Salesforce (CRM), the titan of cloud-based customer relationship management (CRM) systems, has long been a darling of growth investors. But recent quarters tell a story of slowing momentum, with revenue growth decelerating and management’s outlook hinting at more negativity to come. Still, beneath the surface, Salesforce is refining its operating efficiency, boosting profitability, and introducing innovations that could reignite investor enthusiasm. In the meantime, at its current valuation, Salesforce’s stock might just be a bargain hiding in plain sight. For these reasons, I am bullish on the stock.

Revenue Growth Hits a Wall

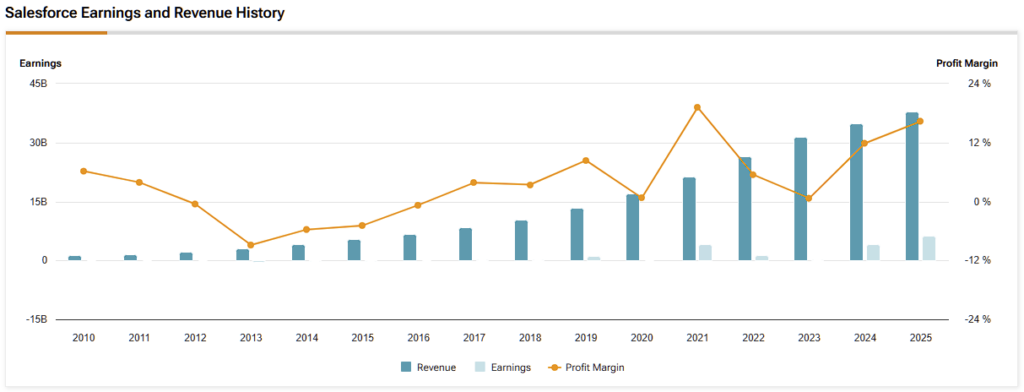

Salesforce’s revenue growth, once a blazing double-digit engine, has swiftly cooled. For FY2025, the company reported $37.9 billion in revenue, up 8.7% year-over-year, marking a steady deceleration from the 11.2%, 18.4%, and 24.7% in their respective 2022, 2023, and 2024 periods. The fourth quarter alone saw $10 billion, a 7.6% increase.

Looking to FY2026, Salesforce projects revenue of ~$40.1 billion, which implies a modest 7.4% growth rate, well below the $41.35 billion Wall Street anticipated. Thus, deceleration is set to persist due to an increasingly cautious enterprise spending environment, intensified by elevated interest rates and a general economic uncertainty, which are crimping budgets for cloud software.

Profitability Shines Through the Clouds

However, while top-line growth slows down, Salesforce is quietly becoming a profitability powerhouse. Last quarter, the company’s adjusted operating margin hit 33.1%, up from 31.4% the prior year, with full-year margins expanding to 33% from 30.5%.

This leap comes from disciplined cost controls, including prior workforce reductions, and a focus on operational efficiency. For FY26, Salesforce expects margins to climb further to 34%, even as it invests heavily in AI.

Hidden Gems Agentforce and Data Cloud Deliver When It Counts

Beyond its recent focus on growing profits amid decelerating top-line growth, Salesforce is still planting seeds for future growth. Although its Agentforce platform is early in its journey, it is gaining traction, with 5,000 deals closed since October 2024, including 3,000 paid, for clients such as Pfizer and Singapore Airlines. This AI agent builder, embedded across Sales Cloud, Service Cloud, and Slack, automates tasks and enhances customer interactions, positioning Salesforce to capture a slice of the AI-driven enterprise market.

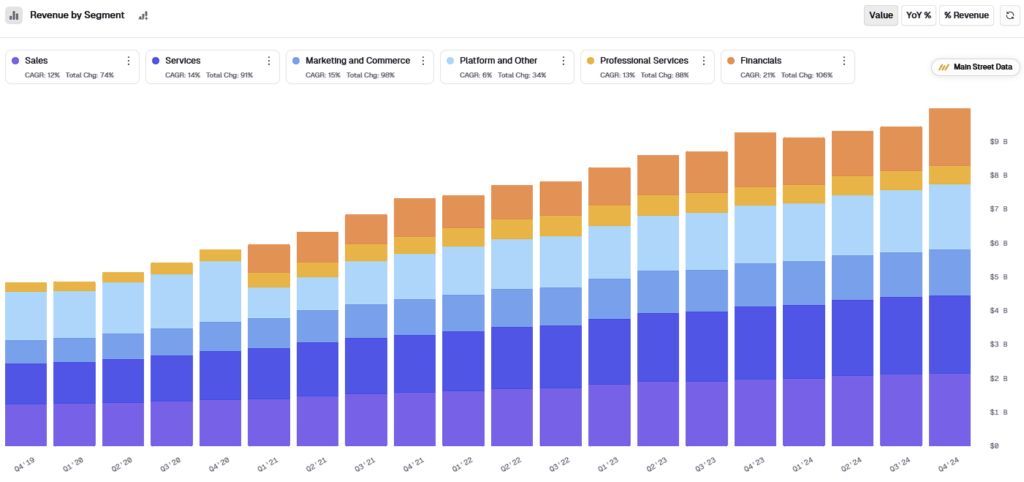

Meanwhile, with $900 million in annual recurring revenue (up 120% year-over-year), the company’s Data Cloud has doubled its data processing to 50 trillion records, quickly becoming a cornerstone for AI-driven insights. These developments suggest a pivot toward a broader, AI-powered ecosystem that could revive Salesforce’s growth trajectory, especially since the tech giant already has the customer base on which it can expand vertically.

A Valuation That Screams Opportunity

The growth slowdown has undeniably rattled investor confidence, sending Salesforce’s stock tumbling. Adding to the pressure, the recent Trump tariffs, which helped trigger a broader tech selloff, dragged CRM down with the rest of its sector peers. So after taking hits from multiple angles, the stock’s now hanging near its 52-week lows. However, in my view, that drop hides a solid opportunity since Wall Street seems to overlook Salesforce’s core strengths.

For starters, the tariff worries feel overdone. Unlike hardware-heavy tech companies, Salesforce runs a cloud-based software model that doesn’t depend much on physical supply chains. Most of its revenue comes from subscriptions tied to global enterprise deals, so it’s pretty well shielded from the cost spikes tariffs usually bring. Also, about 3/4 of last year’s revenue came from the Americas, with a notable portion locked into multi-year deals, providing a buffer against short-term economic policy shifts. Thus, any tariff-related sell-off seems transitory, not persistent.

Moreover, at about 22.5x this year’s expected EPS of $11.16, Salesforce trades at a multiple far below its historical average. With analysts projecting double-digit EPS growth through 2028, driven by a margin expansion and AI-driven efficiencies, I believe today’s valuation is a steal for a giant of Salesforce’s caliber. Even if the company’s investment case softens in the near term, for any reason, I believe that the current valuation should also provide a rather wide safety net against further downside.

Is Salesforce Stock a Buy or Sell?

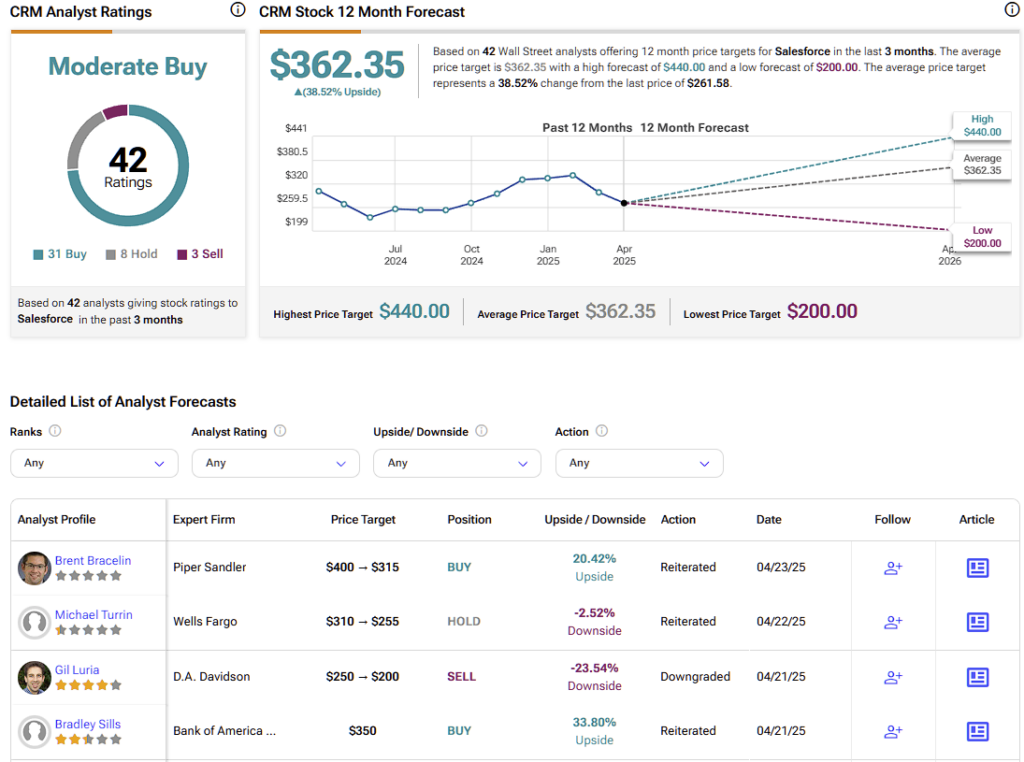

Salesforce is currently covered by 42 analysts, with the consensus leaning toward a bullish outlook. CRM stock carries a Moderate Buy consensus rating according to 31 Buy, eight Hold, and three Sell ratings over the past three months. CRM’s average price target of $362.35 implies a 38.5% upside potential over the next twelve months.

CRM Giant at a Crossroads

Salesforce stands at an inflection point. Revenue growth is undeniably slowing, and this year’s guidance further tempers expectations, reflecting a cautious market. Nonetheless, the company’s margin expansion, boosted capital returns, and under-the-radar progress in Agentforce and Data Cloud paint a brighter picture. In the meantime, with a valuation that’s increasingly hard to ignore, Salesforce’s stock could be a rare opportunity for those willing to weather the near-term storm.