Ives, a long-time Apple bull at Wedbush, is concerned. Although he maintains a positive outlook, he lowered his price target from $325 to $250. Ives believes that if Apple were to manufacture in the U.S., iPhones could cost as much as $3,500.

Considering that iPhones are the core of Apple’s ecosystem, such a drastic price increase would severely impact iPhone sales and the company’s high-margin Services business, which has been a significant growth driver in recent years.

Considering Different Scenarios for Apple

To better understand the trade war’s potential impact on Apple’s business, let’s consider a hypothetical scenario where China negotiates to ease the impact of the export tariffs. Suppose China backs down and agrees that iPhones can be manufactured in the U.S. under the same terms. However, would China then ban using iPhones and other Apple products within the country? The answer is, quite possibly.

If that were the case, it could lead to a significant loss for Apple. On average, around 30 million to 35 million iPhones are shipped to China annually, each selling for approximately $1,000. That’s about $35 billion in potential lost sales for Apple in the region. In fact, in FY 2024, Greater China accounted for $67 billion in sales, making up 17% of Apple’s total revenue for the year. This figure could decline substantially in the coming years.

On a more optimistic note, as Morgan Stanley’s bullish analyst Erik Woodring pointed out, there’s some hope for Apple in the way consumers buy iPhones. Most people around the world still purchase their iPhones on installment plans. So, while a 15% to 20% price increase would likely hurt demand, the silver lining is that Apple may be somewhat insulated from these challenges. With installment plans, consumers can spread out the price hikes over two or three years, making the higher costs more digestible.

Is Apple a Buy, Hold, or Sell?

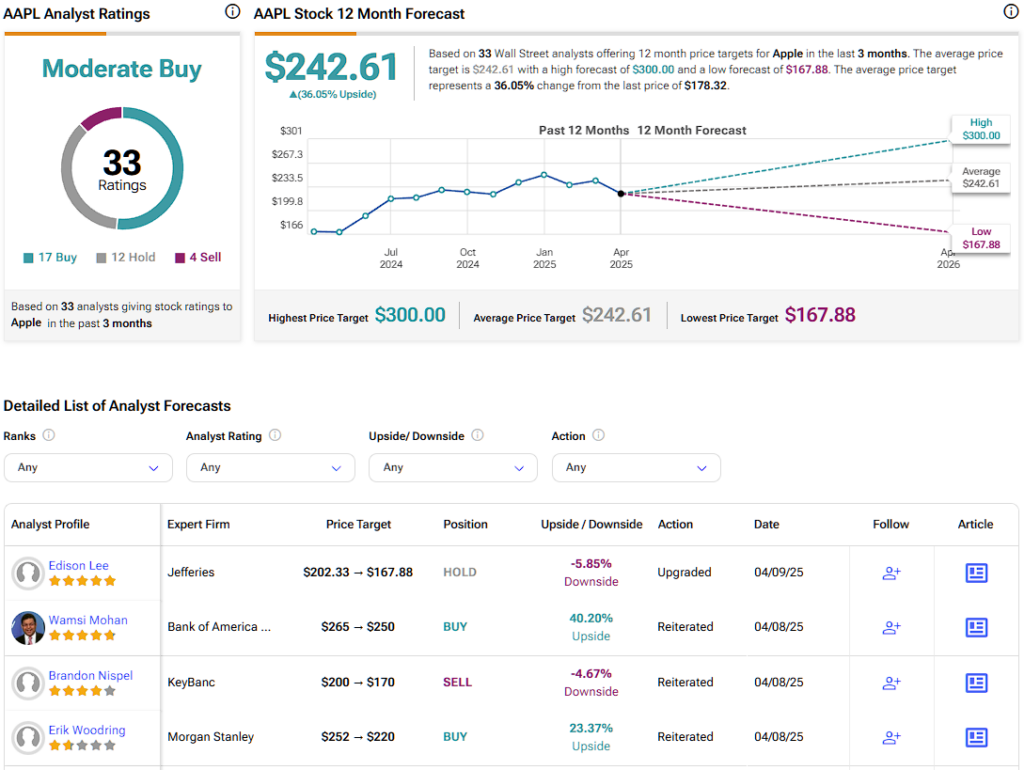

Despite the tariff debacle, several analysts have lowered their price targets on Apple stock, but only one has downgraded Apple to a Sell since the beginning of April. Out of the 33 analysts covering the stock in the past three months, 17 have a Buy rating, 12 rate the stock as Hold, and four have a Sell rating. The average price target is $242.61, which suggests a 36% upside potential from the current price.

Patience is a Virtue With AAPL Stock

For long-term Apple shareholders, the key to deciding when to sell or trim positions lies in structural changes that disrupt the company’s investment thesis—a rare scenario for a company of Apple’s size. The ongoing trade war and the imposition of import tariffs, particularly those affecting China, could significantly impact Apple’s long-term outlook if these tariffs remain in place.

Higher costs will probably lead to lower demand, especially for key products in Apple’s ecosystem, which could delay the company’s AI supercycle and even affect its Services business. In other words, this is a game changer — and not in winning way for AAPL shareholders. Given this scenario, and with the Trump administration struggling to negotiate better terms with key countries in Apple’s supply chain, I expect further losses ahead, with Apple likely underperforming the broader market.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue